Everyone who’s had a past experience with Capital One should already know that their approval policy deviated from other card-issuers in the industry. They didn’t have any set rule distinguishing approval of multiple cards within the same time frame. If you’re deemed a loyal customer in Capital One’s eyes, you could get 2 or more cards within the same day as well as two of the same cards within the same day.

Everyone who’s had a past experience with Capital One should already know that their approval policy deviated from other card-issuers in the industry. They didn’t have any set rule distinguishing approval of multiple cards within the same time frame. If you’re deemed a loyal customer in Capital One’s eyes, you could get 2 or more cards within the same day as well as two of the same cards within the same day.

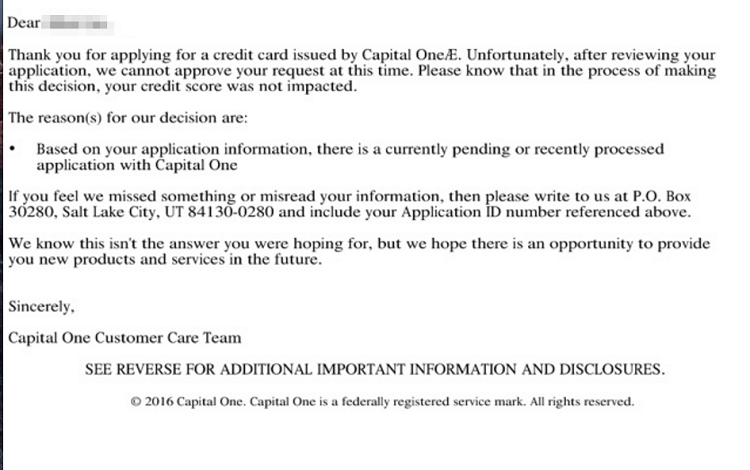

Big changes are going to occur apparently and if you’re currently applying for a card from Capital One, you should know this: Capital One has moved from their lenient policies on approval to a more strict approach towards approving multiple credit cards at the same time (they would deem your second application as “duplicate”) and they won’t allow more than one card per six months. Thus abruptly coining the 1/6 Rule.

Editor’s Note: Capital One does a pull from all three credit bureaus. Remember to freeze your Experian credit report before applying for a Capital One card. When you freeze your Experian, Just your Equifax and Transunion will take a pull.

Capital One 1/6 Rule Summary:

- You can only apply for one Capital One credit card per six months; 1/6 rule.

- Automated System Denial; Any cards that are applied for past 1/6 won’t be processed at all and no hard pull is done.

- All credit cards are included in this rule, both personal card and business cards. So, for example, if you apply for the Venture Card, you won’t be able to apply for Spark for Business until six months later.

- As long as you’re approved, you could get the bonus on a new card, even if you have the exact same card already.

- You can still have multiples of the same card open at the same time if you space out the applications. e.g. two Ventures or two Sparks for Business.

Conclusion:

Capital One has made some serious changes towards their application approval process and will now carry on a new 1/6 Rule in an attempt to prevent churners or any customer deemed as untrustworthy. Keep in mind, You can only apply for one Cpaital One credit card per six months. There is an implemented Automated System Denial that would consider all of your second applications done on the same day to be void and considered as “duplicates”.

Of course, Capital One will not do any hard pulls of that sense making it a slight relief towards this new policy. Keep in mind that this rule will still be in affect for both personal and business cards if you choose to apply for both at the same day, but ou can still have multiple of the same card open if you space out your applications.

All-In-All, this is quite an understandable perspective from Capital One given that their approval policy was quite lenient I should say the least. Now, I feel that Capital One’s 1/6 Rule makes Chase’s 5/24 rule feel a little more easy-going, given that if you actually take advantage of their targeted offers, but the 1/6 Rule is a whole lot more forgiving than a “Once Per Lifetime” Rule implemented by American Express. Make sure you also check out our Capital One Venture Review as well as out complete list of Credit Card Promotions!

I had a Capital One Venture card 2 1/2 years ago. If my application is approved and I receive a new card will I receive the bonus?