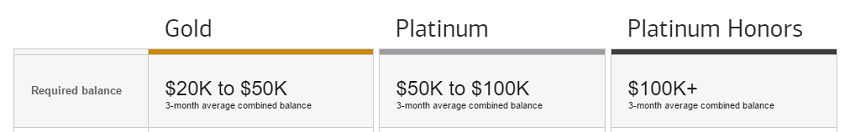

Now lets enter the world of Bank of America with their Preferred Rewards Program. The whole premise of this program is to get paid while holding money in your Bank of America account or Investment Merrill accounts. Simply enough, there is three achievable status altitudes: “Gold, Platinum and Platinum Honors” with each of them differing with incrementally greater benefits/bonuses than the lesser rank.

Now lets enter the world of Bank of America with their Preferred Rewards Program. The whole premise of this program is to get paid while holding money in your Bank of America account or Investment Merrill accounts. Simply enough, there is three achievable status altitudes: “Gold, Platinum and Platinum Honors” with each of them differing with incrementally greater benefits/bonuses than the lesser rank.

Now, there is no fees to join or participate in this program, all you need is an eligible Bank of America® personal checking account, and 3-months average combined balances of $20,000 or more in qualifying Bank of America® banking accounts and/or Merrill Edge®and Merrill Lynch® investment accounts

| Chase College CheckingSM: Get $100 as a new Chase checking customer when you open a Chase College CheckingSM account and complete 10 qualifying transactions within 60 days of account opening. Get Coupon---Chase College Checking Review |

| Chase Secure BankingSM: Earn a $100 bonus when you open a new Chase Secure BankingSM account online or enter your email address to get your coupon and bring it to a Chase branch to open an account. Make sure to complete 10 qualifying transactions within 60 days of coupon enrollment. Apply Now---Chase Secure Banking Review |

| Chase Private Client: Enjoy up to $3,000 bonus when you open a new Chase Private Client Checking account with qualifying activities. Get more from a personalized relationship when you open a new Chase Private Client Checking account with qualifying activities. Learn More---Chase Private Client Review |

Preferred Rewards Status Altitudes:

You will be able to achieve three statuses with the Preferred Rewards Program: Gold, Platinum, and Platinum Honors with a direct correlation between the status/benefits and the amount of money you have with Bank of America or Merrill. Holdings are as followed:

- Preferred Rewards Platinum Honors: $100,000+

- Preferred Rewards Platinum: $50,000-$100,000

- Preferred Rewards Gold: $20,000 – $50,000

- No status: $19,999 or less

Editor’s Note: One qualification you’d need prior to engaging yourself in the preferred rewards program is a checking account. Also, Bank of America is now offering a $100 Bonus for those that open a new Bank of America Core Checking or Interest Checking account by December 31, 2016.

Tiered Credit Card Rewards:

There is also a direct correlation between your credit cards rewards and your status structure. You should expect a incremental increase in rewards tiered towards your given status.

- Preferred Rewards Platinum Honors: 75% bonus

- Preferred Rewards Platinum: 50% bonus

- Preferred Rewards Gold: 25% bonus

- No status: 10% bonus as long as you have a Bank of America checking account

Editor’s Note: The bonus WILL replace any other customer related bonus you might have received from Bank of America.

Bank of America Preferred Program Benefits:

| Benefits | Gold | Platinum | Platinum Honors |

| MM Savings Booster | 5% | 10% | 20% |

| CC Rewards Bonus | 25% | 50% | 75% |

| Mortgage Origination Fee Reduction | $200 | $400 | $600 |

| Auto Loan Rate Discount | 0.25% | 0.35% | 0.50% |

| Free Non-Bank of America ATM Transactions | 12 Annually | Unlimited | |

| Merrill Edge $0 ETF/Equity Trades | 30 Monthly | 100 Monthly |

Cards Eligible for BoA Preferred Rewards Program:

- BankAmericard Cash Rewards (there are also a bunch of other co-branded cards with the same rewards)

- $100 cash sign up bonus after $500 in purchases within the first 90 days of account opening

- Earn 3% cash back on gas for the first $1,500 in combined grocery/gas purchases each quarter

- Earn 2% cash back at grocery stores and NOW Wholesale Clubs (Sams club, etc.)

