Are you traveling out of the country? If you are, you might want to setup Chase International Travel Notifications.

Are you traveling out of the country? If you are, you might want to setup Chase International Travel Notifications.

This is a new feature that Chase is offering to its customers and allows you to notify the bank that you are travelling abroad. While it isn’t necessary to make a travel notification, without this feature, you may be subject to a hold on your account while you are away.

|

|

|

How to Setup Chase International Travel Notifications

There are two options to Setup Chase international travel notifications. You can either call Chase or make a travel notification using Chase Online or Chase Mobile.

Save yourself time, and enjoy your trip by spending a few minutes to set-up Travel Notifications for your Chase Credit Card Account.

Call Chase

The first option is to call Chase Bank using the numbers available on the back of your Chase Credit Card. Call the domestic number if you’re inside the United States, and call the international number if you are overseas.

- Domestic Number: 1-800-432-3117

- International Number: 1-302-594-8200

One of the perks of calling Chase to submit a travel notification is that your Chase agent should be able to apply the travel notice to all your credit cards.

Using Chase Online

You can also log into Chase Online to submit a travel notification. However, keep in mind that Chase will send a security code to your phone to verify your account.

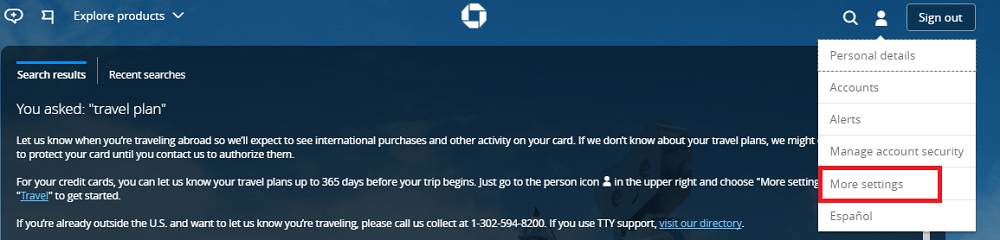

- Log in to your Chase account, just go to the person icon in the upper right and choose “More settings,” then click “Travel” to get started.

- This will take you to a portal where you’ll be able to set up Chase International Travel Notifications. Follow the process, and you’ll be on your way to a safer and more convenient travel!

Using Chase Mobile App

Additionally, you can set-up a travel notification by using the Chase Mobile App. Furthemore, the Chase Mobile App allows you to view all your account balances, request stop payments, make money transfers and deposit checks from anywhere.

- Log-in to your Chase Account.

- Choose one of your credit card accounts.

- Scroll down to “Account Services”.

- Click “Manage travel notifications”.

- Select “Add a trip”.

- Add and verify trip details.

This is an easy option considering you don’t have to be near a desktop or laptop.

Chase Credit Cards

While it isn’t required of you to make a travel notification, you can save yourself the hassle by setting up travel notifications.

Certain Chase Credit Cards, such as the Chase Ink Business Preferred or the Chase Sapphire Preferred, offers extra points when using your card on travel. The Chase Sapphire Reserve card offers even better rewards, zero foreign transaction fees, and access to VIP lounges. The Chase Freedom and Chase Freedom Unlimited earns you cashback as well.

Conclusion

Chase is always dedicated to providing its customer with the best service when it comes to banking simplicity. Travel Notifications are another way that Chase Bank is protecting its customers. Simply follow these steps and enjoy your trip without inconveniences.

Consider opening an account at Chase Bank to get the best banking experience. Furthermore, you can even earn a bonus when applying for a Chase Coupon.

The Best Bank Offers are updated here. See the below pages to get started with some of the best offers: • Chase Bank Offers. Chase offers a range of attractive Checking, Savings and Business Accounts. Chase has a great selection of sign-up bonuses in comparison to other big banks. • HSBC Bank Offers. HSBC Bank routinely has offers for several of their Personal Checking and Business Checking accounts. They also have a good referral program. • Huntington Bank Offers. Huntington Bank has high bonus amounts available through their Checking and Business Checking. Huntington also offers a Business Premier Money Market Account. • Discover Bank Offers. Discover Bank offers top cashback, savings, money market accounts and CD rates for you to take advantage of. Discover has industry leading selections to cater to your banking needs. • TD Bank Offers. TD Bank consistently offers a fantastic selection of checking accounts to cater to your banking needs. However, savings account offers are less frequently available. |

The feature is of course nowhere near as useful as it sounds. It actually only allows you to setup travel within a 14 day window from the date of input.

You then need to phone them to extend the range of dates. It is unclear how far forward they will accept on the phone. In fact non or the rules, other than the travel must start within 14 days are displayed. You can’t enter your itinerary of countries. You can however enter the complete list of countries for the week following your date of input and then phone them to extend the range of dates. Making a phone call necessary in almost all real world situations.