The CareCredit credit card from Synchrony Bank makes it easy for you to access care, without delay. Here for you and your whole family. The CareCredit is a healthcare credit card designed for your health and wellness needs for you, your entire family and your pets. It helps you pay for out-of-pocket expenses not covered by medical insurance by extending special financing options that you can’t get when using your Visa or MasterCard with over 200,000 enrolled providers across the nation.

The CareCredit credit card from Synchrony Bank makes it easy for you to access care, without delay. Here for you and your whole family. The CareCredit is a healthcare credit card designed for your health and wellness needs for you, your entire family and your pets. It helps you pay for out-of-pocket expenses not covered by medical insurance by extending special financing options that you can’t get when using your Visa or MasterCard with over 200,000 enrolled providers across the nation.

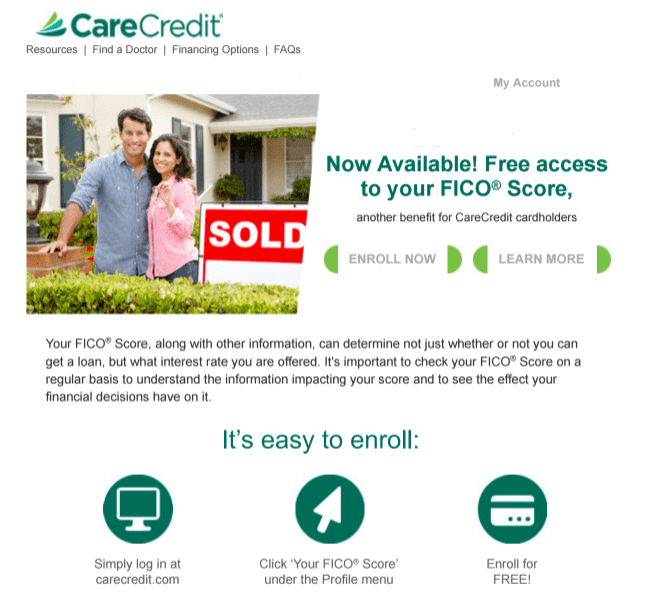

Editor’s Note: This card now offers comprehensive Free FICO Score as a benefit. If you’re an existing cardholder, then you should have already received an e-mail regarding so.

Alternative Credit Card Bonuses:

- Costco Anywhere Visa® Card by Citi

- Chase Freedom UnlimitedSM

- Blue Cash Everyday® Card from American Express

CareCredit Card Features:

- Financing options of 6, 12, 18 or 24 months no interest is charged on purchases of $200 or more when you make the minimum monthly payments and pay the full amount due by the end of the promotional period.

- Pay for health, and wellness care at over 200,000 enrolled providers across the nation.

- CareCredit also extends longer term healthcare financing for 24, 36, 48 or 60-month periods with Reduced APR and Fixed Monthly Payments Required Until Paid in Full. Purchases of $2,500 or more qualify for the 60-month offer with a 16.9% APR (24, 36 and 48 financing terms are for purchases of $1,000 or more with a 14.9% APR).

Pros:

- No Annual Fee

Cons:

- Hefty APR of 26.99%

How To Get CareCredit Card:

Here’s what you may need to have the process go smoothly:

- Doctor’s name, or how you plan to use your CareCredit card

- Name

- Address

- Date of birth

- Social security number or ITIN

- Net income

- Housing Information

Final Analysis:

With the CareCredit credit card from Synchrony Bank, you’ll be able to reap 6, 12, 18 or 24 months no interest is charged on purchases of $200 or more. CareCredit also extends longer term healthcare financing for 24, 36, 48 or 60-month periods with Reduced APR. Fixed monthly payments is required. Pay for health, and wellness care at over 200,000 enrolled providers across the nation. Note that there’s a 26.99% APR attached on this card, carrying a balance can be detrimentally concerning due to the fees. Make sure you pay off your balance in time to avoid so. In most cases, you’d be better off with a Chase Freedom UnlimitedSM . Don’t forget to check out our full list of Credit Card Bonuses if you’re not interested at the moment.