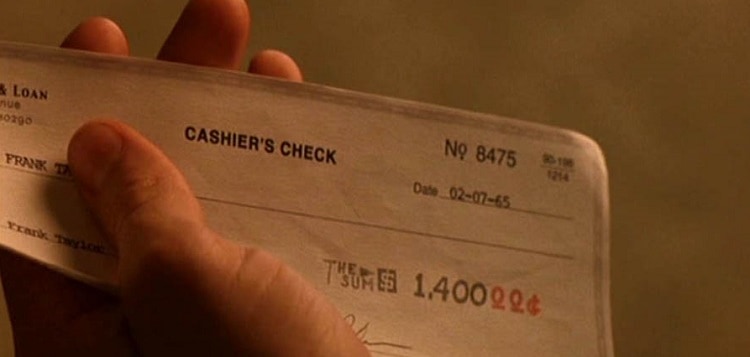

There may be a point in time where you’re making a large purchase and the merchant doesn’t accept credit cards or personal checks. Although it may not be a normal circumstance, you can be readily prepared with Cashier Checks. With a cashier’s check, the bank verifies that you have enough money to cover the amount of the check that you requested. The amount will then be withdrawn from your account and you will be issued a check to the designated payee in the amount that you requested. Differentiating from a regular check, a cashier check basically guarantees it’s payment by a bank, not the purchaser.

|

|

|

Getting a Cashier’s Check:

Typically, you purchase cashier’s checks from banks or credit unions. Some things you’ll need to note:

- You’ll need to be able to supply the exact amount of the check and the name of the Payee (business or person you’re paying to)

- The teller will ensure that you, the remitter, or person who sends a payment, have the available cash to pay for the cashier’s check.

- The check will be written for the amount that you requested. A teller or bank offer will sign it once all requirements are accomplished.

- There will typically be fees for cashier checks which vary by account and institution. credit unions typically charge less than big banks; say less than $5, while big banks might charge upwards of $5.

Cashier’s Check Fraud:

Word of advice, try not to take any cashier’s checks from someone you do not know. If you received one, wait for several days until the check has been deposited or the check has been cleared with your bank. If the check cleared, you will be able to use the funds.

Note that cashier’s checks are usually deposited into a bank account withing the next available day, but banks could also place a hold on amounts over $5,000 until the check has been cleared by the issuing bank. If it comes to that case, it could take days, but this extra ounce of protection if necessary to counter fraud. Watermarks and wet-signatures by tellers/bank officers is also an extra layer of security.

What if I lose the check?

If you end up losing your cashier’s check, don’t fret. The bank will just require you to get an indemnity bond before issuing another one. This ensures that you are liable for the second check, not the bank. Getting an indemnity bond can sometimes be a hassle, so be sure to keep good track of your checks!

Advantages

- Little risk it will bounce

- Settles faster than personal check

- Can only be cashed by payee, therefore lowering theft risks.

Disadvantages

- Fees

- Risk of fraud

Conclusion:

Sometimes, merchants will don’t allow your purchase to be made via a credit card or personal check, which is why Cashier Checks can be an option for payments and purchases as well. They typically come with a fee, nothing too hefty; $5+, usually lower for credit unions. Basically, you’ll need to be able to supply the exact amount of the check. You’ll need your recipient’s information and you really do need to know if he/she is reputable enough for you to send cashier check’s to. Two key disadvantages that I’ve listed are the fees and the risk of fraud or even forgery. Be cautious with cashier checks, other than that, be sure to check out our complete list of Bank Deals for all your banking needs!