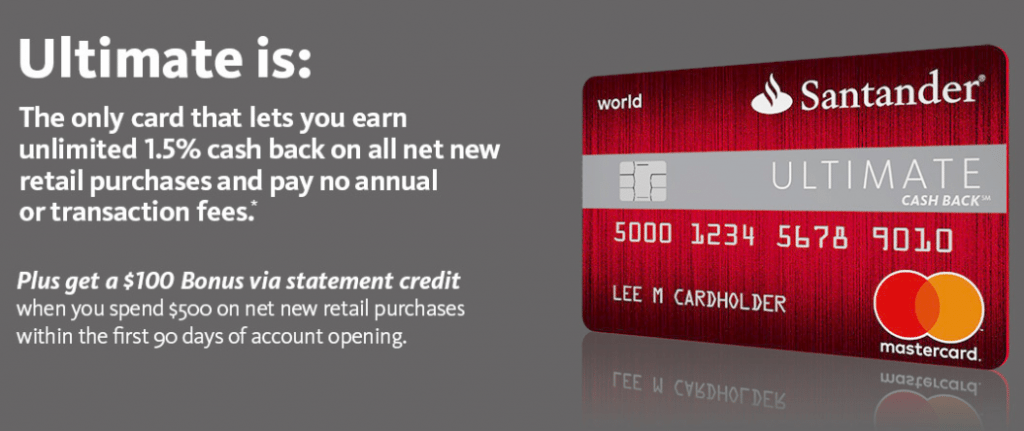

Santander Bank just recently unveiled a new cash-back credit card to their portfolio coined the “Ultimate Cash Back.” Whether it stands to the name, we should find out. Firstly, this card comes through with a $100 sign-up bonus after accomplishing a spending of $500 within the first 90 days of account opening.

It shouldn’t really be a surprise, but the card comes equipped with 1.5% cash back on all purchases with no annual fee or foreign transaction fees. On another note, before you pass up this card, what makes it stand out from it’s practically standard rewards and bonus structure has got to be that there’s no balance transfers nor cash advance fees attached.

Alternative Credit Card Bonuses:

Santander Ultimate Cash Back Card Summary:

- Apply Now

- Maximum Bonus: $100

- Spending Requirement: $500 in the first 90 days from account opening

- Annual Fee: $0

- Bonus Worth: $100 Cash

- Expiration Date: None

- Additional Advice: There’s no foreign transaction fees, no annual fees, nor cash advance fees attached.

Santander Ultimate Cash Back Card Features:

- $100 bonus with a $500 in spending within 90 days of account opening

- Card earns 1.5% cash back on all purchases

- No annual fee

- No foreign transaction fees

- No cash advance or returned payment fees

Conclusion:

With the Santander Ultimate Cash Back Card, you’ll be able to earn $100 in cash bonus value when you make the $500 in necessary spending within 90 days of account opening. Now, this card does earn quite the stagnant 1.5% cash back everywhere that makes it hard to compete in the cash-back everywhere market where tons of other credit cards have had to offer 2%+ for a whole decade now (Fidelity Rewards Visa Signature). However, I can’t really overlook that this card does have it’s points; no cash advance or returned payment fees, no balance transfer fees; bringing me to the conclusion that Santander just missed a mark on execution. Review our entire list of Credit Card Promotions for other offers and bonuses.