Capital One offers 4 cards earning Capital One Miles: Spark Miles for Business, Spark Miles Select for Business, Venture Rewards, and VentureOne Rewards.

Capital One offers 4 cards earning Capital One Miles: Spark Miles for Business, Spark Miles Select for Business, Venture Rewards, and VentureOne Rewards.

Check out our list of the best credit card bonuses here.

Every now and then, one of these cards will offer a limited-time 200,000-mile welcome bonus. We want to look at what is the best way you can take advantage of these amazing bonuses when it’s available.

Capital One also offers great welcome bonuses for their Checking/Savings accounts.

Read below for more information on how to take advantage of these bonuses.

Capital One Miles Quick Facts

| Personal Credit Cards | Capital One® Venture® Rewards Credit Card Capital One® VentureOne® Rewards Credit Card |

| Business Credit Cards | Capital One Spark Miles for Business Capital One Spark Miles Select for Business |

| Redemption Options | Travel purchases via Capital One Travel statement credits Gift cards Transfers to airline partners |

| Average Mile Value | $0.014 |

Earning Capital One Miles

Like we said before, Capital One offers 4 cards that earn Capital One Miles. Spark cards are geared for small businesses. Meanwhile, Venture cards are for personal usage.

The Capital One Venture Rewards Credit Card offers a one-time bonus of 75,000 Miles once you spend $4,000 on purchases within the first 3 months of account opening, plus receive a one-time $250 Capital One Travel credit to use in your first cardholder year – that’s equal to $1,000 in travel. You're able to earn: • 2 Miles per dollar on every purchase, every day. • 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection This card does come with a $95 annual fee. Enjoy no foreign transaction fees and receive up to $120 application fee credit for Global Entry or TSA Pre✔®. |

The Capital One VentureOne Rewards Card offers a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening. Enjoy 0% intro APR on purchases and balance transfers for 15 months; variable APR after that; balance transfer fee applies. You'll earn: • 1.25 Miles per dollar on every purchase, every day. • 5 Miles per dollar on hotels and rental cars booked through Capital One Travel. This card comes with no annual fees and no foreign transaction fees which is a great choice as your go-to travel card! |

The Capital One Spark Miles for Business offers a one-time bonus of 50,000 miles - equal to $500 in travel - once you spend $4,500 on purchases within the first 3 months from account opening. You'll earn: • 2 Miles per $1 on every purchase, everywhere. • 5 Miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel. Receive up to a $120 credit for Global Entry or TSA PreCheck There is an annual fee of $95, however, there is a $0 intro annual fee for the first year. Enjoy no foreign transaction fees and fly on any airline, anytime, with no blackout dates or seat restrictions. |

The Capital One Spark Miles Select offers a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening. You can earn 1.5 miles per $1 on every purchase. Your miles won't expire for the life of the account, and there are no categories to limit where or what you buy. There is no annual fee or foreign transaction fees to worry about making this card a viable option for business travel. |

Redeeming Capital One Miles

The value of your Capital One miles varies and depends on how you use them:

| Redeem For… | Value Per Mile | 200k-Mile Value |

| Travel booked via Capital One | $0.01 | $2,000 |

| Travel statement credits | $0.01 | $2,000 |

| Gift cards | $0.01 | $2,000 |

| Cash back | $0.005 | $1,000 |

| Transfers to airline partners | $0.014* | $2,800 |

The easiest option is to redeem for travel statement credits. With “Purchase Eraser,” you’ll get a flat rate of $0.01 per mile, and you don’t have to worry about any blackout dates. Please note, only travel spending in the previous 90 days qualify for statement credit.

The worst way to use your miles is for cash back in the form of account credits or checks by mail. We recommend avoiding this option because it will devalue your miles by an average 50%.

But if you want the best value for your miles, transfer them to a partner airline and take the time to strategize your award travel. If you put in the legwork to search through booking scenarios with different airlines, you could get great value for your Capital One miles.

