Citi ThankYou Rewards doesn’t get much attention compared to other bank rewards programs. It’s easy to see why Citi ThankYou only has 5 point-earning credit cards, 1 domestic airline transfer partner, and no hotel transfer partners.

Citi ThankYou Rewards doesn’t get much attention compared to other bank rewards programs. It’s easy to see why Citi ThankYou only has 5 point-earning credit cards, 1 domestic airline transfer partner, and no hotel transfer partners.

However, people who like using ThankYou points use them because it’s easy to earn. Additionally, with a few tricks up your sleeve, you’ll be able to use these points to their full potential with Ultimate Rewards points and Capital One miles.

Check out our list of the best credit card welcome bonuses here.

Read below for more information on what Citi ThankYou Rewards has to offer.

Citi ThankYou Rewards Quick Facts

| Credit Cards | Citi Prestige® Credit Card Citi Premier Card Citi Rewards+℠ Card AT&T Access Card from Citi |

| Redemption Options | Travel via ThankYou Travel Center Statement credits & mailed checks Gift cards Shopping at retail partners Payments toward bills, mortgages or student loans Charitable donations Transfer to partner loyalty programs |

| Value Per Point | $0.0075 – $0.0125 Up to $0.06 |

The Chase Sapphire Preferred® Card offers 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. You'll earn: • 5x on travel purchased through Chase TravelSM • 3x on dining, select streaming services and online groceries • 2x on all other travel purchases • 1x on all other purchases • $50 Annual Chase Travel Hotel Credit • Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027. Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase TravelSM This card carries a $95 annual fee. |

Earning ThankYou Points

You’ll be able to earn ThankYou points when you charge your expenses onto an eligible Citi credit card, or with an eligible bank relationship with Citi. To get access to your rewards, just sign into your Citi account or go to the ThankYou Rewards website.

Citi issues a great variety of different credit cards including co-branded airline and hotel cards. However, only a few of them will enable you to earn ThankYou points:

| Credit Card | Welcome Bonus | Ongoing Rewards |

| Citi Prestige Credit Card ($495 annual fee) | 50,000 points – spend: $4,000 – time: 3 months |

5x points on air travel & restaurants 3x points on hotels & cruise lines 1x points on all other purchases |

| Citi Premier Card ($95 annual fee, waived first 12 months) | 60,000 points – spend: $4,000 – time: 3 months |

3x points on travel & gas stations 2x points on restaurants & entertainment 1x points on all other purchases |

| Citi Rewards+ Card ($0 annual fee) | 15,000 points – spend: $1,000 – time: 3 months |

2x points on supermarkets & gas stations – (on up to $6,000 spent each year) 1x points on all other purchases Automatically rounds up to the nearest 10 points |

| AT&T Access Card from Citi (no annual fee) | 10,000 points – spend: $1,000 – time: 3 months |

2x points on AT&T products & services 2x points on eligible retail & travel websites 1x points on all other purchases |

