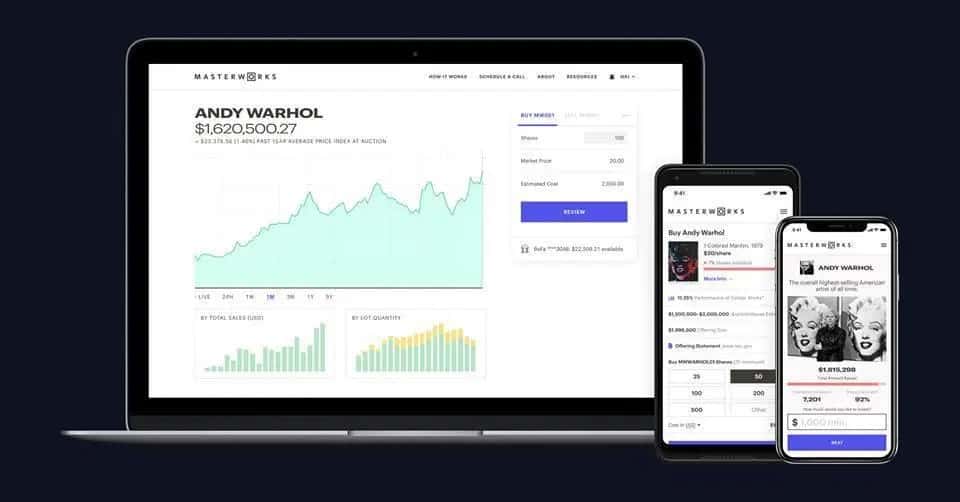

Masterworks is a platform that you can invest into and allows an average person to buy a fractional ownership of fine art for about $20 a share, broadening access to blue-chip art that’s extremely wealthy and for the masses.

With Masterworks, it’s comparable to the real estate crowdfunding programs such as Fundrise and Groundfloor. These two will be able to let small investors invest into a commercial real estate project. However, instead of the real estate, you will be able to put money for amazing artwork. The whole point is to be able to sell the art for a larger bid afterwards.

Why Invest in Art?

Art is noncorrelated: Help correlate and measure how the investment will behave compared to one another. For every diverse protfolio, you would need resources that go in different directions. If one resource increases, the other will decrease. It allows you to gain more protection if there’s any setbacks in the market.

Art would be a great non-correlated resource. Meanwhile there are other stocks that will normally react to daily news and swings, this art market will go at a slow rate. Enjoying the slow and steady rate while ignoring how the broader market will act.

Art is resilient: Like when there was a market crash in 2008, it took about 8 months for it to get to the art universe. Even when that happened, it didn’t cause major damage. With the economic calamity, the value worth for S&P 500 fell 51%+ meanwhile the art index fell about 27%.

Art is global: Art is something that is appreciated worldwide, and can be purchased and sold by anyone wherever they are. There are lots of stocks and bonds that will be restricted in the U.S. and other countries where trading happens. The big worldwide network for possible investors normally adds security for the art platform from any country-specific economic setback and gives constant source for any new purchases.

Art is in demand: In 2005, about $630 million came into the market where artworks were being sold at an auction for at least $5 million. These worth for these pieces would quadruple in their values in 2008 during the financial disaster selling work for about $2.2 billion at these auctions. It didn’t just stop there, in 2015, the art platform built up an incredible $4.2 billion in sales.

Art outperforms the stock market. Typically, the art resources will post returns for about 10.6% if you compare them to S&P 500 total return rate of 5.1%. Artprice states that blue-chip art has normally beat the S&P 500 by over about 250% ever since 2000.

More about Masterworks

Masterworks will allow anybody to buy fractional interests for priceless artwork. How the company makes it happen is by having:

Masterworks purchases blue-chip art. Blue-chip art normally means art pieces that were created by world renown artists whos popularity has shown amazing sales volumes in the past years such as: Warhol, Van Gogh, Kahlo, and Basquiat. The Masterworks teams that operate the purchases behind the scenes have about 75 years of experience altogether as an art collector, dealer, and auction house employee.

You make an investment. After the Masterworks buys a painting, the company will then file an circular offer with Securities and Exchange Commission. After the offering is eligible by SEC, you will be able to make an investment for about $20 each share. You would need at least $1,000 to be able to invest into one.

You monetize your investment. Once 7 years has passed, if the shareholders don’t have other reasons to sell or redeem their shares, Masterworks will try to sell the painting on or before the 10 year anniversary of that offer. Then the profits are handed out accordingly. You will be able to sell your shares to other investors with Masterworks or a third party. However, this option isn’t always available to use.

Masterworks Fees

Masterworks has an annual management fee for 1.5%. This will only cover the costs for regulatory purchases, storage, and gallery rooms, insurance and others.

If you are able to sell the painting at a bigger price, then Masterworks will receive 20% of the profit.

Masterworks Risks

You should consider the risks that come with investing $1,000 on artwork that belongs to Masterworks beforehand. Some of the risks that come with it are:

Untested business model. There will be a combination blockchain technology that will be in place with Masterworks. This tech is extremely unique however, it is untested making it a little more difficult to calculate outcomes.

One type of asset. Even though Masterworks normally buys multiple art pieces, they also deal with one resource. This resource is to depend on one sole asset when their investments have a larger risk attached to it.

Illiquid asset. Normally Masterworks will try to keep an artwork for about 5 to 10 years before they try to have it sold. While they hold it off, they’ll have lots of people who are looking into buying it to vote and take the Masterworks offers. In other words, your money will be in a bunch over time.

The subjective price of art. Since the price of the art pieces are more individual, there won’t always be a guarantee that your artwork will cost more and be enjoyed in the long run.

Bottom Line

A normal buyer will be given a chance to purchase exquisite artwork to be able to add more diversity to their portfolios. However, you should remember that there are still a good amount of risks included like all other investments you will make. But, if you’re alright with taking the chance for those risks, and if you know you’ll be coming back for your moneys worth, then this will be a perfect match for you.

(Visit Masterworks for more information)