c When you need to send or receive money fast, consider a wire transfer. Follow this guide to learn How to Setup Chase Wire Transfers.

When you need to send or receive money fast, consider a wire transfer. Follow this guide to learn How to Setup Chase Wire Transfers.

While more options to send money, still wire transfers or cashiers checks may be your only option for significant transactions.

Chase Wire Transfers

A wire transfer is an electronic transfer of money. The best part of a wire transfer is that the money is available for use immediately. However, sometimes there are delays.

Chances are that a wire transfer will make money available after one or two business days. However, once the wire has cleared the money can be used.

Additionally, wire transfers are more secure and you can monitor the transfer at all times. Checks can bounce and it can take weeks before you notice.

Furthermore, you can send future-dated transfers and recurring transfers. This makes it more convenient for important transactions like mortgage payments.

How to Setup Chase Wire Transfers

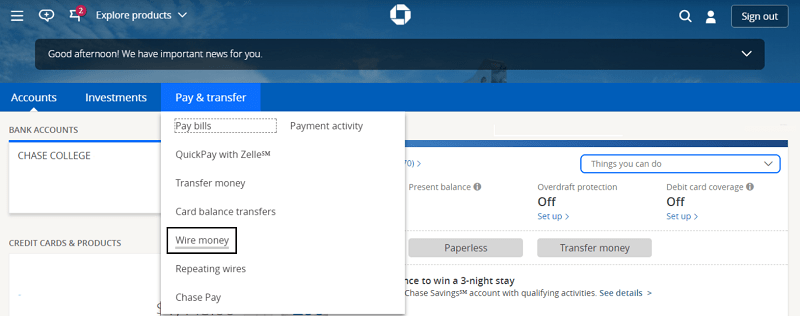

Follow these steps to learn how to setup a Chase Wire Transfer using Online Banking.

- Log in to your Chase Account.

- On the home page will be a navigation bar. Hover over to the Pay & Transfer tab then click on it, there will be a drop down menu list where you can find and click on Wire Money.

- Follow the simple process, and you’ll be able to wire transfer your money conveniently.

Follow these steps to setup a Wire Transfer using the Chase Mobile App.

- Log in to your Chase Account.

- At the top left corner, select the three horizontal lines to open more options.

- Under the transfer tab, select Wire Transfer and follow the remaining steps to setup wire transfers.

The Chase Mobile app offers other services such as access to your account balances, request stop payments, make money transfers and deposit checks from anywhere.

Conclusion

By following this simple process, you’ll be able to send Chase Wire Transfers. My experience with Chase has been nothing short of great, and I will continue using their services for years. to come.

Additionally, be sure to look at Chase Coupons if you decide to open a new account. These Chase Coupons offer cash bonuses when you open a new checking or savings account.

The Best Bank Offers are updated here. See the below pages to get started with some of the best offers: • Chase Bank Offers. Chase offers a range of attractive Checking, Savings and Business Accounts. Chase has a great selection of sign-up bonuses in comparison to other big banks. • HSBC Bank Offers. HSBC Bank routinely has offers for several of their Personal Checking and Business Checking accounts. They also have a good referral program. • Huntington Bank Offers. Huntington Bank has high bonus amounts available through their Checking and Business Checking. Huntington also offers a Business Premier Money Market Account. • Discover Bank Offers. Discover Bank offers top cashback, savings, money market accounts and CD rates for you to take advantage of. Discover has industry leading selections to cater to your banking needs. • TD Bank Offers. TD Bank consistently offers a fantastic selection of checking accounts to cater to your banking needs. However, savings account offers are less frequently available. |