For those of you that are familiar with the Ulta Cosmetic Beauty franchise. Comenity is now expanding their banking services to Ulta Beauty. You will now have the chance to get their hands on two new cards: Ultamate Rewards Credit Card & the Ultamate Rewards Mastercard. Make your first purchase with this card and you will get 20% off any Ulta Product(s)!

For those of you that are familiar with the Ulta Cosmetic Beauty franchise. Comenity is now expanding their banking services to Ulta Beauty. You will now have the chance to get their hands on two new cards: Ultamate Rewards Credit Card & the Ultamate Rewards Mastercard. Make your first purchase with this card and you will get 20% off any Ulta Product(s)!

Keep in mind that these credit cards can only be used in-store only so it’s basically a store card. On the other hand, the Mastercard can be used anywhere that Mastercard is accepted. Both cards will earn rewards as followed: No Annual fee, 2x the points for every $1 spent at Ulta Beauty and so much more.

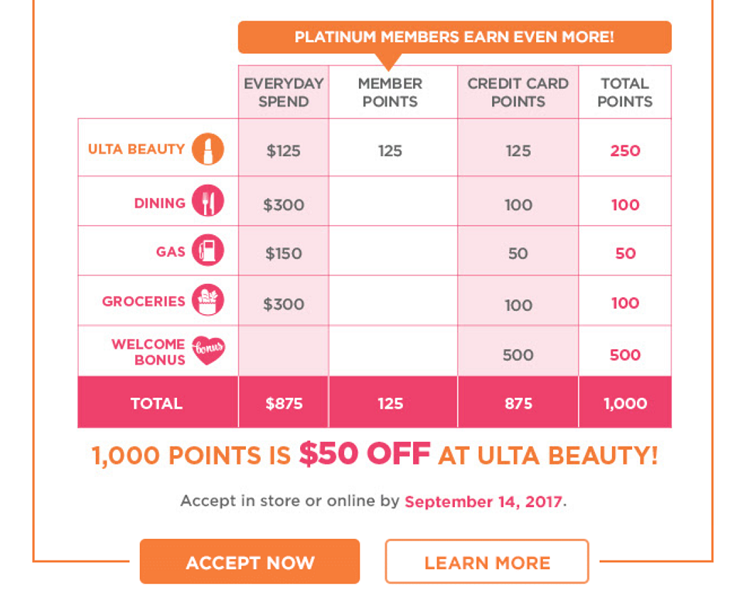

Editor’s Note: Keep in mind that with a Ultamate Rewards Mastercard, you’ll also be able to earn 500 Welcoming points for making a spend of $500 within 3 months.

Alternative Credit Card Bonuses:

Ultamate Rewards Card Summary:

- Apply Now

- Maximum Bonus: Earn 20% off your first purchase

- Spending Requirement: Make 1 purchase within 3 months.

- Annual Fee: $0

- Bonus Worth: YMMV

- Expiration Date: None

Ultamate Rewards Card Features:

- 20% off your first purchase

- Enjoy a 500 Point Welcoming Bonus.

- No annual fee

- 2x point for every $1 spent at Ulta beauty

- Earn 1 Point for every $3 spent elsewhere

Ultamate Rewards MasterCard Features:

- 500 Welcoming Points when you spend $500 or more within a given 3 months

- 20% off your first purchase

- No annual fee

- 1x point for every $1 spent at Ulta Beauty

- 1x point for every $1 spent outside of Ulta Beauty

Point Redemption:

Maximum point worth is 6.25 cents apiece. Keep in mind that point do unfortunately expire after one year after they are earned unless you are able to achieve or maintain Platinum Status, which requires a necessary spend of $450 or more in a calendar year.

- Redeem 100 Points: $3.00 Off Any Item

- Redeem 250 Points: $8.00 Off Any Item

- Redeem 500 Points: $17.50 Off Any Item

- Redeem 750 Points: $30.00 Off Any Item

- Redeem 1000 Points: $50.00 Off Any Item

- Redeem 2000 Points: $125.00 Off Any Item

Conclusion:

If you’re a fan of cosmetics and you’re looking to expand your rewards and savings with ULTA, then make sure you apply for a Ultamate Rewards Credit Card from Comenity. Make sure you are able to distinguish between the two cards; the Ultamate Rewards Credit Card and the Ultamate Rewards Mastercard. The Mastercard has basically the same perks and benefits aside from the sign-up bonus, ability to achieve points outside of the store and spend outside of ULTA’s franchise.

This could be a great opportunity for you cosmetic lovers and enthusiast out there to earn 6.25 cent apiece (great value) on products that they love. I recommend the MasterCard because you could achieve more spend with it and there’s a sign-up bonus. It’s currently unknown as to whether the Shopping Cart Tricks will work, most likely for the Store Card only. Also, be sure to check out our complete list of Credit Card Promotions for other bonuses and offers.

Hello could you please direct me to the application process department thank you In advance!