- Earn 1% cash back everywhere else

- No annual fee

- Susan G. Komen® Credit Card

- U.S. Pride® BankAmericard Cash Rewards™

- BankAmericard Cash Rewards™ Credit Card for Students

- MLB® Credit Card

- World Wildlife Fund Card

- BankAmericard Travel Reward (There is also a promotion going on currently for Up to 2.625% Cash Back )

- 20,000 points after $1000 in spend within 90 days

- 1.5 points for every $1 in spend

- No annual fee or foreign transaction fee

- BankAmericard Travel Rewards for Students

- AAA Member Rewards

- Get a $50 statement credit after you make at least $500 in purchases within the first 90 days

- 3 points per $1 in spend on qualifying AAA & travel purchases

- 2 points per $1 on gas, grocery & drug store purchases

- 1 point on all other purchases

- No annual fee

- Norwegian Cruise Line

- 10,000 Bonus WorldPoints after first purchase

- 2 points per $1 on Norwegian Cruise Line purchases

- No annual fee

Cards Non-Eligible for BoA Preferred Rewards Program:

- Non-rewards credit cards

- Business purpose credit cards

- BankAmericard Privileges® (except Cash Rewards customers in the Platinum Honors tier)

- Bank of America Accolades®

- BankAmericard® Better Balance Rewards™

- Merrill Lynch branded (including Merrill Accolades®, MERRILL+®, Total Merrill® Cash Back, Total Merrill Match® and Merrill Lynch®Octave™)

- U.S. Trust branded (including Bank of America Accolades and U.S. Trust® Octave™)

- AAA Dollars® Visa credit card

- AAA® Gas Rebate

- Alaska Airlines®

- Amway™

- Asiana Airlines®

- Azamara Club Cruises®

- Bass Pro Shops®

- Celebrity Cruises®

- Elite Rewards®

- MelaleucaSM

- Royal Caribbean International®

- Spirit Airlines®

- US Airways®

- Virgin Atlantic Airways®

Qualifying For Status

Now before going through each cards benefits within the confines of the Preferred Rewards Program, it’s necessary to list the rewards on other products beforehand because they could possibly be the better option for you. *hint*

- Bank of America deposit account. I’m going to be blunt, Bank of America’s deposit accounts + Preferred Rewards is possibly one of the worst options listed. Your interest rate should usually be 0.03% APY, however, with Platinum Preferred Status, you’ll be able to get 0.10% APY. 1% or more on an online savings and checking combo could earn you $1,000 a year in interest. Ideally then, to earn an extra $270 in cash back a year, you’re basically sacrificing $900 a year comparative to the 1% account.

- Merrill EDGE self-directed investment account. The easiest way to get that $100,000 in deposit value would be via an IRA or rollover IRA from a 401K plan account with Merrill Edge.

- Free online trades.

- up to 30 per month with Platinum

- up to 100 per month with Platinum honors

- Cash bonuses derived from adding a qualifying deposit of assets

- $100 bonus: $20,000 in assets

- $150 bonus: $50,000 in assets

- $250 bonus: $100,000 in assets

- $600 bonus: $200,000+ in assets

- Ability to purchase Vanguard ETFs

- Free online trades.

Keep in mind that the only way Preferred Rewards would make sense in terms of the Merrill Investment with higher balances is to have your IRA or brokerage account WITH Merrill Lynch. Balances do count towards the minimum for Preferred Rewards. Also, if you use a Merrill Edge account, you’ll get free trades every month (listed benefit above) and be able to keep your money in low cost index funds instituting equitable returns on top of no excessive fees.

BankAmericard Cash Rewards

The cash rewards excels in gas and grocery spending with a prosperous 3X on Gas and 2X on Groceries and Wholesale Clubs. This makes it all the more necessary to evaluate the most optimal cash back with each status.

Gas:

- Gold: 3.75% cash back on gas station purchases

- Platinum: 4.5% cash back on gas station purchases

- Platinum Honors: 5.25% back on gas station purchases

Grocery stores & Wholesale Clubs:

- Gold: 2.5% cash back on grocery store purchases

- Platinum: 3% cash back on grocery store purchases

- Platinum Honors: 3.5% back on grocery store purchases

Of course, if you had an exhaustible $100,000 to keep with Bank of America or ME, the cash rewards card certainly cannot be revamped enough to compete with specialized gas cards such as the Fort Know Credit Union VISA Platinum or the PenFed Platinum Rewards VISA and 3.5% back on groceries with Platinum Honors is better than decent, but putting the card side-by-side with the Old Cash Blue, an impressive 5% cash back on groceries is the better candidate and you won’t have to let Bank of America hold your $100,000 either. Keep in mind that your cash back will not be capped!

