Apply for the Chase Fairmont Visa Signature® Card and you can earn yourself 2 free nights at any participating Fairmont hotel or resort worldwide after you make $3,000 in purchases within your first 3 months of account opening. You can also earn 1 free night each card anniversary year you make $12,000 in purchases with your card.

Apply for the Chase Fairmont Visa Signature® Card and you can earn yourself 2 free nights at any participating Fairmont hotel or resort worldwide after you make $3,000 in purchases within your first 3 months of account opening. You can also earn 1 free night each card anniversary year you make $12,000 in purchases with your card.

In addition, you can earn Fairmont Rewards on every purchase you make — 5x for every $1 spent on Fairmont stays, 2x for every $1 spent on airline tickets purchased directly with airlines, at car rental agencies, and on transit and commuting, and 1 for every $1 spent on all other purchases.This is a attractive card that’ll have you saving big on all your travelling needs. There’s an appealing no foreign transaction fee and exclusive Fairmont Premier status is instantly given when you acquire the card. This card could be a great option for you so be sure to read on if you’re interested!

Editor’s Note: This is one of the very few cards in Chase’s selection that doesn’t currently fall under the Chase 5/24 Rule. Be sure to also check out our wide selection of Chase Credit Card Reviews in order to fully ensure your satisfaction with this product.

Alternative Credit Card Bonuses:

- Citi® Hilton HHonors™ Reserve Card

- Hilton HHonors™ Card from American Express

- Starwood Preferred Guest® Credit Card from American Express

- IHG® Rewards Club Select Credit Card

Chase Fairmont Visa Signature Card Features:

- Earn 2 Complimentary Nights after you make $3,000 in purchases within your first 3 months of account opening*

- Earn 1 Complimentary Night each anniversary year that you make $12,000 in purchases with your card*

- Earn Fairmont Rewards on Every Purchase — 5 for every $1 spent on Fairmont stays, 2 for every $1 spent on airline tickets purchased directly with airlines, at car rental agencies, and on transit and commuting, and 1 for every $1 spent on all other purchases*

- No Foreign Transaction Fees on purchases worldwide

-

Automatic Upgrade to Premier Status after your credit card account is approved

-

Earn Platinum Status faster — when you spend $7,500 on your card, we will give you a stay credit towards Platinum status, up to a maximum of two stay credits per calendar year

-

Added value for existing Premier and Platinum members: Annual Fairmont Gold upgrade certificate plus dining certificates as long as you maintain your Premier or Platinum membership status earned through stays

- $0 Introductory Annual Fee, then $95

Maximize Your Chase Fairmont Bonus:

Complete the Sign up Bonus spending requirements and you’ll receive:

- Two free night certificates

- 2 x $25 Fairmont dining (lunch & dinner) totaling in $50 value or Willow Stream Spa e-certificates (from Premier status)

- 1 suite upgrade

- 1 room upgrade

Your suite/room upgrades can be combined with your free night certificates.

You can apply the suite/room upgrades to your free night certificates. Now, the Suite/Room upgrades can be applied to a single stay which can be a total of up to five concurring nights. When booking a room, be sure to check the:

- Standard room availability; Free nights can only be booked under STANDARD rooms.

- Suite/Room upgrades will be available as well.

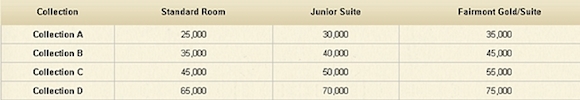

Redeeming Your Rewards with Chase Fairmont:

Fairmont points CAN be redeemed for free hotel night stays at Fairmont designations. The number of points needed varies based on which hotel category (A-D) and type of room you’re after (Standard, Junior Suite or Fairmont Gold/Suite). You will need a Fairmont card & Chase account to view the chart below.

Chase Fairmont Status Overview:

- Club: Base level with no stay requirements.

- Premier: Mid. level, 5 stays or 10 nights is required.

- Platinum: Highest level, 10 stays or 30 nights required.

Premier status:

Premier status comes with exclusive perks including:

- 1 complimentary room upgrade

- 1 complimentary suite upgrade

- 750 airline miles on qualifying stays

- 1 Complimentary third night on a three-night stay (cannot be used with your free night certificates)

- $50 Fairmont dining (lunch & dinner) or Willow Stream Spa e-certificate

The room upgrades and dining certificates are quite the catch!

Platinum status:

Platinum status comes with exclusive perks including:

- 2 complimentary room upgrade

- 2 complimentary suite upgrade

- 1 Complimentary night

- 1,000 airline miles on qualifying stays

- Free welcome amenity

- $100 Fairmont dining (lunch & dinner) or Willow Stream Spa e-certificates

Take advantage of One Free Night Stay!

Pros:

- Generous Sign Up Bonus

- Premier Status

- No Foreign Transaction Fee

- Complimentary room/suite upgrade

Cons:

- There is an Annual fee of $95 (luckily it’s waived for the first year thought!)

Credit Score Required:

Chase Fairmont card is kind of a hard card to specifically say what credit is good credit, but this is a premium credit card offered from Chase so I’m expecting you’d need a 700+ before applying for one.

If you’re denied for this card, I always recommend that you contact Chase’s Reconsideration Center.

Credit Bureau- Chase Pull:

Chase will do pulls with credit bureaus on the basis of where you live in the United States.

Credit Limit-Increase:

Now, because there are only two data points for this card, it’s kind of iffy as to what we can conclude about your credit limit, you distribute your credit limits between existing cards. This is not an option if your increasing the credit limit on a card to more than $35,000.

Conclusion:

Get your hands on the Chase Fairmont Visa Signature® Card and earn yourself two free nights after meeting the $3,000 minimum spending requirement within the first 3 months of account opening. The Certificates will be added to your Fairmont President’s Club (“FPC”) online profile. Now the biggest question about this card is whether it is worth it or not? I say, if you stay with Fairmont once a year, then it’s definitly worth the annual fee, don’t forget that the annual fee is also waived for the first year as well!

This card definitely has great potential, and what’s even more attractive is that it doesn’t follow the 5/24 Rule guidelines. Make sure that you have at least a 700 credit score before applying, again, if you’re denied, I definitely recommend that you contact a reconsideration specialist. It can also be worth putting $12,000-15,000 of spend on the card per year depending on your goals especially with top benefits such as two free nights, no foreign transaction fees, and travel protection benefits. Find our complete list of Credit Card Bonuses today! Also, Find more Chase bonuses just like this with our in-depth Chase Reviews!