If you are at least 18 years old and lives in any of the qualifying states, you could open a bank account through Huntington Bank either online or in person.

If you are at least 18 years old and lives in any of the qualifying states, you could open a bank account through Huntington Bank either online or in person.

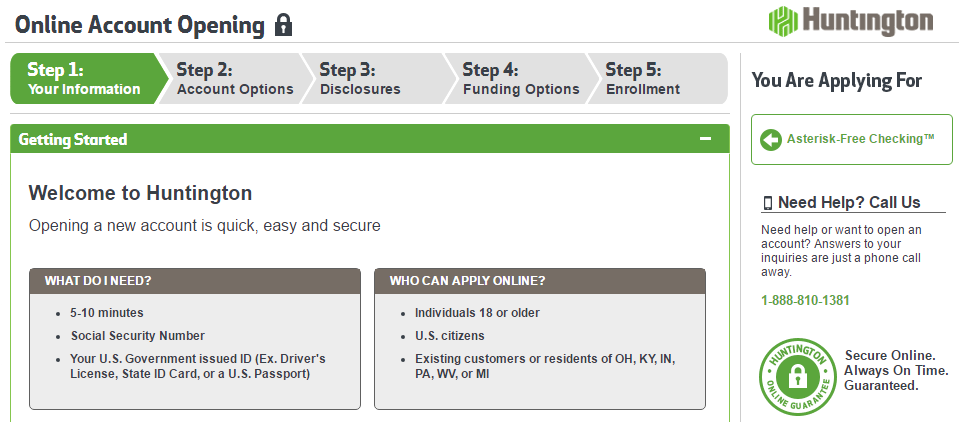

To start the process, you would need to present a valid state ID and most importantly, your Social Security number. Once you have those two items, you can begin your new account experience.

If you are either opening an account for the first time, or aren’t properly prepared, it can become quite tricky and be a hassle. That’s why I have put together this easy to follow guide on how to successfully create your new account through Huntington Bank.

| BONUS LINK | OFFER | REVIEW |

| Huntington Bank Unlimited Plus Business Checking | $1,000 Cash | Review |

| Huntington Bank Unlimited Business Checking | $400 Cash | Review |

What You Will Need:

- Official I.D. (State driving license, passport, learners permit etc.)

- Social Security Card

- Proof of residency (Phone bill, electricity bill, water bill etc.)

Checking or Savings?

Here I have provided the differences between a checking account and a savings account:

Checking:

- Easy access to your money for daily transactions

- Able to use a debit card or checks linked to the account to make purchases or pay bills

- Can deposit checks or cash to any local ATM or Chase branch

- No withdrawal restrictions

Savings:

- Gives you the ability to accumulate interest on funds

- Interest rates can be compounded on a daily, weekly, monthly, or annual basis

- Risk-free way of saving money for both short-term and long-term

- Often allows about 3-6 withdrawals a month. Can only withdraw a portion of account balance.

How To Open a Huntington Account Online?

STEPS:

- Head to the website and select the ‘Apply Now’ button for either your new checking or savings account.

- Once you have clicked on the ‘Apply Online’ button, you can choose whether your new account will be a individual or joint account.

- Apply the promotion code if you have one, if not, simply click no.

- Keep in mind that any of the promotions offered are only available to customers who do not have a new account through Huntington Bank within the past 6 months.

- At this step, you can click Yes or No to the following questions below:

- Are you a U.S. citizen?

- Have you, or has anyone you know, ever held a political office outside of the U.S. (currently or in the past)?

- Will you use this account to accept or make payments on behalf of your business?

- Click ‘Yes’ or ‘No’ to “

- Click ‘Continue’ and fill out the Personal Information Form with your name, Social Security Number, date of birth, ID and occupation.

- Click “Continue” and fill out the Contact Information Form with your name, address, phone number, and email address.

- At this point, you will click ‘Next Step’ and your identity will then be verified.

- Lastly, you will be met with their terms of agreement and make an opening deposit if necessary.

- Once you have met the requirements for the specific account(s), your bonus will be deposited within the given date.

Huntington Bank Promotions

• Open a Huntington Unlimited Plus Business Checking Account • Earn $1,000 bonus when you open a Huntington Unlimited Plus Business Checking account and make total deposits of at least $20,000 within 30 days of account opening. • Maintain minimum daily balance of $20,000 for 60 days after meeting deposit requirement. • The $1,000 bonus will be deposited into your account after all requirements are met. • Enjoy overdraft protection with no annual fee or deposit-to-deposit overdraft protection with no transfer fee! • Bonus Service. Choose one bonus service such as fraud tools, discounts on payroll services, or Huntington Deposit Scan® • Ideal for businesses with higher checking activity and greater cash flow needs. |

• Open a Huntington Unlimited Business Checking Account • Earn $400 bonus when you open a Huntington Unlimited Business Checking account and make total deposits of at least $5,000 within 60 days of account opening. • The $400 bonus will be deposited into your account after all requirements are met. • Get Overdraft Protection Account with no annual fee, or Deposit-to-Deposit Overdraft Protection with no transfer fee. • Enjoy unlimited transactions. And up to $10,000 in cash or currency deposits monthly in-branch or at an ATM at no charge. • Designed for businesses with higher checking activity and greater cash flow needs. • Bonus service. Choose one bonus service such as fraud tools, discounts on payroll services, or Huntington Deposit Scan®. |

Conclusion

This guide is an easy to follow process to help customers who would like to open their first Huntington Bank account. All you have to do right now is to head over to our Huntington Bank Promotions list and decide which of the accounts fits your needs the best.

Once you have selected which account you would like to open, gather all your necessary documents and either sign up online or in-person!

The process should run more smoothly as you follow this guide and once you have a new account, you will be well on your way to earning your bonus as well!

in Russia, no Bank can cash such a check(((