If you’re looking for a competitive mortgage rate, you can try checking out Better Mortgage for simple, online mortgages. Better is making purchasing or refinancing your next home faster, simpler and more transparent than ever as well as saving you time and money in the process. If you’re interested, be sure to read on for more information!

If you’re looking for a competitive mortgage rate, you can try checking out Better Mortgage for simple, online mortgages. Better is making purchasing or refinancing your next home faster, simpler and more transparent than ever as well as saving you time and money in the process. If you’re interested, be sure to read on for more information!

Editor’s Note: Mortgage products are available in Arizona, California, Colorado, Connecticut, Florida, Georgia, Illinois, New Jersey, North Carolina, Oregon, Pennsylvania, Washington and Washington, D.C.

| BONUS LINK | OFFER | REVIEW |

Better Mortgage In-Depth:

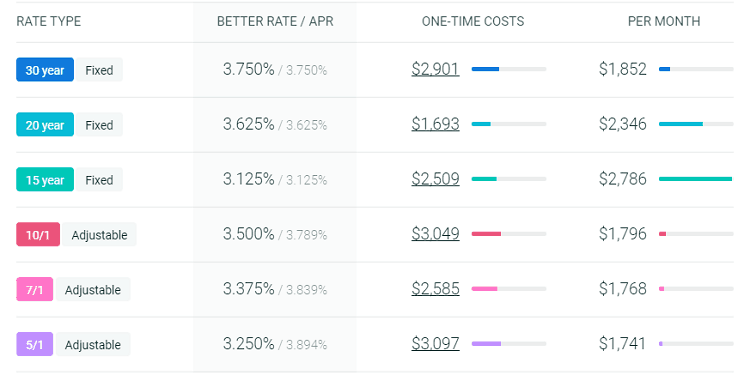

Scrolling through Better Mortgage’s Page, you really do get a balance of simplicity and functionality. One thing I must outline is just how easy it is to navigate through the site and it goes a long way in telling you just how exactly your mortgage process will be (most of the time). Just by clicking “Get Started,” you can go through their quick pre-qualification toolbar that wouldn’t even take more than 3 minutes. Also, one thing I absolutely admire is their transparency; you can click the “Check Today’s Rates” button to navigate to 30-years, 15-years, and ARMs products and their respective rates.

Better Mortgage Summary:

- Apply Now

- Account Type: Mortgage Loan

- Availability: AZ, CA, CO, CT, FL, GA, IL, NJ, NC, OR, PA, WA, D.C

- Expiration Date: None

- Additional Advise: Have the necessary documents and validation information ready to make your process as smooth as possible.

- Closing Loan: Standard lock period is within 30 days or less

Better Mortgage Basic Requirements:

Below are examples of supporting documents which may be included in a loan file:

Income Documents:

- Pay Stubs covering the customer’s most recent two pay periods for each applicant.

- W-2 Forms for the previous two years.

- Two most recent years’ federal tax returns (e.g. for a loan in 2015, the customer need to submit the customer’s 2014 and 2013 federal tax returns). All the pages and all schedules.

- If the customer is self-employed, the two most recent years’ business tax returns are also needed.

- For self–employed or investment income, the two most recent years’ 1099’s and K-1 forms are also needed

- For self–employed business income,year-to-date profit and loss statement and balance sheet.

- For retired customers, copy of Social Security and/or Pension “award letters” detailing the amount of retirement income.

Asset Documents:

- Two most recent months’ bank statements. All of the pages.

Other Documents:

- Homeowner’s Insurance statement(s) for all properties owned showing the customer’s coverage and the annual premium.

- Mortgage statements for all properties owned that have liens.

- Copy of driver’s license or State I.D.card for all customers.

- If divorced, the customer’s fully executed divorce decree.

Conclusion:

Arizona, California, Colorado, Connecticut, Florida, Georgia, Illinois, New Jersey, North Carolina, Oregon, Pennsylvania, Washington and Washington, D.C residents, do your next home financing with Better Mortgage for visibly-transparent lower rates, efficient mortgage process platform, and so much more. Some things they do absolutely right building an effective do-it-yourself platform for mortgage processing and offering options to their customers. Also, be sure to check out our Best Mortgage Rates for you new or current home owners looking to purchase or refinance!