Available nationwide, SunTrust Advantage Money Market Savings account is offering a 1.50% APY Rate. Keep reading below to learn more about this attractive account and rate. SunTrust Advantage Money Market Savings Review Since 1890, generations of affluent Americans have relied on the enduring presence of SunTrust to reach their financial goals. As an integral part… [Continue Reading]

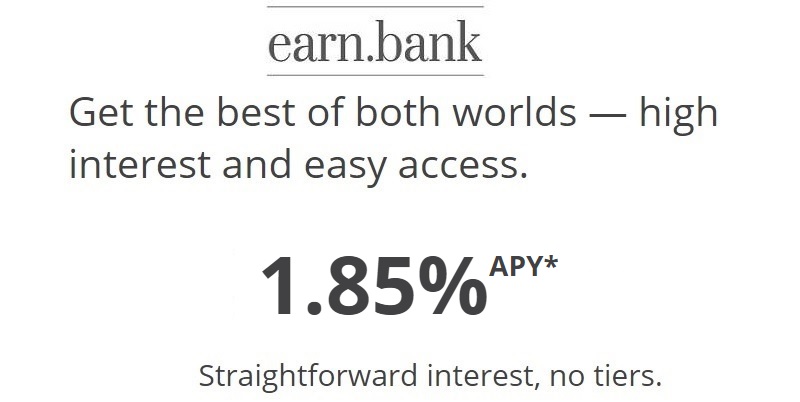

Earn Bank Money Market 1.85% APY (Nationwide)

Available nationwide, Earn Bank is offering a 1.85% APY Rate for their Money Market Account. Definitely continue reading below for everything you would need to know about the attractive account and rate! Earn Bank Money Market Review Earn Bank is a digital bank that leverages technology to cut costs and passes savings on to customers… [Continue Reading]

USE Federal Credit Union Kasasa Cash Checking Review: 2.50% APY (Nationwide)

Available nationwide, USE Federal Credit Union is offering a 2.50% APY on their Kasasa Cash Checking Account. Continue reading to learn everything you need to know about the attractive rate and account. USE Federal Credit Union Kasasa Cash Checking Review Chartered in 1938 by Oklahoma City postal workers, US Employees Federal Credit Union has a… [Continue Reading]

Xceed Financial Credit Union Xclusive Money Market 2.00% APY (Nationwide)

Available for residents Nationwide, Xceed Financial Credit Union Xclusive Money Market is offering 2.00% APY. Continue reading below to learn everything you need to know about Xceed Financial Credit Union and this account. Xceed Financial Credit Union Money Market Review Xceed Financial is a full-service financial institution, they are a member-owned and operated Credit Union…. [Continue Reading]

TBK Bank Money Market 0.25% APY (Texas only)

Available for residents in Texas, TBK Bank Money Market is offering 0.25% APY. Continue reading below to learn everything you need to know about TBK Bank and this account. TBK Bank Money Market Review TBK Bank is headquartered in Dallas and is the 18th largest bank in the state of Texas. This bank has a long… [Continue Reading]

MECU Money Market 2.25% APY (Nationwide)

Available nationwide, MECU Money Market is offering a rate of 2.25% APY when you open an MECU Money Market Account. Continue reading below to learn everything you need to know about MECU. MECU Money Market Review MECU is a Maryland-based credit union whose acronym stands for Municipal Employees Credit Union. Membership eligibility has expanded since… [Continue Reading]

TruMark Financial Credit Union Money Market 2.00% APY (Pennsylvania only)

Available nationwide, TruMark Financial Credit Union Money Market is offering a 2.00% APY Rate. Definitely continue reading below for everything you would need to know about the attractive account and rate! TruMark Financial Credit Union Money Market Review TruMark Financial Credit Union, headquartered in Fort Washington, Montgomery County, Pennsylvania, is the fifth largest credit union in Pennsylvania. In… [Continue Reading]

NEXBank High Yield Money Market 1.46% APY (Nationwide)

Available nationwide, NEXBank is offering residents nationwide a generous 1.46% APY when you sign up and open a new High Yield Money Market Account. Keep reading to learn more about this rate and account! NEXBank High Yield Money Market Review With $8.5 billion in assets, NexBank delivers commercial banking, mortgage banking, and institutional services primarily to institutional clients and financial… [Continue Reading]

Unified Bank Money Market 2.01% APY (Ohio only)