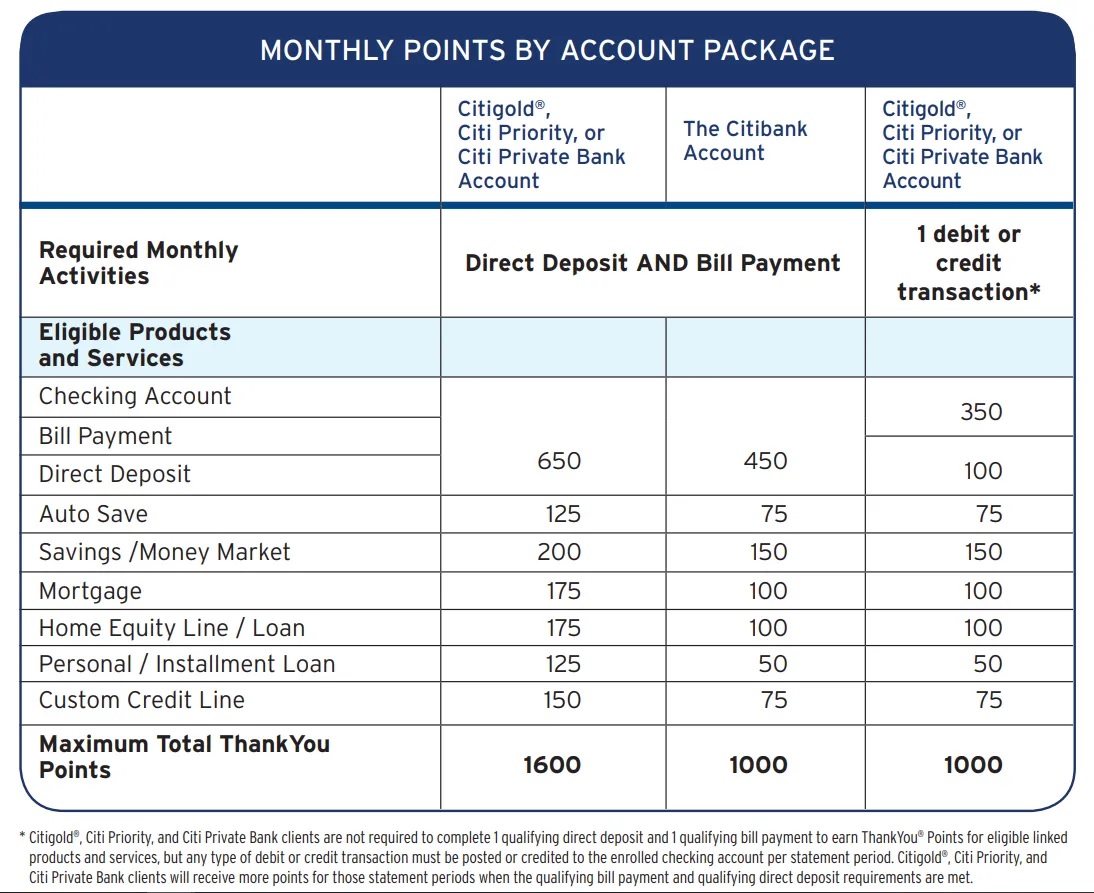

Additionally, you’ll be able to earn ThankYou points for having a Citibank account and finishing one direct deposit and one bill payment, or one debit or credit transaction each month.

It’s highly recommended to combine your Citi ThankYou credit card points and your THankYou banking relationship points into a single ThankYou member account. This way, you’ll be able to redeem them for larger rewards much faster.

If you’re short on points, there’s the option to buy ThankYou points you need. But, it’s not really recommended to do so. You’ll have to pay $0.025 per point, which is way more than what they’re worth. Plus, it only comes in 1,000-ponit increments.

Normally, there are some cases where it’s better if you pay the difference in points with cash instead.

Redeeming ThankYou Points

Usually, when it comes to ThankYou points, there are 2 types. One is the type you can earn with Citi Prestige and Citi Premier, which are worth more and can be transferred. The other points you earn are on Citi Rewards+ and AT&T Access from Citi, which aren’t worth as much and cannot be transferred.

Just as long as you have a Citi Prestige or Citi Premier card, you’ll be able to combine your ThankYou points earned from a lower-tier ThankYou card. In other words, you can transfer your “basic” ThankYou points towards a partner program.

Fortunately, ThankYou points will not expire as long as your account is open. But, late payments may prevent you from redeeming points.

Using the Citi Prestige or Citi Premier card, you’ll be able to transfer your ThankYou points towards:

- Avianca LifeMiles

- Cathay Pacific Asia Miles

- EVA Air Infinity MileageLands

- Etihad Guest Miles

- Air France/KLM Flying Blue

- InterMiles

- JetBlue TrueBlue

- Malaysia Airlines Enrich

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Sears Shop Your Way

- Singapore Airlines KrisFlyer

- Thai Airways Royal Orchid Plus

- Turkish Airlines Miles & Smiles

- Virgin Atlantic Flying Club

Majority of the time, the transfer rate is 1:1. Remember, you have to transfer in 1,000-point increments. This is the best way for you to use your ThankYou points that come with the highest-value rewards up to $0.06 per point. On average, you’ll receive $0.15 apiece when you transfer towards a partner program.

