See all Pre-Approved, Pre-Qualified Credit Cards Offers, Promotions, and Bonuses here.

If you are interested in signing up for a credit card, then you should be aware of cards that are already pre-qualified for you. There is a difference between signing up for a card as a fresh, new member and signing up for a card pre-approved for you. Generally, the credit cards that are pre-approved have better deals.

You might be asking, “How do I know if I am pre-approved for a credit card?” Well, this article will show you just how to that. Most credit card issuers now allow you to view pre-approval online. Below you will find a list of credit card issuers that allow you to view your pre-approval status.

Note: Being pre-qualified does not mean you will be approved for the credit card. Issuers will perform a hard pull on your credit before they approve you, so if your financial circumstances have changed since pre-qualification, then you will be denied the credit card.

The Chase Sapphire Reserve offers 100,000 points + $500 Chase Travel promo credit after you spend $5,000 in purchases in the first 3 months from account opening. You'll earn • 8x points on all purchases through Chase Travel, including The Edit • 4x points on flights booked direct • 4x points on hotels booked direct • 3x points on dining worldwide • 1x points on all other purchases This card does carry a $795 annual fee and there are no foreign transaction fees. However, you're able to earn a $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year & up to $120 application fee credit for Global Entry or TSA Pre✓®, and more annual value from perks and benefits. Member FDIC |

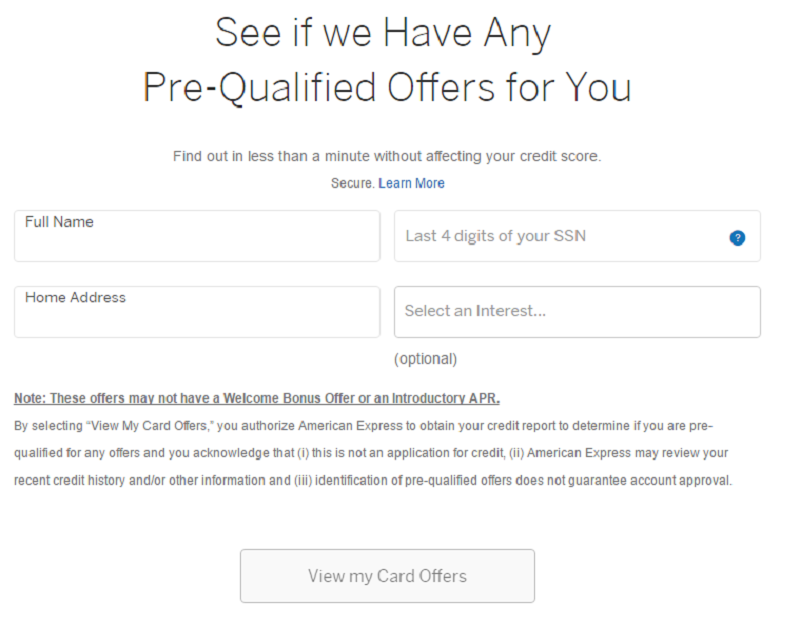

Pre-Approved American Express Cards

American Express allows you to view your pre-qualification status online. You’ll just need to visit the American Express Pre-Qualification Statuspage and click ‘Check for Offer’ on the top. Fill out your personal information, and then click View My Card Offers. You will then be able to see a list of all the credit card offers you have been pre-qualified for.

Additionally, you are able to check if you are pre-qualified for small business credit cards. You just need to go to American Express Small Business Credit Cards.Scroll to the bottom of the page and fill out the form. Be sure to check the box saying that you accept to receive promotional offers from American Express.

