Before you pack your favorite aloha tees and swimming gear, it’s a complete necessity that you understand just what travel accidental insurance may provide on your credit card.

Before you pack your favorite aloha tees and swimming gear, it’s a complete necessity that you understand just what travel accidental insurance may provide on your credit card.

Nothings worse than an accident that completely ruins your trip and your wallet, so we will be further discussing some of the more common travel accident coverages that you find attached to your card including: Trip cancellation insurance, lost baggage insurance, delayed baggage insurance and trip delay protection. hopefully you won’t have to use these benefits, however, it’s a case of reassurance that your family and loved ones are provided for if something does happen.

Recommended Credit Cards:

- Platinum Card® from American Express

- Chase Sapphire Reserve

- Chase Sapphire Preferred® Card

- Ritz-Carlton Rewards Credit Card

- Barclaycard Arrival Plus World Elite MasterCard

- Chase Ink Business PreferredSM Card

Travel Accident Insurance:

This if often referred to as the most common carrier insurance and there’s plenty of misconceptions when it comes to what exactly this benefit covers. It’s like your half-***ed version of term life insurance. In the case of premature death, it does pay out, however it falls short in coverage itself, covering limited aspects such as accidents that rely on you as a passenger: in, or boarding any air, land, or water motorized conveyance, especially on a covered trip. Moreover, if you get to your destination and finally venture upon the whole ‘vacation’ aspect of vacationing, if an accident occurs, unfortunately, travel accident insurance can’t help you there.

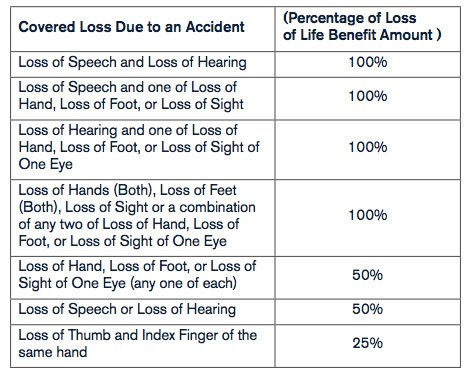

Diffferent credit card issuers have distinguishable payment tables for just how much your beneficiary would receive in the case of death, a lost limb or two, or even becoming legally blind. Coverage will most likely be extended to authorized users on the account as well as your spouses, domestic partners and dependents (children) on trips that you paid for WITH THE CARD. Note that you can always submit a letter to the card issuer to establish another beneficiary.

Keep in mind that the likelihood of you dying from an accident, i guess, from scuba diving, sky-diving, rock climbing or even getting mauled by a bear is a lot higher than the chances of being in an airlines accident.

Editor’s Note: The coverage does not include medical coverage. Some policies pay a much lesser sum in the event of dismemberment.

The Platinum Card® from American Express:

The Platinum Card® from American Express:

The Platinum Card pays $500,000 in the event of loss of life, loss of two limbs, loss of eyesight in both eyes and $250 for loss of eyesight in one eye or one limb. YOU or YOUR beneficiary will not receive the payment if the accident was ruled a suicide or act of war. Payments will not be received if the death is caused by a sickness, or if the injury occurred in a rental vehicle.

- Platinum Card From American Express.

- The Enhanced Business Platinum Card® from American Express OPEN

- Mercedes Benz Platinum Card from American Express.

- The Platinum Card from American Express Exclusively for Morgan Stanley.

- The Platinum Card from American Express Exclusively for Goldman Sachs

- Platinum Card from American Express for Ameriprise Financial.

- American Express Platinum Card for Schwab

Chase Sapphire Reserve:

Chase Sapphire Reserve:

If your fares have been paid on the card, you will get travel accident insurance benefits under the Sapphire Reserve. This will include you, your spouse, dependents (children, adopted children, stepchildren), legal guardians, siblings, parents, and grandparents. Practically anyone in your blood lineage or anyone you married into (In-laws). Chase will pay you up to $1,000,000 or 100% for a loss. Be sure to check out the table below.

Note that payout will not be given in the event that the insured person was incarcerated, speed racing, parachute jumping or participating any professional sporting activity.

Barclaycard Arrival Plus World Elite MasterCard:

Barclaycard Arrival Plus World Elite MasterCard:

With the Barclaycard Arrival Plus World Elite MasterCard or the Barclaycard JetBlue Plus MasterCard®, you are offered travel accident insurance within guidelines towards your spouse, domestic partner, or unmarried children under the age of 25. You should expect coverage to be applicable up to $250,000 payable for accidental loss of life, loss of two limbs or more, legal blindness, speech and hearing.

Additional Coverage: Emergency Evacuation Insurance

Here are some things you should consider if you’re offered this benefit: The coverage is only for the cost of evacuation, not medical care. Pre-existing conditions may lead to any request pertaining to evacuation at the card-issuer’s expense to be denied. If you are out of state, you will be moved to the nearest medical facility and not back to the US. Lastly, and most importantly, call your benefit administrator first before anything if you’re in the event that you’d need to be evacuated to a facility.

Editor’s Note: Some countries have exclusions applicable.

The Platinum Card® from American Express:

There will be no cost cap applicable. Extension of these benefits lies within families and children under 23. You don’t even have to use the card to pay for the trip either. Trip must be 90 days in length maximum, and 100 miles away from your residence. Premium Global Assist (PGA) will be your coordinator in the event that you do need this benefit. They will also pay economy airfare for minors under 16 to be returned home if they’re left unattended or pay for an escort to accompany the minor if it’s required that they get home and get the set family member a pace of treatment if hospitalized for more than 10 consecutive days is anticipated.

Chase Sapphire Reserve:

You will be eligible for up to $100,000 in emergency medical evacuation if and only if a portion of you or your immediate family member’s trip was paid with the Chase Sapphire Reserve or Ritz-Carlton Rewards Credit Card. Your trip must be between 5-60 days and at least 100 miles from your residence. If you’re anticipated hospitalized duration is more than eight days, benefit administrator can arrange for a relative/friend to fly round-trip in economy to your location. On top of that, you will be reimbursed for the cost of the economy ticket home if your original ticket cannot be utilized. Hopefully this won’t be happening to you, however, the benefit also pays up to $1,000 to return your remains to the state.

Conclusion:

If you weren’t too familiar with travel accidental insurance, we hope that this cleared up quite a bit of your questions. Now, some things to keep in mind: This will not cover anything medical-related, it’s best to have a good medical insurance provider at hand anyways. Secondly, there are limitations involved as to what is covered under this benefit and suicide, sickness, injury outside of air, land, or water motorized conveyance does not constitute a pay out.

Note that the likelihood of you dying from an accident from scuba diving, sky-diving, etc., is a lot higher than the chances of being in an airlines accident, however, cruise accidents is more common, so be sure you know what you’re covered for. Lastly, relying on these perks is a no-no, they should only serve as reassurance. If you are contemplating life insurance, I say go for it… The payout might be way better also. Hopefully you won’t ever have to use these perks, but again, it’s a nice little sense of reassurance. Find our complete list of Credit Card Promotions from our exclusive list!