Redeem your ThankYou points with the ThankYou Travel Center for airfare, hotel stays, car rentals, cruises, and more. Point value will vary depending on which credit card you own and what redemption option you use.

| Credit Card | Flights | All Other Travel |

| Citi Prestige | $0.0125/point ($0.01/point after 09/01/2019) |

$0.01/point |

| Citi Premier | $0.0125/point | $0.0125/point |

| Citi Rewards+ | $0.01/point | $0.01/point |

| AT&T Access from Citi | $0.01/point | $0.01/point |

This is why you should book travel with a ThankYou Travel Center:

- It’s easy to use. The Travel Center works like any other online travel agency website. It comes with no complicated award charts to understand.

- Counts as booking directly with the airline. Earn redeemable and elite-qualifying airline miles for flights.

- Great for last-minute bookings and get access to any available seat.

- Good for travel during peak times and no blackout dates.

Here are some other options listed below:

| Redemption | Value per Point |

| Statement credits | $0.01 |

| Gift cards | $0.01 |

| Bill, mortgage, or student loan payment | $0.01 |

| Charitable donations | $0.01 |

| Shop with Points (Amazon or Best Buy) | $0.008 |

| ThankYou Select & Credit | $0.0075 |

| Cash (check by mail) | $0.005 |

There’s also the option for you to share your ThankYou points with anyone that has a ThankYou Rewards account. This is useful if someone you know needs extra points to book a trip.

Be sure to follow these guidelines:

- Transfer up to a maximum of 100,000 ThankYou points per calendar year.

- You can get no more than 100,000 ThankYou points a calendar year.

- Transferred ThankYou points will expire in 90 days.

- The points transferred cannot be transferred again to another account.

Log into your ThankYou Poiints account for more information.

ThankYou Rewards Partner Airline Sweet Spots

With tons of airline partners to transfer to, there are plenty of ways to maximize your ThankYou points. ThankYou Rewards only partners with domestic airlines, but you’ll have great domestic award flight options with their partnerships with international airlines.

See what the favorite sweet spots are based off of the information given to you below:

| Ticket | Class | From | To | Miles | Airline |

| One-way | Ecomony | U.S. | U.S. | 6.500+ | United |

| Ticket | Class | From | To | Miles | Airline |

| One-way | Business | U.S. | Europe | 50,000 | Cathay Pacific |

| Roundtrip | BUsiness | U.S. | Europe | 100,000 | Cathay Pacific |

| Ticket | Class | From | To | Miles | Airline |

| One-way | Business | New York | Casablanca | 44,000 | Royal Air Maroc |

| One-way | Business | U.S. | Europe | 50,000 | American |

| One-way | Business | U.S. | Japan | 50,000 | American |

| One-way | Business | U.S. | South Korea | 50,000 | American |

| Roundtrip | Business | U.S. | Europe | 100,000 | American |

| Ticket | Class | From | To | Miles | Airline |

| Roundtrip | Economy | U.S. | Hawaii | 35,000 | United |

| Roundtrip | Business | U.S. | Hawaii | 69,000 | United |

| One-way | First | New York | Frankfurt | 86,000 | Singapore |

| One-way | First | Los Angeles | Tokyo | 107,000 | Singapore |

| Ticket | Class | From | To | Miles | Airline |

| One-way | Economy | U.S. | U.S. | 12,000 | Delta |

| One-way | Business | U.S. | Europe | 50,000 | Delta |

| One-way | Business | Detroit | Tokyo | 60,000 | Delta |

| One-way | Business | Auckland | U.S. | 62,500 | Air New Zealand |

| Roundtrip | First | U.S. | Tokyo | 110,000+ | ANA |

|

|

|

Conclusion

Usually, Citi ThankYou Rewards is pretty overlooked and has subpar value compared to other rewards programs. However, ThankYou points are worthwhile if you know how you can use them. Maximize your points and carry a Citi Prestige or Citi Premier credit card to get the most out of it.