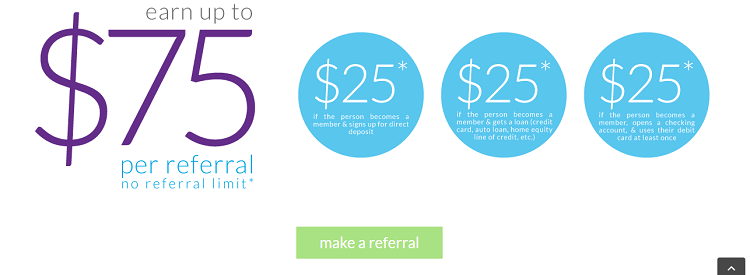

If you’re a current residents of Charlotte, North Carolina, you can now reap the full benefits of an accumulative bonus incentive(s) up to $75 with Charlotte Metro Credit Union. Spread the word to your family, friends, co-workers, or anyone you know and when they become a member with an accomplished direct deposit, you’ll receive $25. Earn an additional $25 when your referee opens a loan and lastly, you’ll earn a $25 when they open a new checking account with at least one debit card purchase made.

If you’re a current residents of Charlotte, North Carolina, you can now reap the full benefits of an accumulative bonus incentive(s) up to $75 with Charlotte Metro Credit Union. Spread the word to your family, friends, co-workers, or anyone you know and when they become a member with an accomplished direct deposit, you’ll receive $25. Earn an additional $25 when your referee opens a loan and lastly, you’ll earn a $25 when they open a new checking account with at least one debit card purchase made.

Once all requirements have been established, you’ll receive a total of $75! With a wide array of checking account options to choose from, you and your friend will surely find an account that suits your financial lifestyles. Make sure you fill out the referral form and hand it out to anyone you think would be interested in this promotion!

Charlotte Metro CU $75 Referral Bonus:

- Refer Now

- Account Type: New Personal Checking, Share account

- Referrer Bonus(You): $75

- Referral Recipient Bonus(Your friend): $0

- Availability: NC

- Expiration Date: None

- Soft/Hard Pull: Unknown

- Credit Card Funding: Unknown

- Direct Deposit Requirement: DD is optional for $25 requisite.

- Additional Requirements: Must enroll in membership to participate

- Monthly Fee: No monthly fees specified

- Early Termination Fee: None

Charlotte Metro CU $75 Referral Steps:

- Stop by an Charlotte Metro branch and open up an account with them if you haven’t already.

- Spread the word to your friends & family.

- Your referee must open up a new share account w/ direct deposit to be approved as a deemed member (Earn $25)

- Next, your referee must open up a checking account with at least one debit card transaction within 30 days. (Earn $25)

- Lastly, your referee must apply for a loan or credit card and receives approval. (Earn $25)

Charlotte Metro CU Checking Features:

- Free Visa Check Card (debit card)

- Courtesy Pay

- Mobile Banking 24-7 access

- Online Banking 24-7 access

- Free Online Bill Payment

- Free eStatements

- Surcharge-FREE ATM access at thousands of locations worldwide

Refer Our Readers:

If you are interested in opening a checking account with Charlotte Metro Credit Union, please feel free to leave a comment in the comments section of this post to exchange referrals with other banking customers. Also, don’t forget to let us know if it’s a hard pull or soft pull when opening an account with this credit union. Also, we’d appreciate it if you can let us known if you can fund a checking account using a credit card!

Conclusion:

Charlotte Metro Credit Union is now offering a great opportunity for you. If you’re a current resident of North Carolina, then I recommend telling your family members, or friends about the many benefits that they will receive with this promotion. Enjoy a Bonus up to $75 along with a conveniently simple checking and savings account that’ll have you on top of all of your expenses and returns.

Be sure to take into consideration that there’s no specified early termination fee, but there must be no negative shares 30 days or longer, no more than 10 days delinquent on any loan, no unpaid charge-offs and you must not currently be in bankruptcy. There is no limit on the number of referral bonuses that can be paid to a member. Activity must be performed within 60 days of membership and payouts will occur at end of 60 days. If you want to check out other banks, head over to our complete list of Bank Referrals for all your banking needs!