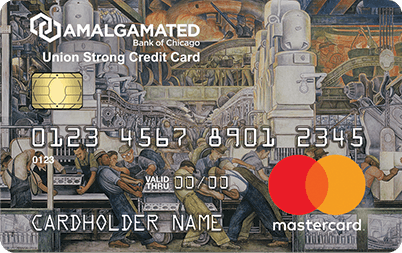

Amalgamated Bank of Chicago is now offering new applicants a $150 statement credit bonus with the Amalgamated Bank of Chicago Union Strong Credit Card. Just make sure you make $1,200 in purchases within the first 90 days of account opening to receive this bonus.

Cardholders earn 5X rewards on up to $1,500 in combined purchases each quarter in popular categories. These include dining, groceries, travel, and automotive. Then, earn 1% rewards on all other spending. Plus, there is no annual fee.

Amalgamated Bank of Chicago is dedicated to provide the best relationships with their customers and their community for almost 100 years. Relationships are based on trust, understanding and excellent services provided by their experienced bankers.

If you’re interested, see what this card has to offer below.

Union Strong Credit Card Features

- Welcome Offer: Earn a $150 statement credit after you spend $1,200 on purchases within the first 90 days from account opening

- Earn 5X rewards on up to $1,500 in combined purchases each quarter in popular categories such as dining, groceries, travel, and automotive

- Earn 1 Point per $1 spent on every purchase with no spending caps and points that don’t expire

- Get extra points by shopping with ABOC Rewards partners via www.ABOCRewards.com

- Your rewards include travel, cash (in the form of a statement credit), gift cards, and merchandise

- Manage your account from your smartphone anytime, anywhere with the ABOC Mobile Credit app

- $0 Annual Fee

Alternative Options

Conclusion

The Amalgamated Bank of Chicago Union Strong Credit Card is free to apply and doesn’t have an annual fee. Just make sure your account is in good standing and you meet the spending requirements in order to earn your $150 statement credit bonus. For cards offered by a bigger bank, see our complete list of Credit Card Promotions to find the one that best suits your needs!

The Chase Freedom FlexSM offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR. You'll earn: • Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! • 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • Unlimited 1% cash back on all other purchases You cash back rewards do not expire as long as your account is open and there is no minimum to redeem for cash back. This card has no annual fee. |