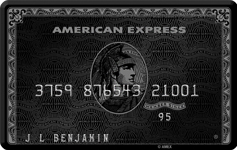

The American Express Centurion (Black Card), a legend in the credit card industry just for how prestigious and exclusive this card is. It’s not something you can just apply for online and the only way you can apply for this card is if you’ve been specifically contacted by American Express themselves. It’s been stated that American Express only sends out invitations for their personal Centurion card if you fulfill a $350,000 minimum spending on all of your AmEx cards within a given calendar year. Note that just because you make the minimum spending and all your accounts are in good standing doesn’t necessarily mean that you’ll get an invitation.

The American Express Centurion (Black Card), a legend in the credit card industry just for how prestigious and exclusive this card is. It’s not something you can just apply for online and the only way you can apply for this card is if you’ve been specifically contacted by American Express themselves. It’s been stated that American Express only sends out invitations for their personal Centurion card if you fulfill a $350,000 minimum spending on all of your AmEx cards within a given calendar year. Note that just because you make the minimum spending and all your accounts are in good standing doesn’t necessarily mean that you’ll get an invitation.

I honestly feel privileged to unveil such a attractive card in all it’s entirety. This is a card that literally can offer you everything you seek in credit card features such as; Room upgrades at the time of booking, special amenities at each property such as $100 credit to use on site or a complimentary hotel transfer, additional Centurion $100-$200 in food and beverages or spa credit, 30% off Airline flights, Priority pass select complimentary access to Centurion Lounges and hundreds of other lounges nationwide and so much more.

Now whether this card makes up for the initiation fee of $5,000 along with an annual fee of $2,500 is totally up to you, but with the Centurion Membership Rewards points program, and a bounty of exclusive, concierge-style perks and benefits, it’s considerable if I had that “Centurion” spending habit. Not only that but this card is definitely a catch for the eyes crafted from slick anodized titanium.

Key Features:

- Initiation fee of $5,000 along with an annual fee of $2,500

- Room upgrade at time of booking (when available)

- Daily breakfast for two people

- In-room Wi-Fi (at most properties)

- Special amenity unique to each property, such as a $100 credit to use on site or a complimentary hotel transfer

- Additional Centurion benefit of $100 or $200 in food and beverage or spa credit (on paid stays of two nights or more)

- Delta SkyMiles Platinum Medallion — Get complimentary upgrades, priority waitlisting, a bonus of 4 miles per dollar spent, waived award reissue fees, priority check-in and boarding, your pick of Choice Benefits and more

- Centurion International Arrival Services

- Gogo In-Flight Wi-Fi –Enjoy free Wi-Fi on up to four devices at more than a million hotspots at airports, hotels and more worldwide

- Receive 30% of your Membership Rewards back as a statement credit when you redeem points for all or a portion of any flight.

- Centurion Airport Lounge Access

- Complimentary access for you and guests to hundreds of airport lounges worldwide, regardless of which airline or class you’re flying.

- Receive a credit for Global Entry ($100) or TSA Precheck priority screening ($85) every five years.

- $200 Airline Fee Credit

- Airline upgrade from business class to first class

- Access to premium car purchasing, luxury rentals and a variety of “driving experiences”

- A table is held for Centurion members every day at 1,000 of the world’s top restaurants. Reservations are on a first-come, first-served basis

- Access to sports, music, fashion, fine dining and other events that provide VIP experiences

- and so much more

Pros:

- Exclusive Centurion Perks

- Access to exclusive events

- Delta SkyMiles Platinum Medallion Status

Cons:

- EXCLUSIVE

- Fees on this card is beyond hefty (understandable)

Conclusion:

Now, this card’s prestige is quite enticing and I believe it’s that kind of feel primarily because of how rare and sanctioned it is. Now whether it’s worth it is still a big question; I say, if you’re a multi-millionaire that could accomplish a quarter million spend every calendar year then this card may be your calling. It is an attractive card and one of the few cards that you can actually buy a airplane with. It’s prestigious in all it’s entirety, but odds are, most of us will ever get the chance to decide whether this card is worth it or not.

Now there are a couple of cards that offer a fraction of these perks at a significantly lower annual fee such as the Platinum Card from American Express, which is definitely a more practical go-to card, with a usually generous sign-up bonus and many of the travel perks you get from a Centurion but for a fraction of the price ($450 vs $2,500). Honestly, all I can really say is that it’s a prestigious card that’ll offer you luxurious opportunities if you are approved. Don’t forget to check out our complete list of Credit Card Promotions for other bonuses and offers.