Considering that a Discover Bank’s CD is the safest way to grow your money and still get an incredible rate, it’s popularity has grown for those out there looking for a CD account.

Considering that a Discover Bank’s CD is the safest way to grow your money and still get an incredible rate, it’s popularity has grown for those out there looking for a CD account.

Dependability is key for most individuals these days and if you have money that you do not need for a period of time, then CDs can definitely live up to the potential. Flexible terms on a low-risk/high-yield FDIC-insured accounts is hard to come by as it is, and all you need is a $2,500 deposit to jump-start your growth! Be sure to read on if you’re interested in how to open a Discover Bank CD.

Discover Bank CD Information:

- Apply Now

- Account Type: Certificate of Deposit

- Availability: Nationwide

- Expiration Date: None

- Monthly Fee: $0.

- Additional Advice: Choose a longer IRA CD term to earn more money!

- Closing Account Fee: None

• Get started and open a Discover® CD in 3 easy steps. • Available nationwide online • Discover offers CDs with some of the highest and most competitive rates! • Select terms as short as 3 months up to 120 months • Rates ranging from 2.00% APY up to 4.05% APY. • Opening a Discover Bank Certificate of Deposit is extremely quick and easy. • Funds on deposit are FDIC-insured up to the maximum allowed by law. |

How To Open A Discover Bank CD:

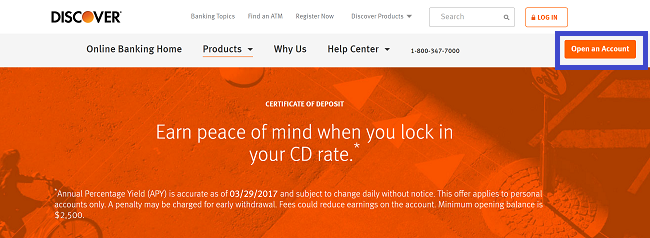

- Go to Discover Bank’s Online Landing Page.

- Hover your mouse over to the ‘Open an Account’ button on the top-right portion.

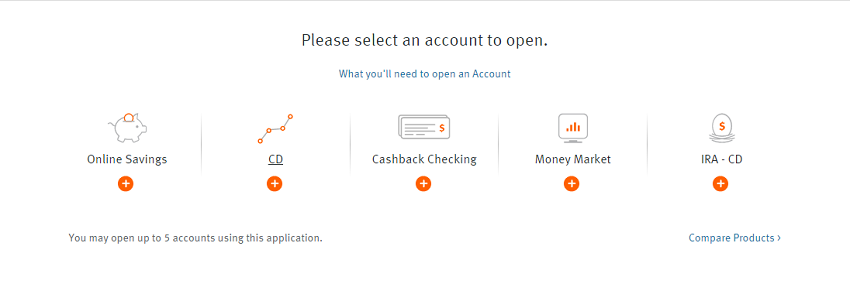

- The 2nd option they give you is ‘CD’. Be sure to click on CD

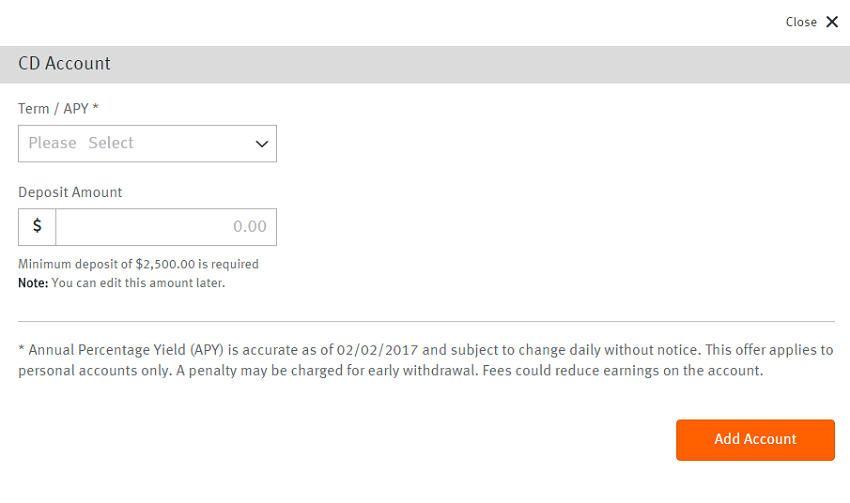

- Select your term and deposit amount

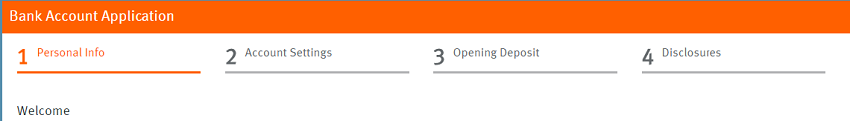

- Provide all the necessary information:

- Your social security number.

- Your driver’s license or other photo I.D. like a passport.

- Your bank account information — your bank’s routing number and your bank account number.

- Your employment information — your employer’s name and address.

- You can choose whether or not you want to set up automatic investment plan. (I’d advise it considering this is a effective tool for you to keep consistency with your deposit)

Discover CD Rates

| CD Term | APY Rate |

|---|---|

| 3-Month Term | 2.00% APY |

| 6-Month Term | 3.50% APY |

| 9-Month Term | 3.50% APY |

| 12-Month Term | 4.05% APY |

| 18-Month Term | 3.70% APY |

| 24-Month Term | 3.50% APY |

| 30-Month Term | 3.50% APY |

| 3-Year Term | 3.50% APY |

| 4-Year Term | 3.50% APY |

| 5-Year Term | 3.50% APY |

| 7-Year Term | 3.50% APY |

| 10-Year Term | 3.50% APY |

Conclusion:

Opening a Discover Bank CD can be as easy as 6 steps or less. when you open a CD account with Discover Bank, all you really need is a minimum deposit of $2,500. Keep in mind that the longer the term, the better your rate will be. It is recommended that you keep a consistent deposit within your CD account. Flexible terms on a low-risk/high-yield FDIC-insured accounts is hard to come by as it is, which is one of the biggest reasons why we recommend a CD account with Discover. Be sure to also check out our full list of Best CD Rates!

The Chase Sapphire Reserve offers 125,000 bonus points after you spend $6,000 in purchases in the first 3 months from account opening. You'll earn • 8x points on all purchases through Chase Travel, including The Edit • 4x points on flights booked direct • 4x points on hotels booked direct • 3x points on dining worldwide • 1x points on all other purchases This card does carry a $795 annual fee and there are no foreign transaction fees. However, you're able to earn a $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year & up to $120 application fee credit for Global Entry or TSA Pre✓®, and more annual value from perks and benefits. Member FDIC |