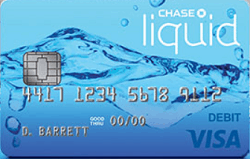

Get a Chase Liquid Prepaid Card at your local Chase branch today and with just a $25 initial minimum load, you’ll be able to access over 16,000 Chase ATMs nationwide at no additional fees.

Get a Chase Liquid Prepaid Card at your local Chase branch today and with just a $25 initial minimum load, you’ll be able to access over 16,000 Chase ATMs nationwide at no additional fees.

You’ll be able to load cash or checks and withdraw at any Chase ATM, as well as make purchases in stores and online, pay bills, or even assess Chase’s Quick Pay with Zelle. If you’re interested, be sure to read on!

Chase Liquid Prepaid Card Summary

- Apply Now

- Availability: Nationwide

- Expiration Date: None

- Soft/Hard Pull: Soft

- Credit Card Funding: Not Specified

- Additional Requirements: None

- Monthly Fee: $4.95

- Early Termination Fee: None

Chase Liquid Prepaid Card Features

- Withdraw Cash – With a Chase Liquid Card, your cash is more accessible. Take advantage of access to over 16,000 Chase ATMs (withdraw up to $500 per day).

- Pay Bills – pay bills online with Chase Online Bill Pay or you can use your Chase Liquid Card to pay phone, electric, cable and any other bill at merchant sites where VISA®debit cards are accepted

- Load your card – via Direct Deposit, Chase QuickDepositSM on your mobile device, load cash or checks to your card at Chase ATMs, or load money at any Chase branch. Cash loads are limited to $4,000 per month.

- Flat monthly service fee of $4.95

- Monitor your balance

- Chase Liquid Card can be used for purchases virtually anywhere VISA® debit cards are accepted, excluding rentals such as cars, equipment and furniture.

How To Open Chase Liquid Prepaid

- Step 1: Bring two forms of ID including a valid photo ID (driver’s license, passport, etc.) and initial load of $25 or more to your local branch.

- Step 2: Complete an application with a Chase banker.

- After you have been approved, you will leave with a working card and PIN that you can use in stores, online, and ATMs. If you received a non-personalized, temporary card, your personalized card will arrive by mail within 7-10 days.

Conclusion

The Chase Liquid Prepaid Card would be a good option for those of you that are surrounded by Chase ATMs. Considering you get free access to over 16,000 Chase ATMs nationwide. This makes for lesser fees for any transaction at mind.

Now, there is a $4.95 monthly service fee attached, which is minuscule comparative to a majority of prepaids out there that pride themselves on “no monthly fees,” but charge hefty load fees. If you are not currently interested, then be sure to check out our list of Best Secured Credit Cards or our compiled list of the Best Bank Deals nationwide, and local, for more information!

The Best Bank Offers are updated here. See the below pages to get started with some of the best offers: • Chase Bank Offers. Chase offers a range of attractive Checking, Savings and Business Accounts. Chase has a great selection of sign-up bonuses in comparison to other big banks. • HSBC Bank Offers. HSBC Bank routinely has offers for several of their Personal Checking and Business Checking accounts. They also have a good referral program. • Huntington Bank Offers. Huntington Bank has high bonus amounts available through their Checking and Business Checking. Huntington also offers a Business Premier Money Market Account. • Discover Bank Offers. Discover Bank offers top cashback, savings, money market accounts and CD rates for you to take advantage of. Discover has industry leading selections to cater to your banking needs. • TD Bank Offers. TD Bank consistently offers a fantastic selection of checking accounts to cater to your banking needs. However, savings account offers are less frequently available. |

What’s the limit amount of money I can have on a chase prepaid card? can i deposit up to 8,000 on a prepaid card from chase thanks,