If you want the latest Tally Save bonuses or promotions, be sure to check here for frequent updates!

Tally Save is a money managing app that specializes in helping you pay off your debt faster. If you are interested in what other bonuses that Tally has, continue reading the review below.

Plus, they will also reward you for putting some of your money into savings and even reduce your credit card balances.

Tally Features

Tally is a full service financial automation that’s built to be a debt manager to help people overcome credit card debt and put billions of dollars back in people’s pockets. They take over your credit card bills, making sure you never miss a payment. Tally’s vision is to automate people’s entire financial lives, so they can stress less about money and do more of what they love.

With Tally, they will combine all of your credit cards onto one payment with a lower interest rate. After you are eligible, they will look at your cards and credit profile to look for an offer for a credit line. Additionally, you must have a FICO score of 660 or more to be able to partake.

They will use your Tally credit line to pay off all of your credit cards. In other words, this helps you save money on interest when you use Tally. Plus, each month you must make 1 transaction to Tally, no matter how many cards you have. Furthermore, keep making the monthly payments, and Tally will keep paying down your credit card balance.

You can choose to make card payments by yourself also, you can choose You Pay option. Tally will still send you reminders when your payment is due and how much you should pay towards each credit card. Other features include:

- Tally Credit Card Manager: A comprehensive dashboard that covers all your credit card balances to give you a snapshot of your overall debt.

- Tally Advisor: A built-in AI that analyzes your credit card debt, spending habits, and financial goals to recommend a customized payoff plan that helps you get out of debt in the shortest amount of time possible.

- A debt collector: They take into consideration your credit card balances, APRs, credit score, and the payments you made in the past month, to help determine the amount of interest you’ll spend on your credit cards.

- Late fee protection: You’ll never miss any payments since Tally pays at least the minimum amount on all your credit cards two days before they’re due.

- Covid Relief Program: They support members who experienced a loss of income due to the pandemic. Choose to postpone a credit line payment, but interest charges will still accrue on the balance. Tally will also halt payments to your credit cards, so you’ll need to make the payments yourself.

Tally Limitations

Tally has limited availability. Plus they don’t offer credit lines in Maine, Montana, Nevada, West Virginia, and Wyoming at the moment.

You’ll need a minimum credit score of at least 660 to take advantage of a Tally credit line.

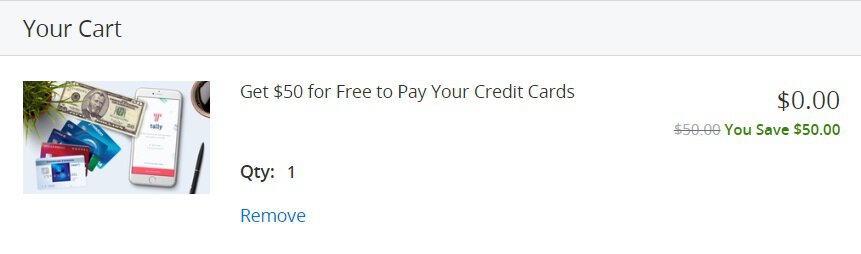

(Expired) Tally $50 Bonus Offer

Sign up for Tally Save and earn a $50 discount at Groupon

For a limited time only, Groupon is currently offering a $50 bonus when you create a new Tally account!

(Visit for more information)

How To Earn the Bonus

- You must “buy” the Tally deal, but you don’t have to actually spend any money in this process.

- Go through a process of “buying” Tally (you don’t actually have to purchase anything at this step)

- Visit their website on the voucher and finish the $50 redemption.

- Download the Tally app and load your credit cards on your new account

- This current offer is only available to new Tally customers.

- To be a customer, you have to pass a soft credit check and have a FICO score of 660 or higher.

- You have to register at least one credit card in order to qualify and have at least $1,000 as a combined total.

- New customer must link at least one credit card with Tally and have a minimum interest-bearing balance of $1,000 for all credit cards.

- Tally takes about 60 business days from account activation to reward you with your bonus

- This offer is not available for Tally promo codes, it is separate