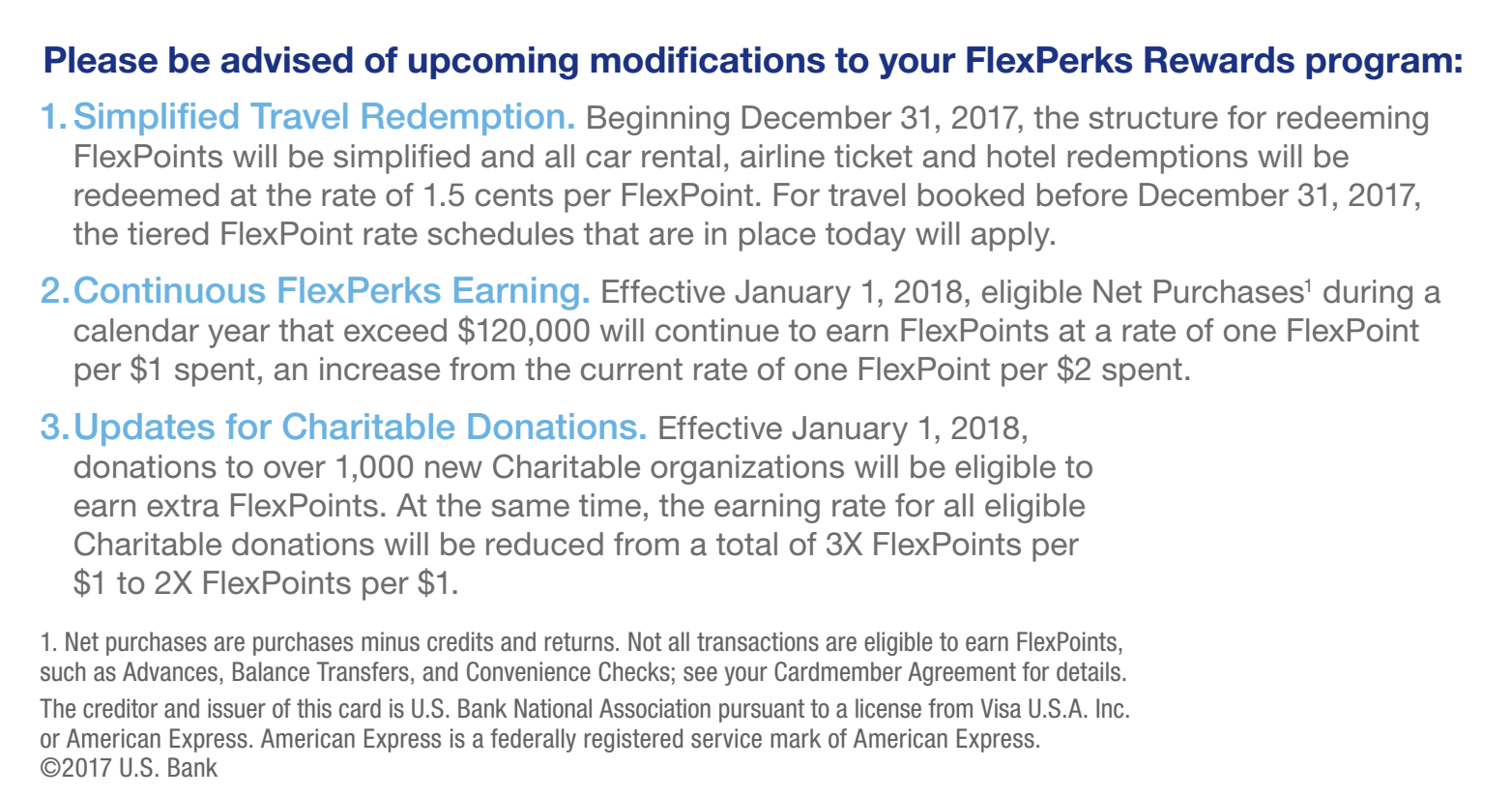

U.S. Bank has confirmed some renditions towards their FlexPerks program. Starting December 31, 2017, FlexPoints will be redeemable towards travel at a value (fixed) of 1.5 CPP, getting rid of the current tiered redemption system. Now, this isn’t entirely bad news considering that the Flexperks Redemption system as it stands now earns 1-2 CPP depending on how you redeem, but lets face it, 2 CPP on Flexperks is the pinnacle of point value and is rather tough to achieve at times.

FlexPerks Credit Cards:

- US Bank FlexPerks® Gold American Express®

- U.S. Bank FlexPerks Business Travel Rewards Visa® Signature Card

- U.S. Bank FlexPerks® Select+ American Express® Card

Alternative Credit Cards:

- Chase Sapphire Preferred® Card

- Platinum Card® from American Express

- Barclaycard Arrival PlusTM World Elite MasterCard®

US Bank FlexPoints Devaluations News In-Depth:

I reiterate that this isn’t entirely bad news! I mean, a consistent point value may be just what U.S. Bank needs to stay afloat with current competition.

I mean, if you look at it this way, FlexPoints has a breakeven-point to the valuation of their current rewards program. With the current system intact, you should expect to get your hands on airplane tickets upwards of $400 costing 20,000 FlexPoints, an essential 2 CPP, however, if you want to redeem your points for a ticket upwards of $401+, you’d have to adhere to the next tier which involved collating in 30,000 points and a value of 1.34 CPP.

On top of that, redeeming your points towards car rentals, airline tickets and hotels is much simpler with a consistent point value! Now, big news for you hefty-spending Flexperk cardholders. Those of you who spend over $120,000 in a calendar year will be earning One Flexpoint per $1 spent instead of the current One Flexpoint per $2 spent. However, it’s worth noting that charitable donations will earn 2x Flexpoints instead of the previous 3x points per $1.

U.S. Bank FlexPerks Current Points Worth:

- Airfare (maximum value of 2¢ per point)

- Hotels, car rentals & cruises (maximum value of 1.5¢ per point)

- Merchandise (value of 1¢ per point)

- Gift cards (value of 1¢ per point)

- Statement credit (value of 1¢ per point)

- Annual fee (value of 1.7¢ per point for this card)

* Starting January 1, 2018, you should expect a consistent-flat 1.5 Cent Per Point Worth

Conclusion:

For those of you that like consistency within your rewards, well you’re in luck. I can’t really say if this is a advantage or disadvantage because this is all on what you prefer, but a consistent 1.5 CPP is definitely no negative in my book. With the Altitude Reserve VISA Infinite’s recent drop, it should be of some evidence that maybe, just maybe, we the people will finally get what we were fending for. Altitude & Flexpoint transfer-ability. These moves may be exactly what U.S. Bank needs to stay afloat with current competition. Find out which card is right for you by checking out our complete list of Credit Card Promotions today!