Thinking about applying for a new credit card because of those hot introductory offers? Sure, 100,000 bonus points may seem enticing, but how much is each point or mile really worth? Not all rewards are created equal. On one card, 100,000 points may be worth less than 70,000 miles on another. Here, we can help you determine what your points and miles are worth and maximize their value.

Thinking about applying for a new credit card because of those hot introductory offers? Sure, 100,000 bonus points may seem enticing, but how much is each point or mile really worth? Not all rewards are created equal. On one card, 100,000 points may be worth less than 70,000 miles on another. Here, we can help you determine what your points and miles are worth and maximize their value.

Recommended Credit Card

See our review of the Barclaycard Arrival Plus® World Elite Mastercard® and why you should have it in your wallet.

Points vs. Miles

Some credit cards come with points. Others come with miles. What’s the difference?

To start off, points and miles work in similar ways. Depending on the program and the rewards card, you’ll earn either one with each eligible purchase. Once you’ve gained enough, you can redeem your points or miles for a variety of rewards.

For airline co-branded cards, they refer their earning currency as “miles.” You can redeem them for flights, which will get you the most value. However, each mile has no set value. Therefore, you’ll need to calculate how maximize the value of your miles.

On the other hand, points often have given values. They’re usually more flexible when you redeem them for cash back, gift cards, merchandise and travel purchases.

Determining Rewards Redemption Value

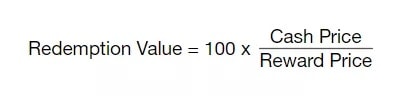

To find your rewards redemption value, use this simple equation:

Get the cash price of your reward divide that by the number of points or miles you need to redeem the reward. Then, multiply that by 100 to convert the dollar amount into cents. You’ll end up with the per-point or per-mile value in cents.

For example, if you want to book flight that’s $500 and the reward price is 100,000 miles, how much is your redemption value?

Use $500 as your cash price, 100,000 miles as your reward price, and multiply that by 100. Using this method, each point is worth $0.50.

As a rule of thumb, one point or mile should be worth an average of $0.01. Anything less is considered sub par. Anything more is essentially a good deal.

Factors To Consider

Redemption value is just one part of the overall rewards value. There are also other things you should factor in:

- Earn Rate: This is the amount of points or miles you receive for every dollar you spend. Some cards have a flat earn rate for every purchase. Others give you double, triple or more for purchases within bonus categories.

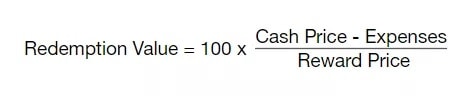

- Reward Fees: For the above equation, the cash price should include the full amount of the paid booking, including any taxes and fees. Any added expenses as a result of booking the reward are excluded. For instance, if you have to pay $50 to redeem for a flight that normally costs $500, you’re only getting a $450 value for your miles. To get a truer sense for the value of your points or miles, deduct these kinds of expenses from the cash price in your calculations.

-

- Test this method with the above flight example. Use $500 as your cash price, subtract the $50 expense to book the reward flight, put 100,000 miles as your reward price, and multiply that by 100. The per-point value drops from $0.50 to $0.45.

- Card Cost: How much do your rewards card cost including annual fees, interest and other costs that decrease the value of your points or miles? If you carry a balance, the interest charge will easily negate your rewards value.

- As a rule of thumb, if you pay more in fees and interest than you earn in points or miles, drop the card. Remember to pay your credit card balance – full and on time – every month.

- Points Transfer Potential: Some rewards credit cards will let you transfer your points to a partner program. If you need more miles to purchase a flight or for better points or miles value, a transfer may be beneficial. Before you do the transfer, consider both the transfer ratio and the new redemption value. You don’t want your points to lose their worth when you switch.

What Points & Miles Are Worth

Here’s a list of how much points and miles are worth according to reward program when you redeem them. We tried to be as accurate as possible, but value is always subject to change:

| Rewards Program | Value In Cents |

| Accor Le Club | 2.0 |

| Aeroplan Loyalty Program | 1.5 |

| Alaska Mileage Plan | 1.8 |

| American AAdvantage | 1.4 |

| American Express Membership Rewards | 2.0 |

| Amtrak Guest Rewards | 2.5 |

| ANA Mileage Club | 1.4 |

| Asia Miles | 1.3 |

| Asiana Club | 1.4 |

| Avianca LifeMiles | 1.7 |

| Avios | 1.5 |

| Bank of America Premium Rewards | 1.0 |

| Barclaycard Arrival Miles | 1.0 |

| Best Western Rewards | 0.7 |

| Capital One Credit Card Rewards | 1.4 |

| Chase Ultimate Rewards | 2.0 |

| Choice Privileges | 0.6 |

| Citi ThankYou Points | 1.7 |

| Delta SkyMiles | 1.2 |

| Diners Club Rewards | 2.1 |

| Discover Rewards | 1.0 |

| Emirates Skywards | 1.2 |

| Etihad Guest | 1.4 |

| Flying Blue | 1.2 |

| Frontier Miles | 1.1 |

| HawaiianMiles | 1.2 |

| Hilton Honors | 0.6 |

| IHG Rewards Club | 0.5 |

| JetBlue TrueBlue Rewards Program | 1.3 |

| Korean Air SkyPass | 1.7 |

| LATAM Pass Points | 1.5 |

| Marriott Bonvoy | 0.9 |

| Miles & More | 1.4 |

| Qatar Airways Qmiles | 0.8 |

| Radisson Rewards | 0.4 |

| Singapore Krisflyer | 1.3 |

| Southwest Rapid Rewards | 1.5 |

| Spirit Airlines Free Spirit | 0.4 |

| Turkish Airlines Miles and Smiles | 1.3 |

| U.S. Bank FlexPerks | 1.5 |

| United MileagePlus | 1.4 |

| Virgin Atlantic Flying Club | 1.5 |

| Wells Fargo Go Far Rewards | 1.5 |

| World of Hyatt Loyalty Program | 1.7 |

| Wyndham Rewards | 1.2 |

Conclusion

It might take a good amount of effort to maximize the value of a rewards credit card, but it’s usually worth it in the long run. The minimum you should do to get the most out of your points or miles is to make sure to meet the introductory offer requirements and pay your balance in full every month. Of course, it may be fun to see your points or miles pile up, but don’t spend more than you usually would just for the rewards. In the long run, it won’t be so rewarding.

Comment down below on your experience with maximizing your credit card points and miles worth. In addition, if you don’t have a credit card just yet, feel free to check out our credit card promotions masterpost to find one that suits your needs.

The Best Bank Offers are updated here. See the below pages to get started with some of the best offers: • Chase Bank Offers. Chase offers a range of attractive Checking, Savings and Business Accounts. Chase has a great selection of sign-up bonuses in comparison to other big banks. • HSBC Bank Offers. HSBC Bank routinely has offers for several of their Personal Checking and Business Checking accounts. They also have a good referral program. • Huntington Bank Offers. Huntington Bank has high bonus amounts available through their Checking and Business Checking. Huntington also offers a Business Premier Money Market Account. • Discover Bank Offers. Discover Bank offers top cashback, savings, money market accounts and CD rates for you to take advantage of. Discover has industry leading selections to cater to your banking needs. • TD Bank Offers. TD Bank consistently offers a fantastic selection of checking accounts to cater to your banking needs. However, savings account offers are less frequently available. |