For those of you that are familiar with the clothing brand Forever 21 franchise. Comenity Bank recently expanded their banking services to Forever 21 offering a new co-branded credit card coined Forever Rewarded Credit Card from Comenity Bank. You could earn a $10 discount for just making your first purchase outside of Forever 21 within a given 90 days of account opening.

For those of you that are familiar with the clothing brand Forever 21 franchise. Comenity Bank recently expanded their banking services to Forever 21 offering a new co-branded credit card coined Forever Rewarded Credit Card from Comenity Bank. You could earn a $10 discount for just making your first purchase outside of Forever 21 within a given 90 days of account opening.

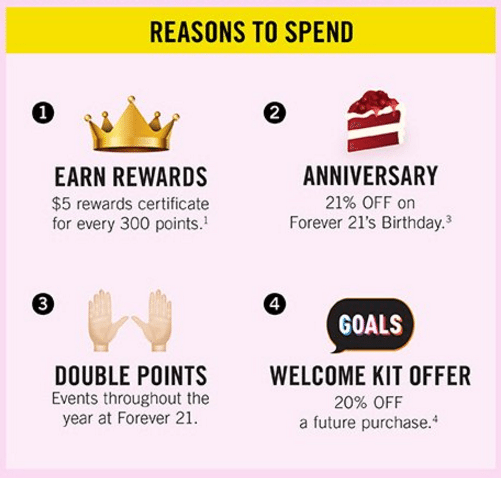

The card will earn you 3x the points per dollar spent in store or online at forever 21, 2x the points per dollar spent on qualifying restaurant purchases and 1x the points everywhere else. On top of that, you’ll get occasional discounts on purchases such as points automatically redeemed for a $5 certificate every 300 points earned, double points events throughout the year and so much more.

| Chase College CheckingSM: Get $100 as a new Chase checking customer when you open a Chase College CheckingSM account and complete 10 qualifying transactions within 60 days of account opening. Get Coupon---Chase College Checking Review |

| Chase Secure BankingSM: Earn a $100 bonus when you open a new Chase Secure BankingSM account online or enter your email address to get your coupon and bring it to a Chase branch to open an account. Make sure to complete 10 qualifying transactions within 60 days of coupon enrollment. Apply Now---Chase Secure Banking Review |

| Chase Private Client: Enjoy up to $3,000 bonus when you open a new Chase Private Client Checking account with qualifying activities. Get more from a personalized relationship when you open a new Chase Private Client Checking account with qualifying activities. Learn More---Chase Private Client Review |

Alternative Credit Card Bonuses:

Forever Rewarded Card Summary:

- Apply Now

- Maximum Bonus: $10 discount for making your first purchase outside Forever 21

- Spending Requirement: Make 1 purchase within 3 months.

- Annual Fee: $0

- Bonus Worth: YMMV

- Expiration Date: None

Forever Rewarded VISA Credit Card Features:

- $10 discount for making your first purchase outside Forever 21 within 90 days of account opening

- 3x points per $1 spent in store and online at forever 21

- 2x points per $1 spent on qualifying restaurant purchases

- 1x points per $1 spent on all other purchases

- 15% off your first purchase

- Points are automatically redeemed for a $5 rewards certificate for every 300 points earned

- Double point events throughout the year

- $5 Birthday Discount on accessories

- 21% off on Forever 21’s birthday

- Exclusive cardholder only promotions

Forever Rewarded Credit Card Features:

- 3x points per $1 spent in store and online at forever 21

- 15% off your first purchase

- Points are automatically redeemed for a $5 rewards certificate for every 300 points earned

- Double point events throughout the year

- $5 Birthday Discount on accessories

- 21% off on Forever 21’s birthday

- Exclusive cardholder only promotions

Conclusion:

If you’re a fan of fashion and you’re looking to expand your rewards and save big at Forever 21, then make sure to apply for Comenity’s new co-branded cards: Forever Rewarded Credit Card and Forever Rewarded VISA Credit Card. You will get a $10 discount on your first purchase made outside of Forever 21 within a given 90 days of card activation. Being quite frank, the sign-up bonus is below decent and you will be valuing Forever 21 points at 1.67¢ towards Forever 21 purchases, however, with exclusive discounts and events such as “double points on Forever 21 purchases,” it does offer something to look forward to. It all really depends on how attentive of a Forever 21 shopper you are or if shopping cart tricks works for this card. Most likely, the store card will only work for Shopping Cart Tricks. Also, be sure to check out our complete list of Credit Card Promotions for other bonuses and offers.

I am extremely dissatisfied with the Forever 21 Credit Card. I was convinced to sign up and, since I shop there frequently decided to do so. Unfortunately, my first two statements were diverted in the mailing system and I did not receive my reward until they were expired. I know that is not totally the credit card comany’s fault (and have signed up for electronic statements as of today); however, there has to be SOME way to reissue my expired certificates totally $20!!! If this is not rectified, I will be closing my credit card.