Trim now welcomes new users with a free 14-day free trial of their Premium service. Trim will help you cancel your unwanted subscriptions and lower your monthly bills by negotiating with your providers. They recently offered their Premium service, so there’s more features to look into. For example, you can check out their high-yield savings account and financial coaching.

Trim now welcomes new users with a free 14-day free trial of their Premium service. Trim will help you cancel your unwanted subscriptions and lower your monthly bills by negotiating with your providers. They recently offered their Premium service, so there’s more features to look into. For example, you can check out their high-yield savings account and financial coaching.

Read below for more information on Trim and their free trial offer.

Trim 14-Day Free Trial

Trim is offering a free 14-day trial of their Premium service. Just go to the Trim website and click on the “Start Free Trial” button. This offer is valid for new users only.

(Visit for more information)

Trim Features

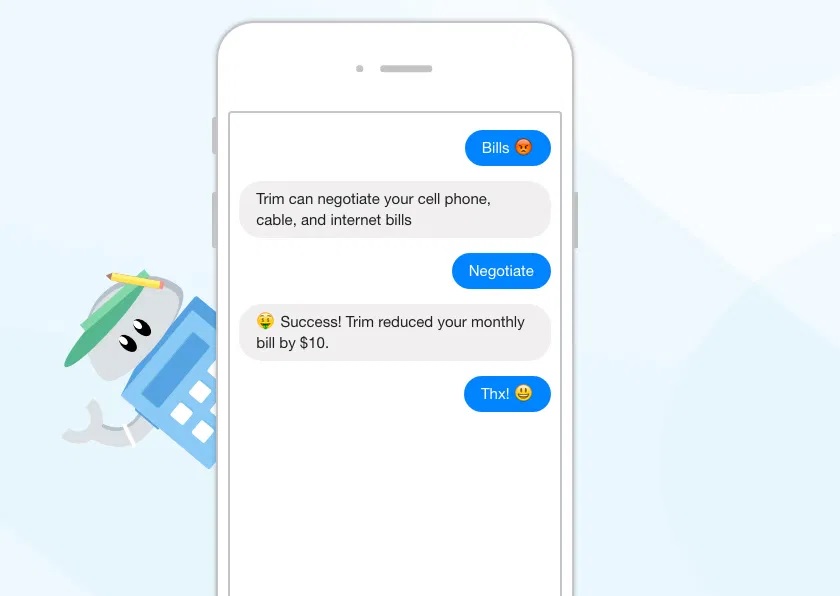

Trim will help you save money by cancelling unwanted subscriptions and negotiating bills for you. Compared to other bill services, Trim is not an app, you register for an account on their website, then all interactions are done over SMS text messages or Facebook Messenger. When you don’t go into the app route, the process feels like you’re talking to someone about your finances.

Canceling Unwanted Subscriptions

Trim works like a personal finance bot that goes through your transactions to find recurring subscriptions. They’ll send you the services they find, with how much you’re spending on them. You’ll pick the services you don’t want, and Trim will cancel them for you. Additionally, it will update you throughout the process.

Lowering Your Bills

Trim will negotiate your cable, internet, phone, and medical bills for you. Just to be sure you’re getting the best possible rates. Just submit a bill for negotiation and provide a payment method. Don’t worry, they won’t charge your card unless Trim saves you money. They will contact the providers to negotiate and you’ll be notified if Trim can save you money. If they can, then they will charge you for the negotiation 3 days after.

Other Features

Trim doesn’t come with serious budgeting tools to use. However, they will help you look through your cash flow. Additionally, you’ll be able to set alerts for upcoming bills, track your net worth, and get text alerts on how much you’re spending on different retailers.

Furthermore, Trim also works with sponsored personal finance products, insurance companies, banks, etc. to help you save.

Trim Premium

Trim offers a new paid service with a savings account, automatic credit card payments, debt calculator, and financial coaching.

Trim Simple Savings

Trim’s automated savings account comes with a 4% annualized bonus on your first $2.000. After that, the rate will lower down to 1.1%, which is still slightly higher than the average APR. All funds are FDIC-insured up to around $250,000.

TrimPay

TrimPay helps you pay off your credit card debt. Just pick a credit card, set up automated weekly bank transfers to your TrimPay savings account. Then, pick the day of the month you want to pay your credit card bill. You’ll be able to withdraw funds from your TrimPay account if you need.

Debt Calculator

When you link your accounts, Trim will help you build a payoff plan to minimize interest.

Financial Coaching

Premium members receive unlimited email access to a team of financial planners. Additionally, you can ask them questions related to personal finance, such as creating an emergency fund, paying off debt, and saving for retirement.

Trim Fees

It doesn’t cost anything to open a Trim account, and lots of their services are offered for free including: finding subscriptions and canceling them. You can set up spending alerts and personalized reminders, detecting overdraft or late fees and fighting them. Furthermore, you can access your personal finance dashboard as well.

Bill negotiation comes at a cost which is 33% of your total annual savings. In other words, if Trim saved you $20 a month on your cell phone bill, or $240 for the year. You’ll have to pay $79.20 for the negotiation service. The fee is only applied after Trim successfully lowers your bill.

Trim Premium will run you $99 annually.

|

|

|

Conclusion

Trim is a solid option if you want assistance in cutting back on extra spending you have. Additionally, this service will save you money when you cancel unwanted subscriptions, lowering recurring bills, and more. Just tell them what you want canceled, and they will take care of it.

Other bill canceling services are Billshark and Truebill.