This may very well be namely the premium card that Bank of America was hoping to push since June. The Bank of America Premium Rewards VISA Infinite with presumably “Premium Rewards” has just released more intel regarding features and better yet, there’s a 50,000 Sign-up Bonus attached for a $3,000 spending threshold. Here’s what you should expect right now: $100 in airline incidentals credit, $100 in Global Entry/TSA, 2x the points per $1 spent on travel and dining and 1.5% points per $1 spent elsewhere with an ability to reap Bank of America’s Preferred Rewards Program, all on top of a $95 annual fee.

This may very well be namely the premium card that Bank of America was hoping to push since June. The Bank of America Premium Rewards VISA Infinite with presumably “Premium Rewards” has just released more intel regarding features and better yet, there’s a 50,000 Sign-up Bonus attached for a $3,000 spending threshold. Here’s what you should expect right now: $100 in airline incidentals credit, $100 in Global Entry/TSA, 2x the points per $1 spent on travel and dining and 1.5% points per $1 spent elsewhere with an ability to reap Bank of America’s Preferred Rewards Program, all on top of a $95 annual fee.

I have said in a previous BoA Premium Card Review Post that this card will likely rival against the Chase Sapphire Reserve, U.S. Bank Altitude, UBS Infinite, and the Platinum Card from American Express, however, from the looks of it, this could be the Chase Sapphire Preferred® Card’s rival instead.

Alternative Credit Card Bonuses:

- Chase Sapphire Preferred® Card

- Barclaycard Arrival PlusTM World Elite MasterCard®

- Platinum Card® from American Express

Bank of America Premium Rewards Card In-Depth:

We’re stretching into not even a month for the release of the new Bank of America Premium Rewards Card and lets just say that a majority of the card’s aspects have already been confirmed. Firstly, an exceptionally attractive 50,000 Bonus Points for a reasonable spending requirement of $3,000 within 3 months of account opening.

One of the truthfully, more appealing features about this card is that it offers Preferred Rewards Capabilities, allowing you to earn a beautifully rewarding 2.625x the points everywhere and 3.5x on travel/dining for a low annual fee of $95. With the annual fee in mind, it’s of all evidence that Bank of America made the best move possible by pulling from the premium card race and catering towards their Preferred Rewards customers who keep liquid-able assets with them.

Furthermore, I only suggest keeping this card long-term if you are a Preferred Rewards client and that you can actually get value out of the travel incident credit. 2x on Travel/Dining and 1.5% everywhere is decent, but there are countless more cards out there that offer you more rewarding aspects, perhaps the Chase Sapphire Preferred® Card (waived AF for the first year).

Also, if you factor in the $100 Travel Incidental Credit and you can actually value it close to what it really is valued at, then this card may be a step up from the no annual fee Travel Rewards card and therefore be a good additive to your wallet.

Bank of America Premium Rewards Card VISA Infinite Summary:

- Apply Now

- Maximum Bonus: 50,000 Bonus Points

- Spending Requirement: Make at least $3000 in purchases within first 3 months

- Annual Fee: $95

- Bonus Worth: $500; $405 if you account the annual fee.

- Expiration Date: None

- Additional Advice: Those of you who are able to reach Platinum Honors will be able to reap a 75% rewards bonus.

Bank of America Premium Rewards Card VISA Infinite Features:

- To be released September 2017

- 2x points per $1 spent on all travel and dining purchases

- 1.5x points per $1 spent on all other purchases

- Travel fee reimbursement:

- $100 airline incidentals credit, including baggage fee and flight drinks (NOT airfare)

- $100 Global Entry/TSA PreCheck

- $95 annual fee

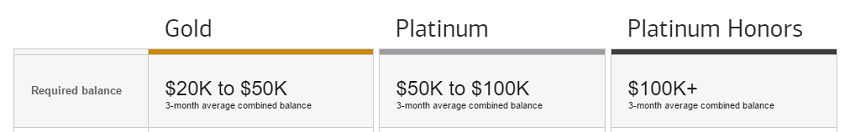

Preferred Rewards Status Altitudes:

You will be able to achieve three statuses with the Preferred Rewards Program: Gold, Platinum, and Platinum Honors with a direct correlation between the status/benefits and the amount of money you have with Bank of America or Merrill. Holdings are as followed:

- Preferred Rewards Platinum Honors: $100,000+

- Preferred Rewards Platinum: $50,000-$100,000

- Preferred Rewards Gold: $20,000 – $50,000

- No status: $19,999 or less

Those of you who are able to reach Platinum Honors will be able to reap a 75% rewards bonus on top of a number of benefits, so this may be rather exciting to see attached to this new Premium Travel Rewards card.

Pairing your Premium Rewards with Bank of America’s Preferred Rewards Program is where all the attractiveness comes to play with the ability to earn 2.625x the points on all of your purchases if maximized correctly. With regards to your travel and dining rewards category, you’ll be able to reap an earning up to 3.5x points on such.

Conclusion:

You could earn yourself 50,000 Bonus Points when you spend $3,000 within 3 months on a new Bank Americard Premium Rewards VISA Infinite, set to release in September of 2017. Definitely something for Preferred Rewards program participants to look forward to considering you can maximize your travel at 3.5x points per $1 spent on top of $100 in travel credit reimbursement. The Travel credit would be able to offset the annual fee if maximized correctly.

If you really do maximize and pair your rewards earnings with Preferred Honors Status, this would beautifully sum up at perhaps the best Restaurant credit card you can get your hands on, and at a low $95 annual fee, there’s no complaining. Be sure to also check out our other cards from our complete list of Credit Card Promotions.