Get your free credit score & credit report at CreditCard.com, because knowing your credit score is a huge determinant on finding the right credit cards for you. Being able to successfully manage your credit score is detrimental considering that lenders base reliability with a number when it comes to paying off your debt.

Get your free credit score & credit report at CreditCard.com, because knowing your credit score is a huge determinant on finding the right credit cards for you. Being able to successfully manage your credit score is detrimental considering that lenders base reliability with a number when it comes to paying off your debt.

Considering that a good credit score means a lower interest rate and easier approval on a car and mortgage loan, keeping track of your credit score is the initiative you’d need to take and although it does sound difficult in the beginning, with CreditCard.com, you’ll be able to get on the right track in no time!

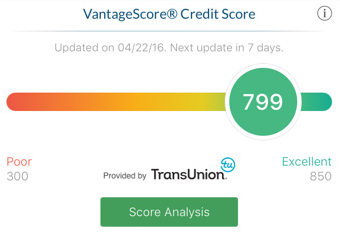

VantageScore V3

Lenders will occasionally look at your VantageScore as one of your credit score sources, so it’s worth keeping that in mind. This score could play a big factor in whether or not you’re approved for a new loan or card or not. CreditCard.com provides their members free VantageScore V3 which ranks from 300-850.

I almost always recommend that you check your FICO score as well when applying for a significant loan or credit card because, lets face it, VantageScore differs greatly from FICO in terms of the ranking system and VantageScore could put you into a completely different scoring category.

Access Your free Credit Score Instantly:

Feel empowered to take control of your credit with Score & Report. Receive account alerts, free monthly credit score reports, personalized financial tips to help improve your score, and much more without ever leaving the app. Improve the way you keep track of credit trends, available credit, total balances, and account activity.

What You Should Know About your Credit Report with CreditCard.com:

- Lenders do look at your credit history – a record of whether or not you’ve paid your bills

- Credit Scores matter to consumers because lending decisions weigh on them.

- Credit bureaus track borrowing behavior. Experian, Equifax and TransUnion keep records of how you have behaved when loaned money

- Credit Reports include identifying information (SSN, etc.), account history, data from public records (bankruptcy, etc.), and a record of inquiries into your credit history.

- Some credit report information could be wrong, Double-check!!

- FICO score is the most widely used credit score.

- Service providers, employers may also review your credit report.

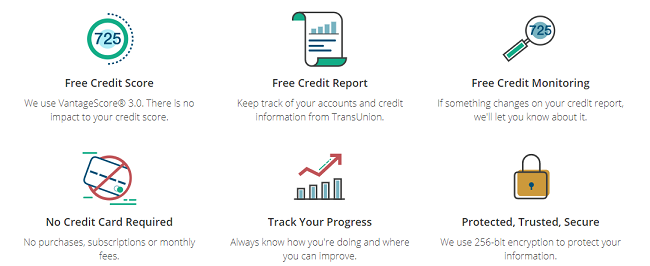

By now, you should already be aware that knowing your credit score is imperative! Now, onto a pressing question with most Free Credit Score providers, is CreditCard.com’s free credit score and credit report really free or not? We can confirm that CreditCard.com is completely legit. Most suspicious free credit monitoring services would ask for credit card information, or offer you a free trial that leads to a suspected subscription that you didn’t want. However, with CreditCard.com, it’s 100% safe considering that they do not ask for any credit card information whatsoever.

CreditCard.com Free Credit Score Key Features:

- Free Credit Score – Vantage V3.0

- Free Credit Report – TransUnion

- Free Credit Monitoring

- Track Your Progress

- Receive personalized financial tips and advice based on your account preferences

- Payment History Feature – Know where each of your account(s) stand

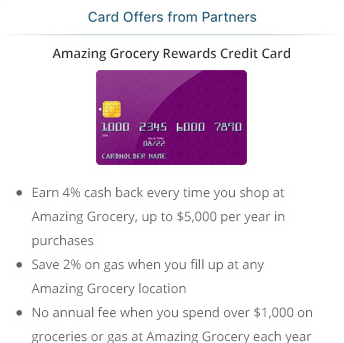

- Score & Report provides you with the offers that match your spending habits and reward preferences.

- Protected, Trusted, Secure – 256-encryption to protect your information

- NO Credit Card Required – No purchases, subscriptions, etc.

Benefits of Using CreditCard.com:

- Feel empowered to take control of your credit with Score & Report. Receive account alerts, free monthly credit score reports, personalized financial tips to help improve your score, and much more without ever leaving the app. Improve the way you keep track of credit trends, available credit, total balances, and account activity.

- Score & Report makes is easy to track credit score fluctuations over time. You can instantly see if your score improves or drops with Score & Report’s easy to read credit score timeline. Score & Report gives you more than just a number, it gives you the data behind your credit score.

- Receive personalized financial tips and advice based on your account preferences. Use their tips to help improve your credit score and overall financial strategy. Score & Report makes it easy to keep track of your credit history through your phone. Each tip is crafted to help you feel empowered to take control of your credit score.

- Know where each of your accounts stand with Score & Report. Easily see which accounts are current or delinquent with Score & Report’s payment history feature. Quickly connect to the correct contact at your bank to dispute any suspicious activity or inaccuracies. Stay up-to-date on each account inside your app.

- Stop wasting time researching numerous credit card offers that do not meet your credit needs or history. Score & Report provides you with the offers that match your spending habits and reward preferences. Their app helps guarantee your application will be approved and provides offers that will appeal to you the most. Never worry that you have the wrong card in your hand.

Conclusion:

CreditCard.com is an overall efficient method to take control of your credit score, and credit report and the best part is that it’s absolutely free. Yes, free credit score with Vantage V3, free credit reports from Transunion and free credit monitoring. One thing I particularly like is their Score & Report Match system, in which case they’ll match your spending habits and rewards preferences with credit cards suitable to your credit needs. It’s guaranteed and worth checking out if anything, since it is free! One thing I’d like to leave a note on is that again, VantageScore varies significantly from FICO and could leave you in a different scoring category. If you want a more in-depth answer as to why your Credit Score is crucial then be sure to check our post on Your Credit Score and Credit History. Don’t forget to also check out our full list of Credit Card Bonuses if you’re not interested at the moment.