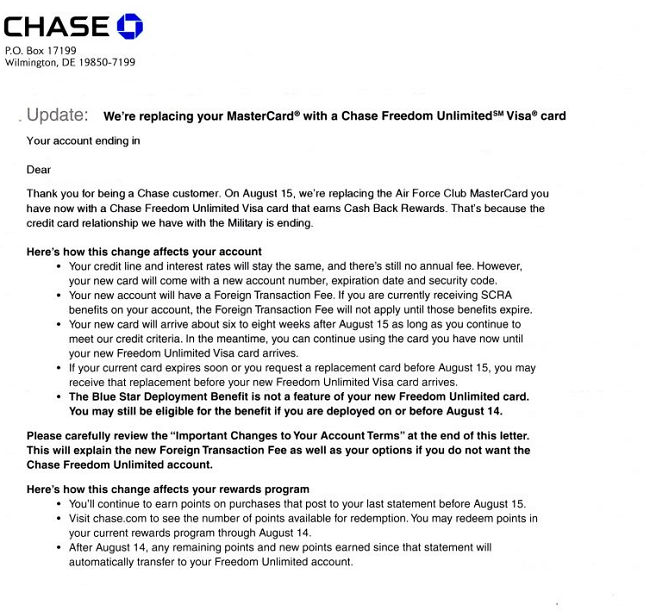

Chase recent decisions towards discontinuing the Chase Air Force Club Credit Card or Military Free Cash Rewards card has led to those cardholders being converted to the Chase Freedom UnlimitedSM. Current cardholders, you should expect your conversion to be done by August 15, 2017.

Chase recent decisions towards discontinuing the Chase Air Force Club Credit Card or Military Free Cash Rewards card has led to those cardholders being converted to the Chase Freedom UnlimitedSM. Current cardholders, you should expect your conversion to be done by August 15, 2017.

Now, this card offered 2% back on purchases at the Commissary, the Exchange & FSS/MWR activities and 1% cash back on all other purchases, on no annual fee. The Freedom Unlimited will offer Unlimited 1.5% cash back on every purchase, 0% Intro APR for 15 months on top of no annual fee.

Alternative Credit Card Bonuses:

- USAA Preferred Cash Rewards Visa Signature

- USAA Rewards Visa Signature

- USAA Cashback Rewards Plus American Express

Chase Air Force Club Credit Card Features:

- No annual fee

- Earn 2 points for each $1 of net purchases on your enrolled account made at qualified Military Exchange, Commissary, MCCS, Army MWR, and Air Force Services merchant locations (excluding concessionaire purchases)

- Earn 1 point for each $1 of all other net purchases

- Earn an additional 1 point for each $1 of airfare and hotel accommodation net purchases when you book with a toll-free travel redemption number

- There is no maximum number of points that you can accumulate in the program

- Redeem points for cash back, gift cards, and travel

- No foreign transaction fees

- Blue Star deployment benefits

Chase Freedom Unlimited Features:

- Earn a $150 Bonus after you spend $500 on purchases in your first 3 months from account opening

- Unlimited 1.5% cash back on every purchase — it’s automatic

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 15.99-24.74%. Balance transfer fee is 5% of the amount transferred, $5 minimum

- Redeem for cash — any amount, anytime

- Cash Back rewards do not expire as long as your account is open

- No annual fee

Conclusion:

Now, this is kind of a bummer for you enlisted military personnel considering 2% cash back on everything on-base + no annual fee + no foreign transaction fee was quite rewarding. As of August 15, 2017, Chase Air Force Club Credit Card or Military Free Cash Rewards card will be converted to a Chase Freedom UnlimitedSM that holds 1.5% cash back + no annual fee but no foreign transaction fee. You could possibly product change to a Chase Sapphire Preferred® Card or Chase Freedom Card, but the significance of this card was that there was no foreign transaction fee + no annual fee. Find out which card is right for you by checking out our complete list of Credit Card Promotions today!