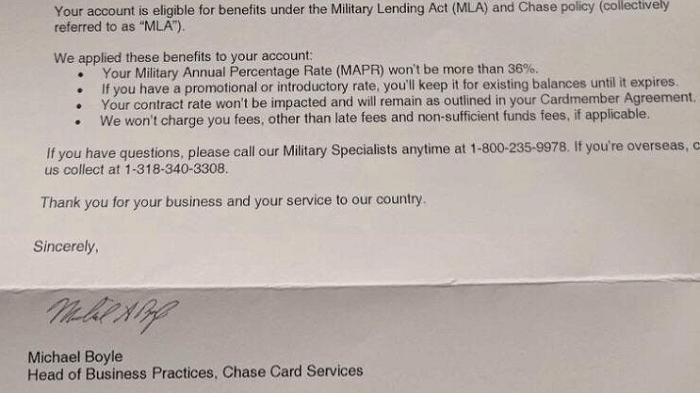

The Military Lending Act (MLA) was passed not too long ago with Chase updating their policy for active duty military personnel in which case, if you fall under this category, it’s to my understanding that you’ll have your annual fee waived completely on top of a Military Annual Percentage Rate (MAPR) that won’t be over 36%. If you have a promotional or introductory rate, you’ll be able to keep it for existing balances until it expires. One thing I’d like to not is that late fees and non-sufficient funds fees are not waived with this act.

Recommended Chase Credit Cards:

- Chase Sapphire Reserve

- Chase Ritz-Carlton Card

- Chase Ink Business PreferredSM Card

- Chase Sapphire Preferred® Card

Chase Waives Annual Fee Summary:

- Your Military Annual Percentage Rate (MAPR) won’t be more than 36%.

- If you have a promotional or introductory rate, you’ll keep it for existing balances until it expires.

- Your contract rate won’t be impacted and will remain as outlined kin your cardmember agreement.

- we won’t charge you fees, other than late fees and non-sufficient funds fees, if applicable.

Military Lending Act vs. Servicemember Civil Relief Act:

- MLP waives the annual fee on all accounts opened after September 20, 2017.

- SCRA only waived annual fees of cards that were open prior to active duty.

- SCRA is a debt relief – debt forgiveness program for active duty military.

- SCRA caps interest rates at 6%-ish (MLA caps interest rates and fees at 36%)

Conclusion:

Definitely a great lead from Chase integrating the Military Lending Act and definitely provides support to active duty military personnel. Essentially, if you’ve applied for an account after September 20, 2017, call in and you may be able to grab one of Chase’s most exceptional of cards at a waived annual fee. Note that insufficient funds fees and late fees do not count. Definitely attractive by all means, so if you’re current active duty military, big ups to you, hopefully you were able to grab the waived annual fee (especially on a Sapphire Reserve if you plan on it). Find out which card is right for you by checking out our complete list of Credit Card Promotions today!

Great Article. I am active duty Navy and just got the Chase Sapphire Reserve, based on this article, and had the MLA applied, and all annual fee was waived.

Does anyone know if Citibank honors the MLA? I’d like to apply for the Citi American Executive card, which come with a $450 annual fee. I wonder if they waive the annual fees, like Chase does.