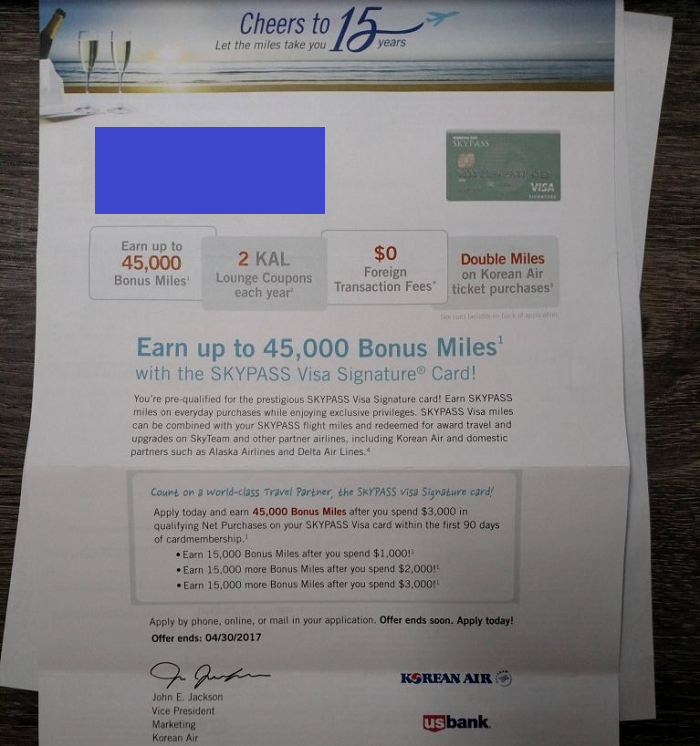

With the SKYPASS Visa Signature Card, you can earn 45,000 SKYPASS Bonus Miles after making a $3,000 spend in 90 days. If you aren’t able to fulfill the spending requirement, you can always grab the lesser bonuses of 30,000 for $2,000 spend or 15,000 for a $1,000 in spend within 90 days.

With the SKYPASS Visa Signature Card, you can earn 45,000 SKYPASS Bonus Miles after making a $3,000 spend in 90 days. If you aren’t able to fulfill the spending requirement, you can always grab the lesser bonuses of 30,000 for $2,000 spend or 15,000 for a $1,000 in spend within 90 days.

With this card, you will receive great benefits such as earning Double Miles on Korean Air ticket purchases, 1 mile for every net $1 in purchases, and receive 2,000 Bonus Miles at renewal. There is no foreign transaction fee and you will receive a multitude of Visa Signature benefits. With a annual fee of $80, see if this card is worth getting.

Editor’s Note: This offer will be under targeted circumstances, either through email or by mail, therefore, Your Miles May Vary.

Alternative Credit Card Bonuses:

- Chase Sapphire Preferred® Card

- Citi® / AAdvantage® Platinum Select® World Elite™ MasterCard®

- Gold Delta SkyMiles® Credit Card from American Express

SKYPASS Visa Signature Card Summary:

- Maximum Bonus: 45,000 SKYPASS Bonus Miles

- Spending Requirement: $3,000 Spend in 90 days

- Annual Fee: $80

- Bonus Worth: 45,000 Bonus Miles is worth about $450

- Expiration Date: “Limited Time”

- Additional Advice: If you are not eligible for the Signature product, you will automatically be considered for the SKYPASS Visa Classic Card which does not have the same level of rewards.

SKYPASS Visa Signature Card Features:

- Earn 45,000 SKYPASS Bonus Miles after your first purchase after $3,000 spend in 90 days

- Earn Double Miles on Korean Air ticket purchases

- Earn 1 mile per $1 spent on all other purchases

- Receive a 2,000 Bonus Miles Reward at card renewal

- 2 KAL Lounge coupons each year

- No foreign transaction fees (based on your creditworthiness)

- Redeem miles for reward travel and upgrades on Korean Air and SkyTeam partners

- SKYPASS Visa card purchases help you reach and maintain Morning Calm Club Membership

- EMV chip technology for added security abroad

- Use your card at millions of locations worldwide

- Cash access at more than one million ATMs

- Bilingual automated 24-hour account access

- No cap on miles you can earn

- $80 Annual Fee

SKYPASS Visa Signature Pros:

- 45,000 SKYPASS Bonus Miles

- Lounge Coupons

- No foreign transaction fee

SKYPASS Visa Signature Cons:

- Hefty Annual Fee of $80

Conclusion:

45,000 Skypass Bonus Miles + 2 KAL lounge coupons each year sounds pretty nice on the SKYPASS Visa Signature Card, however, this promotion is targeted. You will either get an invitation through mail or email. Your odds of getting targeted increases with a relationship product from US Bank. This primarily means a checking account with direct deposit may be fully suitable. Definitely a nice promotion with points transferable to SPG, Chase & Diners Club.

You can rack up a lot of miles and use your miles for reward travel and upgrades on Korean Air and SkyTeam partners. If you travel with Korea Air often, then I highly recommend getting this card for the benefits and rewards options. Find our complete list of U.S Bank Credit Card Promotions as well as our complete listing of the Best Credit Card Promotions!

Hi

I am interested in making US bank credit card for Korean air mileage, what card do you recommend ?

No annual fee if possible.

thank you

Plz more detail bonus mileage. Interesting.