BankAmericard Travel Reward

Ultimately, this card will earn you 1.5x the points on all purchases with a 1¢ a piece when redeeming them against travel expenses. However, you will only be able to get 0.6¢ out of your redemption if redeemed for cash. 1.5% isn’t very interesting to say the least, but let’s see what the Preferred Rewards Program can do to revamp this card!

- Gold: 1.875x points on all purchases

- Platinum: 2.25x points on all purchases

- Platinum Honors: 2.625x points on all purchases

The Preferred Rewards Program seemingly only works in favor for the Platinum Honors with 2.625x the points on all purchases. Of course, there are cards out there with the ability to get 3% cash back everywhere (The JCB Cards), however, the card’s availability is a hassle. Now 2.625% cash back does have one big red flag, and that’s if you redeem your points for cash, you’ll only be receiving a maximum of 1.575% Cash back versus the 2.625x applicable towards Travel Expense Redemptions.

AAA Member Rewards

With the AAA Member Rewards Card, you will be able to take advantage of 3 points per $1 in spend on qualifying AAA & travel purchases, 2 points per $1 on gas, grocery & drug store purchases and 1 point on all other purchases with points worthy at 1 cent a piece. However, within the confines the of BoA Preferred Rewards Program, the bonus will only be attached to the 1 base points instead of the category bonus.

AAA Purchases

- Gold: 3.25x points on AAA purchases

- Platinum: 3.5x points on AAA purchases

- Platinum Honors: 3.75x points on AAA purchases

Travel purchases

Below is the merchant category code along with what Bank of America codes as travel:

- Airlines: (MCC 3000-3299-representing individual major airline carriers, and 4511- Airlines/Air Carriers)

- Hotels, Motels, Inns and Resorts: (MCC 3501-3999-representing individual major hotel/motel chains and 7011-Hotels/Motels/Resorts)

- Steamship/Cruise Lines: (MCC 4411)

- Car Rental Agencies: (MCC 3351- 3441-representing individual major agencies; and 7512- Automobile Rental Agency)

- Travel Agencies: (MCC 4722)

Gas, Grocery & Drug Store (GGD) Purchases

- Gold: 2.25x points on GGD purchases

- Platinum: 2.5x points on GGD purchases

- Platinum Honors: 2.75x points on GGD purchases

In retrospect, this card could optimize your travel purchases IF you have Platinum Honor Status and you’re willing to let Bank of America hold $100,000 in deposit value.

Reiterating that there are plenty of other cards out there that gives you the same, if not a little more benefits such as 5% cash back on gas, or 3.5% cash back on groceries, however, 1.) Most, if not, all cards that offer such a bountiful cash back is capped at a certain spend ( Old Blue Cash Card with a $2,500 cap) and 2.) This card can be quite useful with travel redemption topping up to 5.25% Cash Back.

One of the more attractive things is that AAA sells VISA gift cards with casual promotions for no purchase fees attached. Not only that but purchasing Gift Cards codes as 3X the points, however, prospects of expansion is thin ice.

Keep in mind that AAA may limit you with Gift Card purchases and if you purchase too many GC, MetaBank has the authority to ban you. Now, clearly the Preferred Rewards Program does what it’s meant to do: Revamp decent cards and making them all the more useful. Now, 2.625% Cash Back on the Travel Card alone a really attractive offer. Keep in mind that in order to maximize the program + the Travel Rewards and AAA, it’s best for those able to put a big spending.

Conclusion:

The Preferred Rewards Program does do what it’s supposed to do, and it’s to boost decent cards as well as banking products. Being straightforward, the program is not bad and could very well work into your favor, however, to reap the fullest out of your products, Platinum Honors would be your best bet.

There is a catch, you will have to be holding $100,000 with Bank of America or Merrill Lynch. In doing so, if you were able to get Platinum Honors, the Travel Rewards could be a considerable 2.625% cash back everywhere for you. If you travel frequently, the AAA card offers you cash back that no other competitor can really match and best of all, you’re points are not capped!

Currently, I’m more interst in the Merrill Edge Investment in which you could earn free trades every month with Platinum or Platinum Honors on top of being able to purchase Vanguard ETFs and you’ll be able to earn bonuses with deposit assetts, but to each to each his/her own. Don’t forget to check out our complete list of Credit Card Promotions today!