If you have a checking account with Huntington Bank then at some point you will need to know what your routing number is. This number is also sometimes referred to as the ABA number.

Such identification marks such as a routing number was invented back by the American Bankers Association in 1910 as a way to simplify check processing and make it more secure.

Routing number invention meant that the paying bank started to be uniquely identified, so that the bank clients could become sure that they would get the money from the payer’s bank.

Continue reading below to find your Huntington Bank routing number and learn more about money transfers.

| BONUS LINK | OFFER | REVIEW |

| Huntington Bank Unlimited Plus Business Checking | $1,000 Cash | Review |

| Huntington Bank Unlimited Business Checking | $400 Cash | Review |

What Is a Routing Number?

A routing number is a 9-digit code that banks use to identify themselves. Think of it as an address that lets other banks know where to find your money.

Routing Numbers are used to identify your bank whenever you make a financial transaction like writing a check, setting up direct deposit, or using your bank’s Bill Pay feature.

You need your routing number for many tasks, including:

- ACH payments

- Setting up direct deposit

- Receiving benefits from the government, including tax refunds

- Transferring money between accounts at different banks or investment firms

- Automatic bill payment

- Domestic wire transfers

Many banks have more than one routing number, especially if they have branches in several states. Bank of America has branches throughout the United States and uses different routing numbers for each state.

Huntington Bank Routing Number Information

Find Your Routing Number with these various methods:

When you log in to Online Banking, you can easily find your routing number by navigating to your Account Details page.

The routing number is conveniently located in the Account Information section.

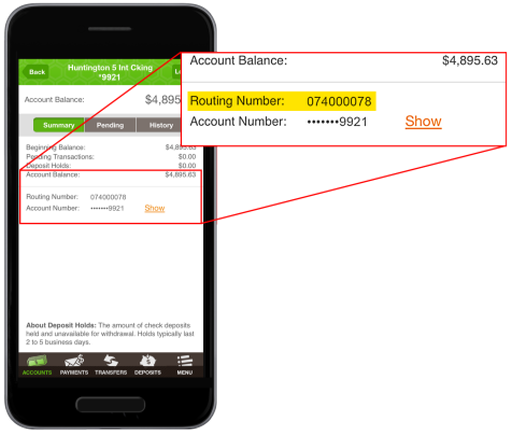

Log in to the Huntington Mobile app and select your account.

Your routing number can be found on the Summary tab.

You can find your routing number on the bottom left of a check.

If you don’t have a check, you can always use the third and fourth numbers of your account number to determine your routing number.

You can find your account number either on the bottom of your check OR accessing your ONLINE BANKING.

You can find your account number at the top of the right column of your statement.

Different Numbers for International Wire Transfers

Wire transfers are a faster way to send money than an ACH transfer.

From your Huntington Bank account, you can wire money to other bank accounts, and other accounts can wire funds to you.

If you’re moving the money abroad, you’re making an international transfer, and you might need to take exchange rates into consideration when you complete the transaction.

The routing number on a check is different from the ones you use for wire transfers.

Make sure you use the correct number so the funds will be credited correctly.

To Make A Domestic Wire Transfer

Use the Huntington domestic wire transfer routing number 044000024 instead of your regular ABA routing number.

You’ll also need the following information:

- The name of the person to whom you’re wiring funds (the “beneficiary”) as it appears on their account

- The name and address of the beneficiary’s bank

- The routing number of the beneficiary’s bank

- The beneficiary’s account number

Before submitting a wire transfer for processing, it’s a good idea to double-check you have all the necessary information entered correctly.

To Make Any International Wire Transfer

Use the Huntington SWIFT code HUNTUS33.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes are the international equivalents of U.S. routing numbers. They direct the money to the correct bank for international transfers.

You’ll also need the following for an international wire transfer:

- The name of the person to whom you’re wiring funds (“the beneficiary”) as it appears on their account

- The name and address of the beneficiary’s bank

- The beneficiary’s account number

- The SWIFT code of your bank and the bank you are sending to

- Currency being sent

- Purpose of payment

Huntington Bank Promotions

• Open a Huntington Unlimited Plus Business Checking Account • Earn $1,000 bonus when you open a Huntington Unlimited Plus Business Checking account and make total deposits of at least $20,000 within 30 days of account opening. • Maintain minimum daily balance of $20,000 for 60 days after meeting deposit requirement. • The $1,000 bonus will be deposited into your account after all requirements are met. • Enjoy overdraft protection with no annual fee or deposit-to-deposit overdraft protection with no transfer fee! • Bonus Service. Choose one bonus service such as fraud tools, discounts on payroll services, or Huntington Deposit Scan® • Ideal for businesses with higher checking activity and greater cash flow needs. |

• Open a Huntington Unlimited Business Checking Account • Earn $400 bonus when you open a Huntington Unlimited Business Checking account and make total deposits of at least $5,000 within 60 days of account opening. • The $400 bonus will be deposited into your account after all requirements are met. • Get Overdraft Protection Account with no annual fee, or Deposit-to-Deposit Overdraft Protection with no transfer fee. • Enjoy unlimited transactions. And up to $10,000 in cash or currency deposits monthly in-branch or at an ATM at no charge. • Designed for businesses with higher checking activity and greater cash flow needs. • Bonus service. Choose one bonus service such as fraud tools, discounts on payroll services, or Huntington Deposit Scan®. |

Conclusion

Your routing number information is crucial in order to provide the utmost safety towards your transaction volume as much as possible.

If you’re stumbling on this post, it’s because you want to set up direct deposit and your account number and routing number information is a requirement.

If you need help opening an account with Huntington or you want to check out Huntington’s checking account features then you’ve come to the right place!

If you have any further inquiries, be sure to let us know in the comment section below! Also go ahead and check out our list of Best Bank Bonuses and Best Savings Rate.