Available to residents of Ohio, Unified Bank is offering a 2.01% APY Rate for their Money Market Account. Definitely continue reading below for everything you would need to know about the attractive account and rate! Unified Bank Money Market Review Established in 1902, Unified Bank has been operating as a state chartered, commercial banking organization… [Continue Reading]

SharePoint Credit Union eSavings 3.00% APY (MN)

SharePoint Credit Union is offering residents of Minnesota 3.00% APY when they open an eSavings Account and meet all the requirements. Continue reading below to learn everything you need to know about SharePoint Credit Union. SharePoint Credit Union eSavings Review Sharepoint Credit Union is headquartered in Bloomington, Minnesota and was established in 1933. Since then… [Continue Reading]

First Home Bank Advantage Money Market 2.50% APY (Florida)

Available nationwide, First Home Bank is offering a 2.50% APY on their Money Market Account. Keep reading to learn everything you need to know about the attractive account and rate. First Home Bank Money Market Review First Home Bank is headquartered in Saint Petersburg, Florida. It was established in 1999 and has 5 locations across… [Continue Reading]

Mutual Bank Money Market 2.44% APY (Massachusetts only)

Available for residents of Massachusetts, Mutual Bank is currently offering 2.44% APY when you open a Leader Money Market account. Continue reading below to learn everything you need to know about Mutual Bank. Mutual Bank Money Market Account Review Mutual Bank was established in 1888 and has grown throughout the Massachusetts. There are now locations throughout Southeastern Massachusetts, stretching from… [Continue Reading]

Presidential Bank Money Market Plus Checking 2.25% APY (District of Columbia, Maryland, Virginia)

Presidential Bank is offering a 2.25% APY Rate. Definitely continue reading below for everything you would need to know about the attractive account and rate! Presidential Bank Savings Review Presidential Bank was opened in 1985, and on October 6, 1995 became the first bank in the United States to offer its services over the internet. In addition… [Continue Reading]

Barrington Bank & Trust Company Statement Savings 2.25% APY (Nationwide)

**Promotional rate is now inactive** Available to residents nationwide, Barrington Bank & Trust Company is offering a generous 2.25% APY when you open a new Statement Savings Account with a opening deposit of $1,000. Definitely continue reading below for everything you would need to know about the attractive account and rate! Barrington Bank & Trust… [Continue Reading]

American Express Personal Savings Account

American Express is currently offering a personal savings account called the High Yield Online Savings Account with a 2.10% APY Rate. A High Yield Savings Account is a savings account with a variable rate typically higher than retail brick-and-mortar banks. With this account, you’re limited to a maximum of 6 withdrawals or debits per monthly statement… [Continue Reading]

Synchrony Savings Account Review: 2.00% APY High Yield Savings

Synchrony Bank is currently offering residents nationwide a 2.00% APY Rate when you open a new High Yield Savings Account. For those who are not familiar with the current promotion through Synchrony Bank, they are currently offering a rather attractive APY rate no matter how much money you decide to deposit. Once you have signed… [Continue Reading]

Bank5 Connect High Interest Checking 0.76 APY Rate

Bank5Connect is offering a 0.76% APY Rate for their High-Interest Checking Account. With this account, you can keep your money handy for your day-to-day and monthly expenditures. You can also connect with a competitive interest rate. The minimum balance to open an account is $10, and the minimum balance to earn interest is just $100. As an… [Continue Reading]

Hanscom Federal Credit Union Higher Yield Savings 1.75% APY (Nationwide)

Available to residents nationwide, you could be enjoying a 1.75% APY from Hanscom Federal Credit Union when you sign up and open a new Higher Yield Savings Account. For those who are interested, all you would have to do is provide a minimum opening deposit of $25,000 at account opening. Once you have done so,… [Continue Reading]

Barclays Savings Account Review: 1.90% APY Rates (Nationwide)

Available to residents nationwide, Barclays is offering a generous 1.90% APY when you open a new Online Savings Account. To earn this generous rate, just maintain the opening deposit to meet the monthly balance requirement and you can earn the high rate that apply to all balances. Barclays has a range of account features for… [Continue Reading]

CIT Bank No-Penalty CD Review

For residents nationwide, CIT Bank is offering its No-Penalty CD. You can currently get an 11-Month CD Term with a 0.30% APY Rate. Enjoy the security of a CD with the flexibility to access your funds early if you need them. Lock in a great rate for 11 months. If you need your funds prior… [Continue Reading]

- « Previous Page

- 1

- …

- 33

- 34

- 35

- 36

- 37

- …

- 56

- Next Page »