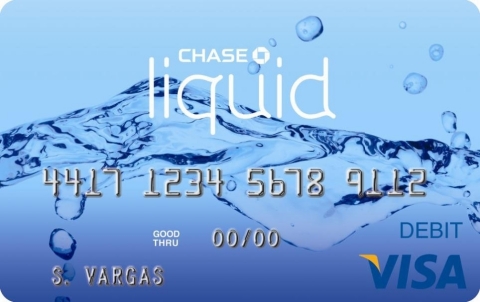

Think of the Chase Liquid Card as a “gift card.” However, this “gift card” is accepted nearly anywhere that accepts VISA® debit cards, excluding rentals such as cars, equipment, or furniture. Chase Liquid is a great way to manage your money without having to open a checking account and a great way to show your children how a debit card works before opening a new checking account for them.

Think of the Chase Liquid Card as a “gift card.” However, this “gift card” is accepted nearly anywhere that accepts VISA® debit cards, excluding rentals such as cars, equipment, or furniture. Chase Liquid is a great way to manage your money without having to open a checking account and a great way to show your children how a debit card works before opening a new checking account for them.

Table of Contents

ToggleHow it Works

- Go to your local branch to apply for a Chase Liquid Card. A $25 initial load will be required to get started.

- Reload cash and checks at any Chase ATM

- Enjoy making purchases with your new Chase Liquid Card!

Chase Liquid has a flat monthly service fee of $4.95

Chase Liquid Card Features:

- Withdraw cash: With a Chase Liquid Card, your cash is more accessible. Take advantage of access to over 16,000 Chase ATMs (withdraw up to $500 per day). You can also withdraw cash from any Chase Teller.

- Load your card: Loading money to your Chase Liquid Card is quick and easy. You can automatically load your paycheck, government benefit check, or tax refund onto your card by enrolling in Direct Deposit. You can load checks using Chase QuickDepositSM on your mobile device, load cash or checks to your card at Chase ATMs, or load money at any Chase branch.

- Monitor your balance: there are many ways to monitor your balance, all without paying a fee:

- Sign up for online banking on Chase.com to check balances and see purchase history online.

- Download the Chase Mobile® App to check balances and see purchase history on your mobile device.

- Receive alerts by text or email for low balances and account activity.

- Make purchases: Chase Liquid Card can be used for purchases virtually anywhere VISA® debit cards are accepted, excluding rentals such as cars, equipment and furniture.

- Pay bills: You can pay bills online with Chase Online Bill Pay or you can use your Chase Liquid Card to pay phone, electric, cable and any other bill at merchant sites where VISA®debit cards are accepted excluding rentals such as cars, equipment and furniture. Plus you can use Chase QuickPay® with ZelleSM to pay others

Want to Open a New Chase Account Instead?

Below you will find our Top Chase Coupon Codes that offer cash bonuses when you open a new bank account with Chase.

• Enjoy $125 as a new Chase checking customer when you open a Chase College CheckingSM account and complete 10 qualifying transactions within 60 days of coupon enrollment. • $0 Monthly Service Fee while in school up to the expected graduation date provided at account opening (five years maximum) for students 17-24 years old. • Wire funds internationally using the Chase Mobile® app or chase.com. Send money to recipients around the world with multiple currency options. Fees apply. • Keep track of your money with confidence and control in the Chase Mobile® app. The Chase Mobile app helps you bank securely and conveniently from anywhere. • With Zelle®, you can send and receive money with people and businesses you know and trust who have an eligible account at a participating U.S. bank. • With Fraud Monitoring, Chase may notify you of unusual debit card purchases and with Zero Liability Protection you won't be held responsible for unauthorized debit card purchases when reported promptly. • JPMorgan Chase Bank, N.A. Member FDIC *With Chase Overdraft AssistSM, we won’t charge an Overdraft Fee if you’re overdrawn by $50 or less at the end of the business day OR if you’re overdrawn by more than $50 and you bring your account balance to overdrawn by $50 or less at the end of the next business day (you have until 11 PM ET (8 PM PT) to make a deposit or transfer). Chase Overdraft Assist does not require enrollment and comes with eligible Chase checking accounts. |

Conclusion

Chase Liquid provides an easy-to-use service for customers who opt out from opening a checking account. With a low fee, Chase Liquid provides a simple and convenient way to make purchases. If you liked this article, go ahead and check out our other Chase Bonuses right here on BankCheckingSavings.com!