Fundera now has a $1,000 Visa Gift Card offer for all small businesses you refer towards this business funding matchmaker. Find more referral bonuses here.

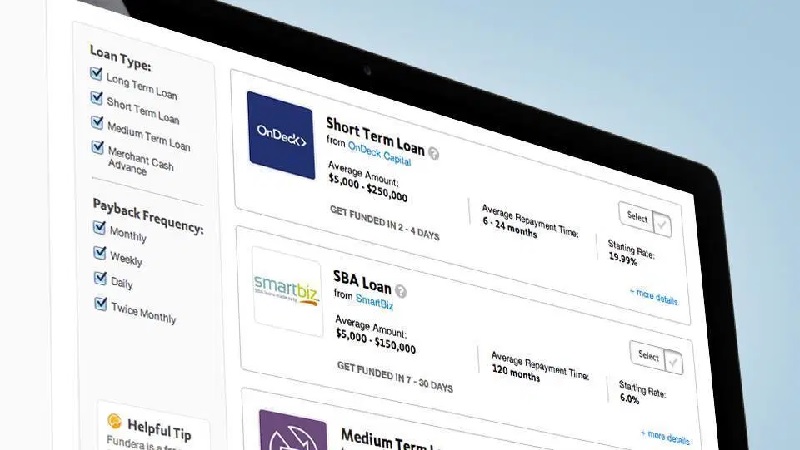

With Fundera, they will be able to connect you with funders that will offer a large range of loan types and amounts. This way, you’re able to see the loans that you’re qualified for, and who will give you the smallest rates. When you use Fundera, they will make it much simpler for you to use their many different items, all based off of your financial needs.

Read below for more information on Fundera’s recent promotions.

Fundera Business Loans Quick Facts

| Loan Amounts | $5,000 – $5,000,000 |

| APR Range | Term Loans: 7% – 50% |

| Repayment Terms | Term Loans: Up to 5 years SBA Loans: Up to 25 years |

| Funding Time | Varies |

| Origination Fee | None |

Pros

- Apply online

- Get access to lots of different lenders and loan types

- Large variety of loan amounts

- Completely transparent terms and fees

- Great customer service

- Large range of online resources

Cons

- Only get access to online lenders

- Can have high interest rates

- Possible extra charges

(View Fundera for more information)

Fundera $1,000 Referral Bonuses

There are plenty of small business owners that want the best loan options. Receive a $1,000 Visa gift card for each business owner that signs up with your personal referral code and finds something on Fundera. Below, is how the referral bonus will work:

- Sign up for the Fundera referral program when you put your email in at the bottom of the webpage. Then click the “Sign Up” button.

- Look for your personal referral code located on your Fundera dashboard. View the status of all of your referrals or get your referral code when you click here.

- Then share your referral code to any small business owner that’s seeking to finance.

- Receive the $1,000 Visa gift card for each small business owner that finds a funding with Fundera with your referral code.

There won’t be a limitation on the amount of people you’re able to refer, nor for the amount of referral bonuses you can gain.

Feel free to leave your referral link down in the comments section below.

Feel free to use to sign-up for a Fundera account.

Fundera Loan Products

Term Loans. Get a lump sum, then you’ll have to make normal payments (typically monthly, less often than weekly). Only until you’ve paid your loan off with interest.

Loan Amount: $25K-$500K | Term: 1 – 5 years | 7-50% APR

Lines of Credit. Get a credit limit, it will be the most amount of money you’ll be able to borrow in your term. Rather than receiving a lump sum, you’ll be able to draw on your line of credit when you have to. It doesn’t matter how much or often you borrow as long as the amount you’ve borrowed doesn’t go over the limit. Pay interest on how much you’ve borrowed.

Loan Amount: $10K-$1M+ | Term: 0.5-5 years | 7-25% APR

Short-Term Loans. You will have to go through the expedited application process. Pay for the flat fee for your loan, rather than paying for interest. This fee will be often as a percentage of the amount you can borrow. Make payments daily or weekly.

Loan Amount: $2.5K-$250K | Term: 3-18 months | Fee: 10%+

Cash Advances. Receive a lump sum of capital. This will repay (with a fee) with a certain percentage of your daily credit card purchases.

Loan Amount: $2.5K-$250K | Fee: 1.14-1.18%

Equipment Financing. Get an installment loan, this is for buying equipment. The equipment is collateral. Loans will be better than the interest rates since they’re secured.

Loan Amount: Up to 100% of equipment value | 8%-30% APR

Invoice Financing. Sell your invoices to a lender. It will cover part of the invoice by 80% or more. The rest will be held until it’s paid off.

Loan Amount: Up to 100% of invoice | Fee: 3%+%/week outstanding

SBA Loans. This is offered with the Small Business Administration (SBA), they’re government-guaranteed loans that’ll enable you access to great rates and terms. However, you will be subject for a long and slow confirmation process to meet all program terms.

Loan Amount: $5K-$5M | Term: 5-25 years | Starting at 7.75% APR

Fundera Business Loans Details

Fundera doesn’t have specific requirements for borrowers. However, for every funder, they’ll have to have their own qualifications such as:

- How long you’ve been in business

- How much revenue you make

- What your personal credit score is

If the requirements aren’t met, you won’t qualify for their items. Fundera offers an eligibility tracker that’ll show you when you meet all requirements for a funder’s new item.

When you use Fundera, they won’t charge you additional fees for borrowers. But, they will get a fee of 2% – 5% of your loan amount from other funding partners. Your funder can pass some of their costs towards you as well. In other words, the Fundera loan can cost more than you would want it to if you go with the funder directly.

The fees will differ depending on what funder you pick.

This is what you should expect to happen during the Fundera application process:

- Make an account and complete the questionnaire form.

- Receive a list of loan products that’s available. Pick from those products and funders that catch your attention.

- Complete the application. It will have questions you need to answer and documents they require.

- Get offers and compare them to the best offers for your financial standing. Call a Fundera representative if you’re in need of assistance.

- Fill out the necessary paperwork.

- Receive your loan.

You can contact Fundera’s customer service by: phone, email, or live chat on their website. It will have an in-depth FAQ, a good resource center that will have business loan calcuators, lender reviews, financial templates, glossaries, etc.

|

|

|

Conclusion

Overall, if you decide to use Fundera, it’s a great opportunity for you and a small business owner to get loans and interest rates out of it. They will provide you with lots of different tools to assist your financial journey. However, if you don’t meet the funders requirements, you won’t qualify for any of their products.