H&R Block is offering a 4% refund bonus if you put some or all of your tax refunds into an Amazon gift card.

H&R Block is offering a 4% refund bonus if you put some or all of your tax refunds into an Amazon gift card.

H&R Block will assist you on your taxes for a good cost. Most customers will use the software, but you can stroll into any of the H&R Block’s 12,000 offices to be able to receive consultation. With the platform being filled with online tax preparations services, with this company’s in person feature is what makes it different from other offers.

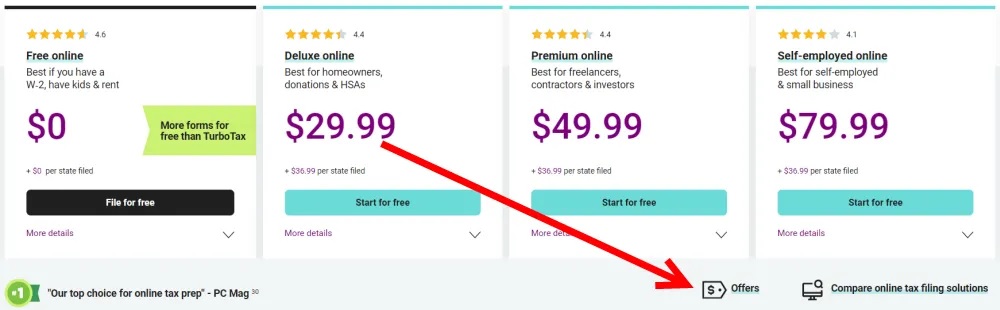

You can see what H&R Block is offering their clients below.

H&R Block 4% Refund Bonus

Use some or all of your refund on an Amazon gift card and receive a 4% bonus using this offer.

- Go to this H&R Block webpage.

- Tap on the “Offers” link that’s seen in the picture above.

- Go down and see the Amazon Refund Bonus Offer.

H&R Block Online Filing vs Software Download

- View their items for filing your taxes online here.

- See their software products available for download for Windows & Mac here.

- Use their calculator to estimate your 2019 tax refund.

- Use their W-4 allowance calculator to estimate your refund or balance due under your current W-4 form.

H&R Block Packages and Pricing

| PLAN | PRICING | DETAILS |

| Free | Federal: $0 State: $29.99 Tax Pro Review: $49.99 |

1040 plus Schedules 1-6 |

| Deluxe | Federal: $49.99 State: $39.99 Tax Pro Review: $79.99 |

Great for itemizers |

| Premium | Federal: $69.99 State: $39.99 Tax Pro Review: $89.99 |

Schedule D or Schedule E (investors & rental property owners) Schedule C-EZ (independent contractors) |

| Self-Employed | Federal: $104.99 State: $39.99 Tax Pro Review: $89.99 |

Small business owners Freelancers Independent contractors Imports Uber driver tax information Integrates with Stride Tax |

Each of your packages will include:

- Snap-a-pic W-2 capture

- Import from other tax preparers

- Refund results in real time

- Technical & tax help center

- Data security for online taxes

- Protection with Tax Identity Shield

H&R Block Tax Support

Each of the H&R Block packages will offer you access to this company’s horde of human tax professionals at 12,000 offices globally. Even though this isn’t a free feature, it’s nice to see that you’ll be able to receive face-to-face assistance when you feel necessary.

H&R Block Software For Tax Season 2022 Now Available For 20% Off

Get H&R Block’s Tax Software for tax season 2022 is available for preorder for 20% off. See offer here.

4% Refund Bonus

Place all your refund on an Amazon gift cards and earn a 4% bonus with this offer.

- Go to this H&R Block webpage.

- Click on the “Offers” link as shown in the image above

- Scroll down to see the Amazon Refund Bonus offer.

