A credit score is a 3 digit number that tells lenders how likely you are to repay them on time. Usually, the higher your score, the better the chances are for you to qualify for good terms. This will help you save money in the long run.

A credit score is a 3 digit number that tells lenders how likely you are to repay them on time. Usually, the higher your score, the better the chances are for you to qualify for good terms. This will help you save money in the long run.

Check out our list of the best credit card bonuses here.

There are plenty of ways for you to improve your credit score. However, it takes some time to do so. The faster you implement the changes below, the faster your score will improve.

How Credit Scores are Calculated

You have many different credit scores. This is because they’re calculated with a mathematical algorithm. Every lender or other financial company will use a different algorithm to calculate your score.

Don’t get too worried about your different credit ratings. Most scoring models will use the same factors, so your credit scores will be relatively the same.

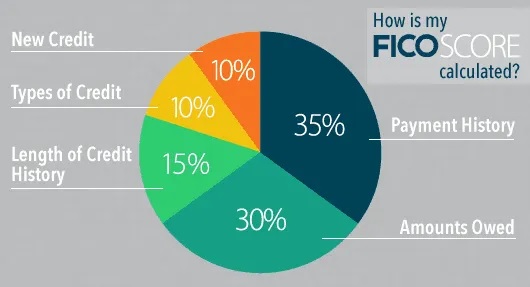

Additionally, there are some credit scoring models like FICO Score that are very common. FICO uses the 5 factors to determine your credit rating:

Normally, credit scores fall between 300 and 850. Anything higher than 750 is considered excellent credit. Anything below 600 means you have poor credit.

Here’s how to check your rating for free!

If your credit score isn’t where you want it to be, there are several things you can do to improve it. Just implement the strategies below, you’ll be able to access lower interest rates and higher credit limits.

5 Ways to Improve Your Credit Score

Before getting into what you can do to build up your score, check your credit score. Pinpoint what factors are negatively affecting your score the most. This will help you understand the changes you need to make better credit ratings.

Here are some things you can do to help build up your score:

Payment history will take up 35% of your FICO Score. It will look at whether you pay on time and if you pay in full, the minimum, or somewhere in between..

The amount you owe will weighs in 30% of your FICO Score. It takes into account how much credit you’re allowed and how much you use. If you use less than 30% of your credit limit, FICO will consider you a safe borrower. However, if you use more than 30% of it, you’re deemed to be a high risk and penalized.

Usually, 15% of your FICO Score will be determined by the length of your credit history. The longer you have an account, the better your score will be.

Credit mix will determine 10% of your FICO Score. You’ll receive a better score if you have a mix of credit: cards, mortgages, auto loans, etc. However, don’t take out another loan just to try to improve your score. You’ll have to be able to afford it as well.

New credit makes up the last 10% of your FICO score. It’s okay to open a new account occasionally. But, it’s considered risky if you open multiple accounts in a short time frame, and your score will show this.

|

|

Conclusion

Owning a good credit score will help open lots of doors for the future. You’ll be able to qualify for great interest rates and terms when you borrow. Additionally, it will even affect how much you pay for life insurance as well. Some landlords will consider your credit score when you apply, and mobile phone providers will look into your credit rating before they lease you a new phone. Since your credit score is highly important, you should do your best to take care of it.