Get your hands on the Ritz-Carlton Rewards VISA Infinite Credit Card and you can receive 2 complimentary nights at any participating Tier 1-4 Ritz-Carlton properties after you spend $4,000 or more within the first three months of account opening. You will also earn 10,000 Ritz-Carlton points when you add an authorized user that makes their first purchase within a given 3 months of enrollment.

Get your hands on the Ritz-Carlton Rewards VISA Infinite Credit Card and you can receive 2 complimentary nights at any participating Tier 1-4 Ritz-Carlton properties after you spend $4,000 or more within the first three months of account opening. You will also earn 10,000 Ritz-Carlton points when you add an authorized user that makes their first purchase within a given 3 months of enrollment.

This is big moves from Chase considering that they’re set to release another prestigious card coined “Chase Sapphire Reserve” which will also be VISA Infinite. Expect a non-waivable annual fee of $450; Priority Pass Select and $300 Travel Credit alone would compensate for the fee. Keep in mind that this will be considered as the same card as the previous Ritz-Carlton VISA Signature; Key difference is the $450 AF vs $395. Existing Ritz cardholders are given the option to upgrade to a VISA Infinite with a minimum line of credit of $15,000.

Editor’s Note: Considering that the Ritz Carlton Rewards VISA Signature didn’t fall under the 5/24 Rule, odds are, the VISA Infinite won’t either.

Alternative Credit Card Bonuses:

- Chase Sapphire Preferred® Card

- Platinum Card® from American Express

- Starwood Preferred Guest® Credit Card

The Ritz-Carlton Rewards Credit Card Summary:

- Maximum Bonus: 2 complimentary nights, $100 hotel credit, $300 travel credit

- Spending Requirement: Must spend $4,000 within first 3 months

- Annual Fee: $450

- Bonus Worth: Roughly $500

- Expiration Date: None

- Additional Advice: Your points can be redeemed for room upgrades, hotel stays, etc or converted into airline miles transferable to 33 airline partners.

The Ritz-Carlton Rewards Credit Card Features:

- Receive two free nights at participating Tier 1-4 Ritz-Carlton properties after you spend $5,000 or more within the first three months of account opening

- Receive 10,000 Ritz-Carlton points when you add an authorized user and they make their first purchase within 3 months of account opening

- 5x points on Ritz-Carlton & partner hotel stays

- 2x points on travel & restaurants

- 1x points on all other purchases

- $300 airline credit (incidentals only)

- $100 hotel credit, can be used towards dining, spa or other hotel recreational activities on paid stays of two nights or longer

- Save $100 on multi-passenger ticket purchases. This benefit can be redeemed at:http://visadiscountair.com/ritzcarltoncard (can be used unlimited times)

- Global Entry or TSA Pre Check credit

- Automatic Gold Elite Status in the first year, you can maintain this by spending $10,000 on purchases your first account year and each account year there after.

- Platinum Elite status when you spend $75,000 on purchases each account year

- Priority pass select membership

- J.P Morgan Premier Concierge Service

- No foreign transaction fees

- Annual fee of $450 is not waived the first year

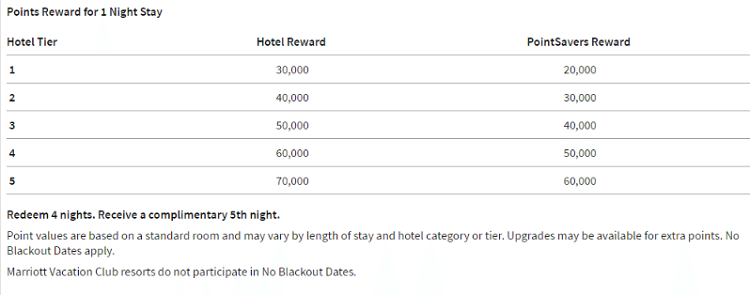

The Ritz-Carlton Rewards Chart:

I recommend that you take a look at the award chart for Ritz-Carlton as well as the properties under tiers. For an additional free night, you’ll need an additional 5,000 points on top of the 5,000 for the minimum spend and an additional 10,000 points for adding an authorized user.

The Ritz-Carlton Rewards Pros:

- Generous Sign-Up

- $300 Travel Credit, $100 Hotel Credit, Priority Pass, Global Entry, etc.

- Gold Elite Status for the first year

- No Foreign Transaction fees

The Ritz-Carlton Rewards Cons:

- The $450 Annual fee isn’t waived for the first year

Conclusion:

You can earn 2 complimentary nights after making a spend of $5,000 within a given 3 months after enrollment with your Ritz-Carlton Rewards VISA Infinite Credit Card. This is an exceptionally prestigious card that will offer you $100 hotel credit on paid stays of 2 nights or longer, $300 annual travel credit, and so much more. Earn 5x the points for every dollar spent at Ritz-Carlton, and earn 2x the points for every dollar spent on travel and dining. The annual fee is quite reasonable, if you take into consideration all the benefits you receive.

Keep in mind that you won’t be able to use it on the Tier 5 luxury properties, but the 2 free nights is still an extraordinary experience for new cardholders. Find our complete list of Credit Card Promotions today!

Can you combine the 3 free nights with points for a fourth night and then get the 5th free?