If you’ve ever received a blank check along with your monthly credit card statement, odds are, you stumbled upon a convenience checks. Usually with convenience checks, you always see cash advanced related to it and that’s because it’s just another way for you to take out a cash advance with your credit card, so essentially, convenience checks are tied to your credit card account.

If you’ve ever received a blank check along with your monthly credit card statement, odds are, you stumbled upon a convenience checks. Usually with convenience checks, you always see cash advanced related to it and that’s because it’s just another way for you to take out a cash advance with your credit card, so essentially, convenience checks are tied to your credit card account.

You will have the ability to transfer a balance from another card or loan, to make a purchase, or to deposit your money into your bank account with convenience checks, however, there’s some things you may want to heed on when it comes to these darn contraptions!

Convenience Checks In-Depth Analysis:

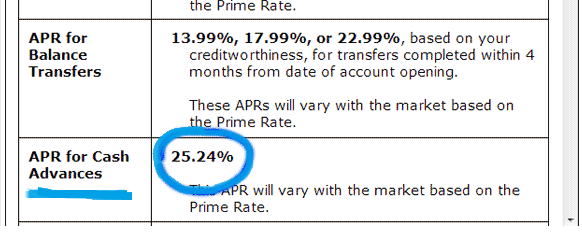

Writing a check from your credit card account provides you with increased flexibility, hence the “convenience” in check. However, keep in mind that convenience checks can attract exorbitantly high costs quickly. That’s why, before you write a check, be sure to understand the interest rate and the fees attached with cash advances.

Now, the allure of a convenience check may deviate from just being a new form of purchasing from your credit card. If you’re in need of extra cash, you can even make a check out to yourself and have it deposited into your bank account. Some credit cards, you can even use convenience checks to do balance transfers considering that you do have the option to make it them out to another credit card issuer.

Writing a convenience check definitely codes different from swiping your credit card to make a purchase. Technically, they’re treated as cash advanced on your credit card, with a soaring high interest rate, no grace period, and a costly fee attached. Taking a cash advance out on your credit card is just too expensive to be worth it!

How to Use Effectively:

If you are going to use the check to pay off an account of yours that is charging a higher interest rate and the terms are less favorable than the convenience check, then it should be a necessary option to pay off that set account with a convenience check. HOWEVER, it’s necessary that you be absolutely sure that you have the ability to pay off the transferred balance in the set time period.

Life has it’s ups and downs, and if something financially unexpected happens and you’re not able to pay it off, then your essentially going to have to take a seat in financial slump-itude. Note that when you use a credit card check, you’re tapping into your credit line on your credit card and adding to the balance. Always, if the answers aren’t clear from the documentation that comes with the blank checks, be sure to call the card issuer and ask if anything.

Convenience Checks Evaluation:

- High Interest Rate

- 3-5% cash advance fee

- No Grace Period

Conclusion

Summing up this, convenience checks is a big no for me. However, if you’re adamant on utilizing convenience checks, then be sure that you’re aware of just exactly how to utilize it efficiently. Bank of America, CitiBank and US Bank are notorious for constantly sending out convenience checks with consecutive monthly statements. If you ever receive one of these blank checks in the mail, just keep in mind that with flexibility and convenience comes a hefty interest rate, 3-5% cash advance fee and there’s absolutely no grace period attached, so convenience checks can get pretty tricky from the get-go. If you liked this article, go ahead and check out our Credit Card Promotions found only on BankCheckingSavings!