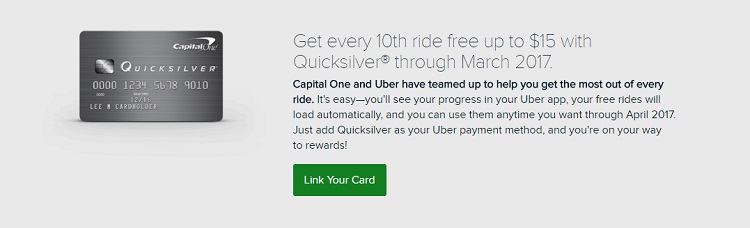

Take advantage of Capital One’s Quicksilver card for Every 10th Ride Free Up To $15 now and through March 2017 as a celebration perk for Capital One’s partnership with Uber. Get the most out of your every ride, not only that but you could earn 1.5% cash back on every purchase with this card with unlimited rewards, no caps or changing categories to worry about. You can redeem your cash back for any amount, anytime. You will also get access to a higher credit line with Credit Steps after making your first 5 monthly payments on time. Additionally the card has no annual fees to worry about making this an efficient daily credit card.

Take advantage of Capital One’s Quicksilver card for Every 10th Ride Free Up To $15 now and through March 2017 as a celebration perk for Capital One’s partnership with Uber. Get the most out of your every ride, not only that but you could earn 1.5% cash back on every purchase with this card with unlimited rewards, no caps or changing categories to worry about. You can redeem your cash back for any amount, anytime. You will also get access to a higher credit line with Credit Steps after making your first 5 monthly payments on time. Additionally the card has no annual fees to worry about making this an efficient daily credit card.

Alternative Credit Card Bonuses:

- Chase Freedom UnlimitedSM

- Citi® Double Cash Card – 18 month BT offer

- Barclaycard CashForwardTMWorld MasterCard®

Editor’s Note: In no way, shape, or form is this alternative list stating any order of similarity or superiority towards this card.

Capital One Quicksilver Credit Card Features:

- Earn 1.5% cash back on all purchases

- Ean a $100 Cash Bonus when you spend at least $500 within the first 3 months

- Unlimited Rewards – no limit on how much you can earn, and no changing categories

- Rewards don’t expire, and you can redeem your cash back for any amount, anytime

- 0% intro APR for 9 months;13.24%-23.24% variable APR after that; 3% fee on the amount transferred for 9 months.

- No annual fee

- No foreign transaction fees

- Fraud coverage

- Capital One Credit Tracker

- VISA Signature Benefits

- And So Much More.

Here’s How It Works:

- Apply for the QuickSilver Credit Card

- Download the Uber App

- Link your QuickSilver to the Uber App

- Every 10th ride, the card on file will be charged automatically with no cash needed.

Pros:

- Uber 10th Ride Free

- Cash Back Everywhere

- Sign-Up Bonus

- Instant reward redemption access

- Points don’t expire, no point cap either

- Long introductory

- No Annual Fee

Cons:

- For people with excellent credit

Conclusion:

If you sign up for the Capital One Quicksilver, you will earn 1.5% cash back on all your purchases as well as every 10th free ride with Uber. This could be a very rewarding opportunity for Capital One Quicksilver cardholders everywhere. With the recent boom of Uber, you can save even more money when you link your Quicksilver to your Uber App. The Quicksilver offers one of the purest and most straightforward cash back percentage among it’s competitors cash back credit cards of 1.5%.

In addition you will receive all the benefits above plus more including Platinum MasterCard Benefits. These give you extended warranty, auto rental insurance, travel accident insurance, 24/7 roadside assistance, and much more. With so many benefits and no annual fee attached, I would highly recommend this card for almost anyone, so give it a shot! You could also take advantage of their $100 sign-up bonus when you meet the required spending requirement. Also, don’t forget to check out our complete list of Credit Card Promotions today!