H&R Block Packages & Pricing

| PLAN | PRICING | DETAILS |

| Free | Federal: $0 State: $29.99 Tax Pro Review: $49.99 |

1040 plus Schedules 1-6 |

| Deluxe | Federal: $49.99 State: $39.99 Tax Pro Review: $79.99 |

Good for itemizers |

| Premium | Federal: $69.99 State: $39.99 Tax Pro Review: $89.99 |

Schedule D or Schedule E (investors & rental property owners) Schedule C-EZ (independent contractors) |

| Self-Employed | Federal: $104.99 State: $39.99 Tax Pro Review: $89.99 |

Small business owners Freelancers Independent contractors Imports Uber driver tax information Integrates with Stride Tax |

You can these across all packages:

- Snap-a-pic W-2 capture

- Import from other tax preparers

- Refund results in real time

- Technical & tax help center

- Data security for online taxes

- Protection with Tax Identity Shield

H&R Block Tax Support

Ask a Tax Pro: With this additional service, you’ll be able to talk to a tax expert with on-demand and unlimited access. There are several options to can choose from to communicate with them such as: talking on the phone, email, or mobile/tablet screen sharing.

Tax Pro Review. You can see how accurate these are and mark any missing deductions/credits using the one-on-one review by a tax pro for your whole return. It’ll take about 3 days to fully complete this review, then the tax professional will be able to sign and e-file the return for you if you wanted.

Even though there aren’t enrolled agents or CPA’s for the H&R Block tax professionals, they all receive the 60+ hours of initial training. They also go through about 30+ hours of training each year to be able to ready themselves for the tax season.

H&R Block vs TurboTax

TurboTax is owned by Intuit, it is a different tax preparation option that gives you a set guidance while you browse their user-friendly programs. TurboTax is most likely H&R Block’s biggest competition. You can see the comparisons and differences below.

Cost: TurboTax will offer you a set of different package options like H&R Block:

| FILING OPTION | H&R BLOCK | TURBOTAX |

| Free | Federal: Free State: $29.99 |

Federal: Free State: Free |

| Deluxe | Federal: $49.99 State: $39.99 |

Federal: $39.99 State: $39.99 |

| Premier | Federal: $69.99 State: $39.99 |

Federal: $59.99 State: $39.99 |

| Self-Employed | Federal: $104.99 State: $39.99 |

Federal: $89.99 State: $39.99 |

Free Option: With both H&R Block and TurboTax, they will offer you a free option. However, the H&R Block package will have more forms and schedules and let you file for many state returns free of charge. For TurboTax, the only free choice they have would be one free state return for you.

Tax Experts: Even though TurboTax won’t give you any brick-and-mortar places like H&R Block does, it will give their customers access to tax professionals (CPAs or EAs) with a fee included. Remember H&R Block gives you tax specialist help online, over the phone, or one-on-one.

Ease of Use: TurboTax is definitely easier to use rather than H&R Block no matter if you go online or talk on the phone. They have an interview style that they use to help you with the filing process. It is easy and straight to the point, there won’t be any complications with tax jargons. H&R Block is also user-friendly, but every now and then you might come across some difficulty with their questions and explanations.

H&R Block Audit Support

H&R Block clients will be able to get “Worry-Free Audit Support.” This will direct you towards an Enrolled Agent who will be able to assist you through any audit. This will cost you $19.99 with an additional audit preparation, IRS correspondence management, and face-to-face audit representation.

H&R Block Tax Refund Options

It doesn’t matter how you choose to file your taxes, you will be able to pick how to get your refund over:

- A direct deposit to a bank account (fastest option)

- An H&R Block Emerald prepaid debit Mastercard

- A paper check

- Next year’s taxes

- U.S. Savings Bonds purchases

- Amazon gift card (5% bonus)

To receive the best value for your refund, you should load the same amount towards an Amazon gift card. This will get you a 4% bonus towards your refund. Pick whether to load your entire refund or some of your refund. If you get a $1,000 refund, this would mean you’d be getting about $1,050 back.

|

|

|

Conclusion

Even though it doesn’t necessarily match TurboTax, H&R Block is very appealing with their offer to assist you one-on-one with a tax professional. This is very beneficial to you if you want to do your taxes on your own for the first time, or if you want to lean on a tax specialist for good measure.

You can even pick to load your tax refund to an Amazon gift card, which will allow you to get a 4% bonus.

(Visit H&R Block for more information)