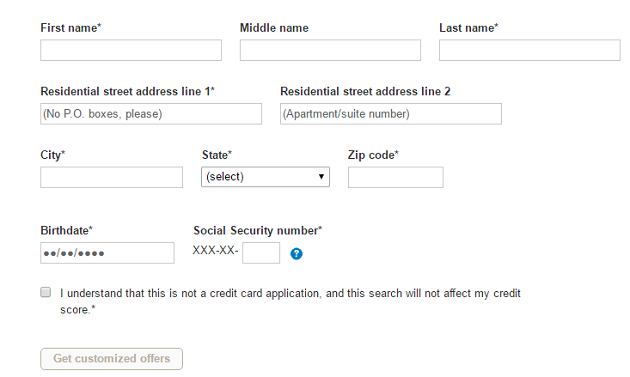

Pre-Approved Bank of America Cards

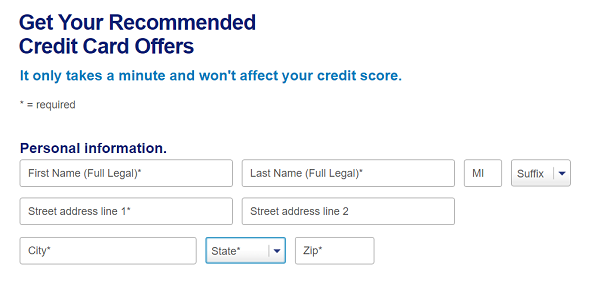

You can view different Bank of America opportunities by clicking on Bank of America Customized Offers.You’ll need to fill out your name, address, DOB, and the last 4 digits of your SSN. Check the small box saying that you understand, and click on Get Customized Offers. The picture below will show you what the page looks like.

Pre-Approved Barclaycard Cards

*BarclayCard recently pulled their pre-approved checker*

Pre-Approved Capital One Cards

You will need to visit the Capital One Pre-Qualification page. On this page you will have to fill out the entire form with your personal information. Be sure to check the box that says “I understand that this is not a credit card application.” After clicking, you’ll be able to see a list of credit cards you might have been pre-qualified for.

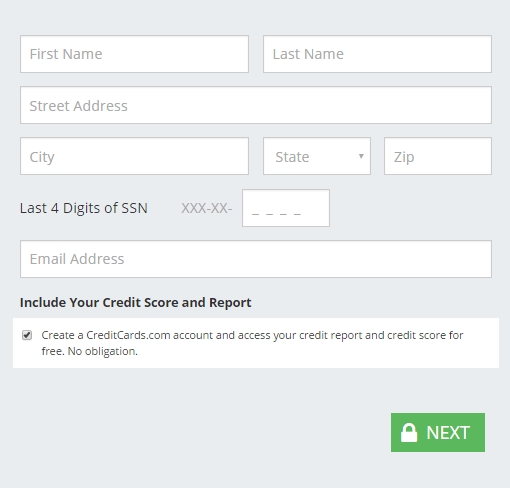

CardMatch by CreditCards.com

On CreditCards.com there is a tool called CardMatch. It was designed to reduce the amount of websites you needed to check for your pre-qualification status. To get started, go to CardMatch.Click on Get Started for Free. You’ll need to fill out your personal information and continue through the process in order to find some card matches just for you.

Chase Pre-Qualified Offers

For Chase, you can check your status by visiting Chase Pre-Qualified Card Offers.Like the other sties, you’ll need to provide your personal information in order to see which cards you are pre-qualified for you.

If you haven’t opened a Chase bank account, go ahead and check out our Chase Bank Account Promotions for cash bonuses.

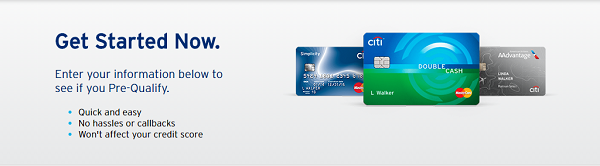

Pre-Approved Citibank Cards

Citibank also has a link where you can check if you have been pre-approved for a credit card. Go ahead and check out the Citibank Pre-Qualification Form. Again, you’ll have to fill out your personal information in order to gain access to your pre-qualified cards.

Pre-Approved Discover Cards

Like most of the other banks, you’ll have to visit their page Discover Find My Offer.Fill out all the information needed (first name, last name, last 4 of your SSN), and you will be able to see which cards you are offered and pre-qualified for.

Pre-Approved US Bank Cards

US Bank recently re-added their pre-qualification checker, which you can view by clicking on US Bank Pre-Qualification Checker. Like the others, you’ll need to enter your full name, address and last four digits of your SSN. You’ll also need to tell them what you look for most in a credit card.

Pre-Approved USAA Cards

USAA is a bit different from usual card issuers when it comes to qualified offers because you WILL need to be a member prior to searching any existing pre-qualified offers. You will need to log into your account and they’ll show you pre-selected offers: search for ‘offers’, select ’My Offers Page’

Conclusion

Being pre-approved for a credit card provides numerous benefits for you as opposed to just freshly applying for one. Banks know if you have a good credit score and are more inclined to give you opportunities to bank with them, resulting in more benefits for you! Be sure to check with each bank to see if you are pre-qualified for their specific credit cards.

If you liked this article, go ahead and check out our Credit Card Offers found only on BankCheckingSavings!

I heard about Brain Tree, and their charges; may I know what are the charges that are going to append on credit cards?