Nowadays, banking has never been easier. With the convenience of mobile and online banking, you are able to be up to date with your finances while giving you step-by-step solutions into resolving your personal finance advice. However, knowing how to find your bank’s routing number is essential and something you will definitely need to know, even if you aren’t writing checks.

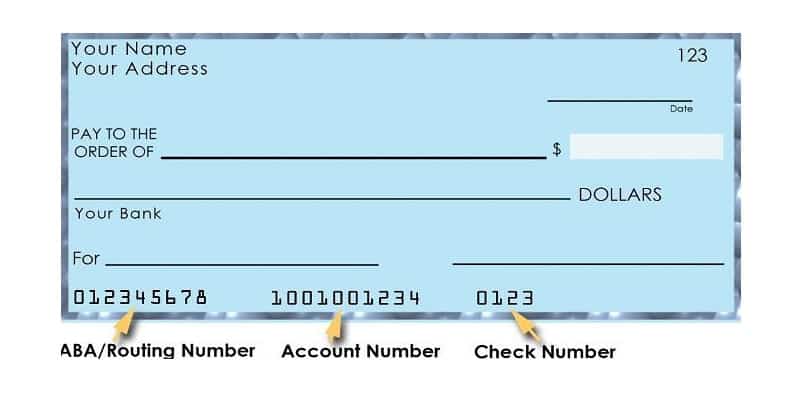

Routing number, also known as the ABA (America Bankers Association) routing transit number (RTN), is a nine-digit code that’s printed on the bottom of checks and other types of financial documents. The codes indicates the state or region where the banking account was opened and which bank is it on which the check was drawn.

In fact, whether you have a personal checking account or business checking account, you still need information from your old-school checkbooks in order to properly set up features associated with account and routing numbers such as automatic monthly bill pay and direct deposits. With that said, continue reading below for a guide onto your bank’s routing number.

|

|

|

What Do The Numbers In The Bank Routing Number Mean?

When it comes to the ABA/Routing Number, those nine digits are not random numbers. In fact, you can break them down into three distinctive sections:

- First Two Digits: These numbers corresponds to the Federal Reserve Routing Symbol, belonging to one of the 12 different Federal Reserve banks across the country. The region of your particular bank will be represented in these two digits.

- Third Digit: This digit corresponds Federal Reserve check processing center that was assigned to the bank.

- Fourth Digit: This digit tells you whether your bank is located in the Federal Reserve city proper with a 0, or 1-9 according to which state in the Federal Reserve district it’s in.

- Fifth-Eighth Digits: These are called the ABA Institution Identifiers. They are in references to the bank you are affiliated with and are assigned by the ABA.

- Last digit: This last digit is used to verify the routing number’s authenticity.

How To Find Your Bank’s Routing Number

If you don’t have a checkbook associated with your account, you are still able to access your personalized routing number online. Finding your bank’s routing number online is incredibly easy. The process varies depending on which bank you are currently with. However, along with most large banks, the steps below should be pretty similar across the board:

- Log into your bank’s website

- Click on the “see statements” icon

- Open the statement as a pdf

- Click on the last four digits of your account number

- See your routing number!

Federal Reserve Routing Symbol

There are a total of twelve Federal Reserves spread across the nation. With each Reserve, the first two digits of your routing number corresponds to where the bank is located.

First two digits:

- 00 – United States Government

- 01 – Boston

- 02 – New York

- 03 – Philadelphia

- 04 – Cleveland

- 05 – Richmond

- 06 – Atlanta

- 07 – Chicago

- 08 – St. Louis

- 09 – Minneapolis

- 10 – Kansas City

- 11 – Dallas

- 12 – San Francisco

- 80 – Traveler’s Checks

Conclusion

All in all, finding your routing number is incredibly easy to do. Unfortunately, it’s one of those things that are not widely known yet necessary when it comes to direct deposits or automatic monthly bill pay. Whether you are looking to understand the digits associated with your routing number or simply trying to understand where your routing number is, it is incredibly important and vital to knowing this personal finance feature.

At the end of the day, whether you are setting up direct deposit or transferring fund between checking accounts and your high interest bank accounts, access to your routing number is a imperative process. Additionally, transfers to investment accounts like Betterment or Fidelity also requires access to your routing number.

However, be sure to do your research when it comes to opening a new account. For those who are interested, be sure to check out our list of bank bonuses and business bank bonuses for all your banking needs. Additionally, check out our list of Referral Bonuses, Bank Rates as well as our CD Rates.

The Chase Sapphire Reserve offers 125,000 bonus points after you spend $6,000 in purchases in the first 3 months from account opening. You'll earn • 8x points on all purchases through Chase Travel, including The Edit • 4x points on flights booked direct • 4x points on hotels booked direct • 3x points on dining worldwide • 1x points on all other purchases This card does carry a $795 annual fee and there are no foreign transaction fees. However, you're able to earn a $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year & up to $120 application fee credit for Global Entry or TSA Pre✓®, and more annual value from perks and benefits. Member FDIC |