Capital One partner airlines include:

- Aeromexico

- Air Canada

- Air France

- Alitalia

- Avianca Airlines

- Cathay Pacific

- JetBlue

- KLM

- Qantas Airways

- Qatar Airways

- Singapore Airlines

Best Ways to Redeem 200k Capital One Miles

If you want the most value for your Capital One miles, transfer them to an airline partner. Most will convert at a 2:1.5 ratio (except Emirates, JetBlue, and Singapore Airlines). This means that with 200,000 Capital One miles in your account, you’ll get 150,000 miles from most partner frequent flyer programs.

Remember, this information below is from an independent source and while it’s accurate at the time of publishing, it’s subject to change without notice.

Here are some of our favorite ways to spend 200k Cpaital One miles (150k airline miles).

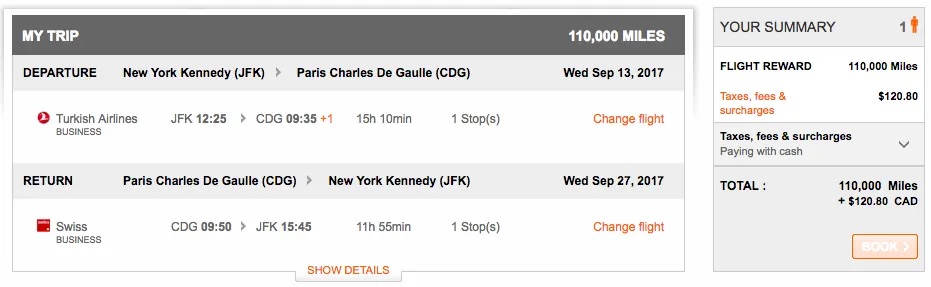

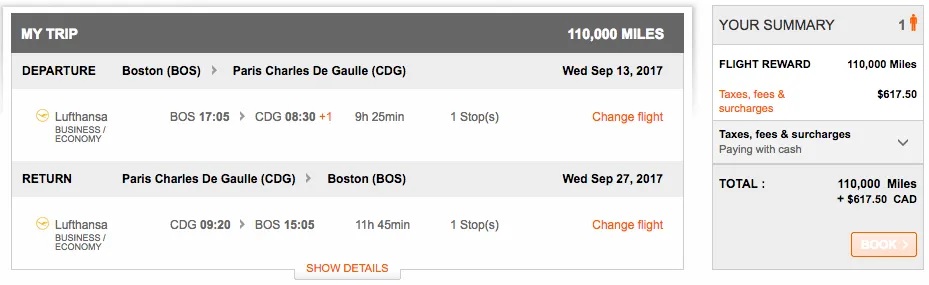

With Air Canada Aeroplan, certain partner airlines will offer award tickets with little to no fuel surcharges. You’ll be able to find great deals with low fees like:

But you might also come across award tickets with high fees like:

To avoid high fees, book with the following partner airlines:

- Aegean Airlines

- Air China

- Air India

- Air New Zealand

- Avianca

- Brussels Airlines

- Copa Airlines

- Croatia Airlines

- EgyptAir

- Ethiopian Airlines

- EVA Air

- SAS

- Shenzhen Airlines

- Singapore Airlines

- South African Airways

- SWISS

- Turkish Airlines

- United Airlines

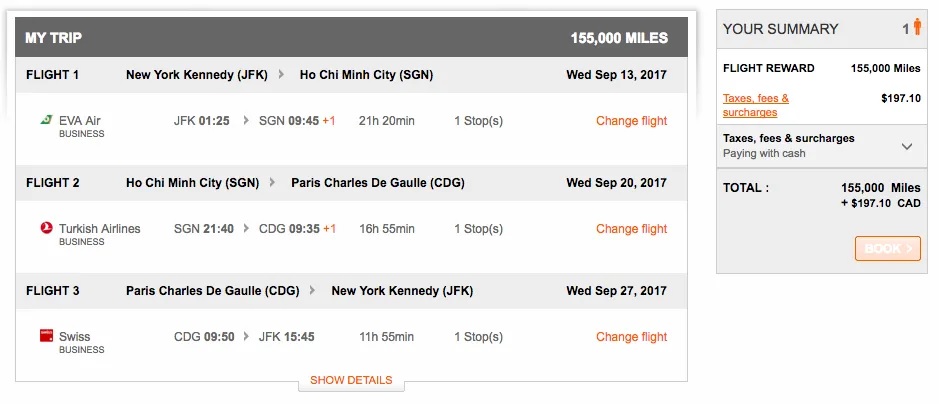

If you travel between two continents, Aeroplan allows either two stopovers or one stopover and one open jaw at the country of origin or destination. This means you can go on a low-key “round-the-world” itinerary for the cost of just one roundtrip award. For example:

