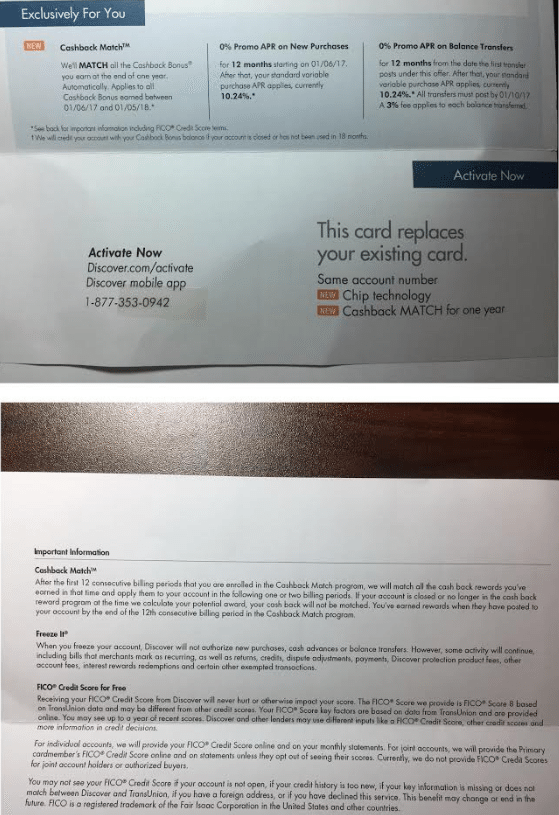

Discover is currently targeting individuals who have had their cards recently replaced automatically. This could be due to either getting an EMV chip compatible card or just having your card expire. Essentially the cash back will be a total match up of your spend within a total year or 12 billing periods: you receive the amount of rewards that you received in the previous year again. This would mean that if you maximize your 5% category… you would actually be earning 10%; 5% now and 5% at the end of your cash back match period.

Discover is currently targeting individuals who have had their cards recently replaced automatically. This could be due to either getting an EMV chip compatible card or just having your card expire. Essentially the cash back will be a total match up of your spend within a total year or 12 billing periods: you receive the amount of rewards that you received in the previous year again. This would mean that if you maximize your 5% category… you would actually be earning 10%; 5% now and 5% at the end of your cash back match period.

Editor’s Note: This offer is targeted, check your mail to see if you are eligible. YMMV. For a limited time for new customers, Discover It CashBack Match Card offers double cash back the first year. You’ll get 5% cash back in categories that change each quarter and 1% cash back on all other purchases.

Alternative Credit Card Bonuses:

- Citi® Double Cash Card – 18 month BT offer

- Blue Cash Preferred® Card from American Express

- Chase Freedom UnlimitedSM

Discover It Card Features:

- 0% introductory APR – Discover is currently offering 0% interest rate on purchases and balance transfers for 12 months. With this excellent feature, consolidate your existing high-interest debt and feel good about not paying extra interest. Although, there is a 3% balance transfer fee, you will most likely be saving of money with a year and half of 0% interest.

- No Hidden Fees – No annual fees, no foreign transaction fees, no over limit fee, and no fee for your first late payment. Your interest rate will not increase for late payments.

- Price Protection – If you find a lower price within 90 days of making a qualifying Discover it card purchase, Discover will refund up to a $500 difference .

- Purchase Protection – If stolen or accidentally damaged, all eligible purchases made with the Discover It card are protected for up to $500 during the first 90 days.

- Return Protection – If you change your mind about a purchase, you can return any eligible purchase within 90 days for up to a $500 refund. For example, if the store return policy on an item that you purchase has a 30 day limit, you will have an extra 60 days for a refund with Discover.

- Fraud Protection – Discover will not make you liable for any charges that you did not make.

- Extended Warranty – Discover will extend the terms of the original U.S. manufacturer’s warranty and any purchased warranty for up to 1 extra year, on warranties of 3 years or less. You will appreciate this on major purchases like electronics, home and medical supplies.

- Free real FICO score – Keep a close eye on your FICO credit score each month for free with the Discover It Card.

- Freeze It On/Off switch – If your card gets lost or stolen, freeze or unfreeze your account within seconds with the mobile app or through Discover’s website. You no longer have to go through drawn out phone call process to reach a representative.

- Flexibility – The Discover It credit card allows you to choose your own monthly due date and you have until midnight of that day to pay by phone or online. This allows you to customize and manage your finances.

- U.S Based, 24 Hour Customer Support – Call any time and speak to a representative without any miscommunication since call centers are here in the US.

Conclusion:

Current Discover cardholders, if you recently had your card replaced automatically by means of EMV chip compatibility renewal or your card expired then Discover offers good news. You will be able to participate in the CashBack Match-up Program. For a whole 12 billing periods, you will be able to optimize your spend and get that generously attractive match-up bonus that you crave. Essentially this would make the 5% category on the Discover IT earn 10%. Definitely a great promotion and if you were targeted, it’s recommended that you try the match-up as soon as possible! If you still would like to review other options, check out our complete list of Credit Card Promotions today!