Douugh is offering new users a $20 cash bonus. Plus earn an additional $20 cash bonus for every person who uses your link to claim their reward. Find more referral bonuses here.

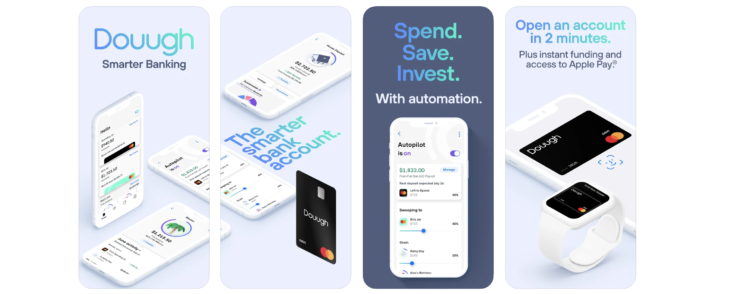

Douugh is a personal finance app that takes the stress out of managing your money and helps you reach your goals faster. You can connect all your existing bank accounts and credit cards.

Be sure to check more popular bank promotions include Chase Bank, Bank of America, Citibank, Discover Bank, CIT Bank, TD Bank, Huntington Bank, HSBC Bank, Wells Fargo and many more.

| Features | Banking, automated budgeting, saving, and investing |

| Minimum Balance | $0 |

| ATMs | 37,000+ in the MoneyPass network |

| Compatibility | Apple Wallet, Google Pay, Samsung Pay, PayPal, Venmo |

| FDIC Insured? | Up to $25,000 |

| Bonuses | $20 welcome bonus, $20 referrals |

Douugh $20 Welcome Bonus

Earn a $20 cash bonus when you use a referral link to join Douugh. Then make at least five debit card purchases within 30 days of account opening. And your bonus will post to you Spending Jar.

Earn a $20 cash bonus when you use a referral link to join Douugh. Then make at least five debit card purchases within 30 days of account opening. And your bonus will post to you Spending Jar.

Keep in mind this offer is valid for new Douugh customers only.

Douugh Give $20, Get $20 Referral Program

Refer your friends to Douugh and you both earn a $20 cash bonus. In order to qualify, your referral must:

- Be new to Douugh.

- Use your unique referral link to sign up.

- Make at least 5 card purchases within 30 days of account opening.

You can find your link through the Douugh app, head to your profile and tap on “Share the Douugh.” There is no limit to how many referral bonuses you can earn.

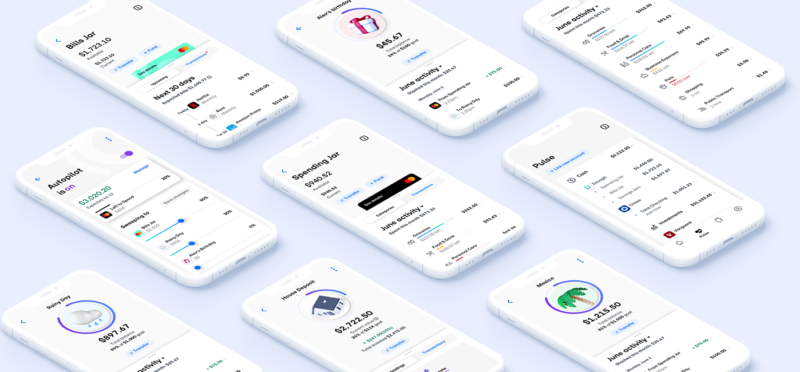

How Douugh Works

Dough is a budgeting app that offers banking, savings, and investing services in one. Just enter you bills and how much you want to save and through automation, Douugh will take care of the rest.

Once your direct deposits are posted to your Douugh checking account, they will automatically move your money to different jars for day-to-day spending, bills, savings, and investments in accordance with your financial goals. The jar works like an envelope system.

- Bill Jars – It’s an account made just for your bills. It’s 100% separate from your regular checking account. With the Bill Jar you can set aside money that’s specifically for your bills, so you’ll know that you have enough to cover your upcoming bill payments.

- Stash Jars – Short terms savings goals. You can open many Stash Jars and you can customize the goal amounts for each.

- Grow Jars – This option have customizable balance goals, you can use one jar for general taxable investment account, one for wedding, and one for buying a house. Grow Jars use low-cast ETFs to build a more diversifies investment portfolio that automatically rebalance.

- Spending Jar – All of your checking account and debit card spending will come out of the Spending Jar. The amount of the Spending Jar is whatever is left after Douugh account for your bills, savings, and investments.

Dough give you a clear snapshot of your finances across all Jars and any external account you linked to dough through their dashboard.

|

|

Conclusion

Doughh is not a traditional bank they provide great features that helps you financially by managing and growing your money on autopilot.

Find all the best personal finance apps