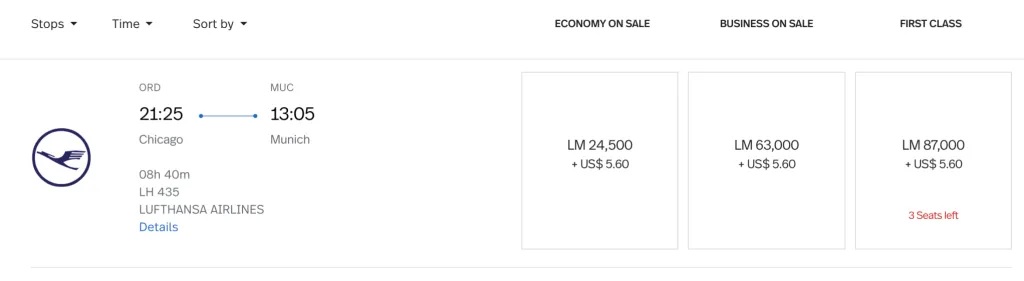

Because Avianca does not pass on fuel surcharges for any partner airline, you can book a Lufthansa first-class, one-way award from the United States to Europe for just 87,000 miles and only $5.60 in fees.

| Route | Class | Mileage |

| United States to the Middle East | One Way | Business | 78,000 |

| United States to North Asia | One Way | First | 90,000 |

| United States to Brazil | Roundtrip | Business | 100,000 |

| United States to Other S. American Countries | Roundtrip | Business | 120,000 |

| United States to Europe | Roundtrip | Business | 126,000 |

Dig deep underneath its complex rules, and you’ll find that Cathay Pacific Asia Miles offers incredible award opportunities. Keep in mind:

- You’re allowed 1 stopover on one-way standard awards (except Air China and Iberia).

- You’re allowed 2 stopovers and 1 open jaw on roundtrip standard awards.

- You’re allowed 5 stopovers and 2 open jaws on Oneworld awards.

- You save several hundred of dollars in fuel surcharges for British Airways-operated award flights.

Here’s what we recommend:

| Route | Class | Mileage |

| United States to Oceania (stopover in Asia) | One Way | Business | 85,000 |

| United States to Europe (stopover in Asia) | One Way | Business | 85,000 |

| United States to Europe (stopover in Australia) | One Way | Business | 90,000 |

| United States (West Coast) to Australia | Roundtrip | Business | 150,000 |

| United States to the Middle East | Roundtrip | Business | 150,000 |

| United States to Asia | Roundtrip | First | 150,000 |

Etihad’s award chart for travel on American Airlines is, in general, much better than AA’s own award chart. The following are all great deals:

| Route | Class | Mileage |

| United States to Europe | Roundtrip | First | 125,000 |

| United States to Asia 1 | Roundtrip (Japan/Korea/Mongolia) |

First | 125,000 |

| United States to Asia 2 | Roundtrip (China/Thailand/Singapore/etc.) |

First | 135,000 |

| United States to the South Pacific | Roundtrip (Australia/New Zealand/Fiji/etc.) |

First | 135,000 |

|

|

|

Conclusion

Overall, every Capital One mile is worth around $0.01. So, you just use the Purchase Eraser for your travel expenses within the last 90 days. Then, you will get one cent per mile every single time with no blackout dates to worry about.

However, if you want the most valuable redemption, transfer your miles to a partner frequent flyer program. This option is more complicated, but you can get an average of $0.014 every mile this way.

Leave a Reply