Available nationwide, FNBO Direct Online Savings is offering a 3.25% APY Rate. Definitely continue reading below for everything you would need to know about the attractive account and rate! Update 9/19/25: The rate has decreased to 3.25% APY (from 3.35%). FNBO Direct Online Savings Review FNBO Direct is an online-only bank offering checking accounts, savings… [Continue Reading]

Best Business Savings Account Rates – 2025

Here you’ll find best business savings, money market, and interest bearing account rates. Update 9/18/25: We’ve updated our list of the top rates for business accounts. You may already have a business checking account and looking to open an interest bearing account for your business to earn interest on the money. This can help business owners… [Continue Reading]

Bluevine Premier Business Checking Review: 3.50% APY on Balances Up to $3M (Nationwide)

Available nationwide, you can earn 3.50% APY on balances up to $3 million with the Bluevine Premier Business Checking account. Update 9/18/25: The rate has decreased to 3.50% APY from 3.70%. Editor’s Note: If you don’t want to pay the monthly fee to earn the highest rate, you can still earn 2.00% APY with the… [Continue Reading]

First Internet Bank Business Money Market Savings Review: 3.30% APY (Up to 4.16% with 5M+) (Nationwide)

Available nationwide, First Internet Bank is offering 3.30% up to 4.16% APY Rate on their Business Money Market Account. Update 9/18/25: The rate for balances above $5M has decreased to 4.16% APY from 4.42%; for balances below $5M has decreased to 3.30% APY from 3.46%. This account offers a highly competitive interest rate (probably the best) but the only… [Continue Reading]

American Heritage Credit Union High Yield Business Savings Review: 3.25% APY (Nationwide)

Available nationwide, the American Heritage Credit Union High Yield Business Savings account is offering 3.25% APY on your funds. Update 9/18/25: The rate has decreased to 3.25% APY (from 3.30%) – keep in mind you’ll need a $10K balance. We recommend a better alternative offering a sign up bonus and a competitive rate with the… [Continue Reading]

E*TRADE Max-Rate Checking Review: $300 Checking Bonus + 2.00% APY (Nationwide)

Available for residents nationwide, E*TRADE is now offering a 2.00% APY for their Max-Rate Checking from Morgan Stanley Private Bank. Update 9/9/25: We’ve added a $300 checking bonus valid through 12/31/25; the rate has decreased to 2.00% APY (from 3.30%). If you’re looking to earn interest on your checking account funds, consider this account! E*TRADE $300… [Continue Reading]

Grasshopper Bank Business Checking Review: 1.80% APY + 1% Cash Back, $200 Referral Bonus (Nationwide)

Available nationwide, Grasshopper Bank is offering up to 1.80% APY on their Business Checking Account. Update 9/5/25: If you have a business checking account earning little to no interest, consider this account to earn up to 1.80% APY on top of 1% cash back on your transactions! A great alternative is the Live Oak Bank… [Continue Reading]

HUSTL Money Market Review: 4.80% APY (Nationwide)

Available nationwide, HUSTL is offering 4.80% APY when you open a new Money Market account. HUSTL is a division of Vantage West Credit Union. Update 8/26/25: The rate has decreased to 4.80% APY from 5.00%. HUSTL Money Market Rate Learn More at HUSTL Eligible account: Savings Credit inquiry: Soft Pull Where it’s available: Nationwide Opening Deposit: $500… [Continue Reading]

Openbank High Yield Savings Review: Earn 4.20% APY (Nationwide)

Openbank is offering 4.20% APY when you open a High Yield Savings account – available nationwide. Openbank is a part of Santander Bank, N.A., which is a member institution of FDIC. Openbank High Yield Savings Rate Learn More at Openbank Eligible account: Savings Credit inquiry: Soft Pull or Hard Pull? Where it’s available: Nationwide Opening Deposit: $500 Monthly fee: None… [Continue Reading]

EagleBank High Yield Savings Review: 4.40% APY (Nationwide)

EagleBank is offering 4.40% APY when you open a High Yield Savings account powered by Raisin – available nationwide. Update 7/2/25: You can currently earn a competitive 4.40% APY (up from 4.35%), however, we do recommend the savings account from Western Alliance Bank. EagleBank High Yield Savings Rate Learn More at EagleBank Eligible account: High… [Continue Reading]

TAB Bank High Yield Savings Review: 4.15% APY (Nationwide)

Available nationwide, TAB Bank High Yield Savings is offering a 4.15% APY Rate. Definitely continue reading below for everything you would need to know about the attractive account and rate! Update 7/2/25: The rate has decreased to 4.15% APY (from 4.26%). TAB Bank High Yield Savings Review Fonuded in 1998, TAB Bank has been working to… [Continue Reading]

Prime Alliance Bank Personal Savings Review: 4.05% APY (Nationwide)

Available nationwide, Prime Alliance Bank Personal Savings is offering a 4.05% APY Rate. Definitely continue reading below for everything you would need to know about the attractive account and rate! Update 6/30/25: The rate has decreased to 4.05% APY from 4.15%. Prime Alliance Bank Personal Savings Review Prime Alliance Bank began in 2004 based on the understanding… [Continue Reading]

Prime Alliance Bank Money Market Review: 4.05% APY (Nationwide)

Available nationwide, Prime Alliance Bank Personal Money Market is offering a 4.05% APY Rate. Definitely continue reading below for everything you would need to know about the attractive account and rate! Update 6/30/25: The rate has decreased to 4.05% APY from 4.15%. Prime Alliance Bank Personal Money Market Review Prime Alliance Bank began in 2004 based on… [Continue Reading]

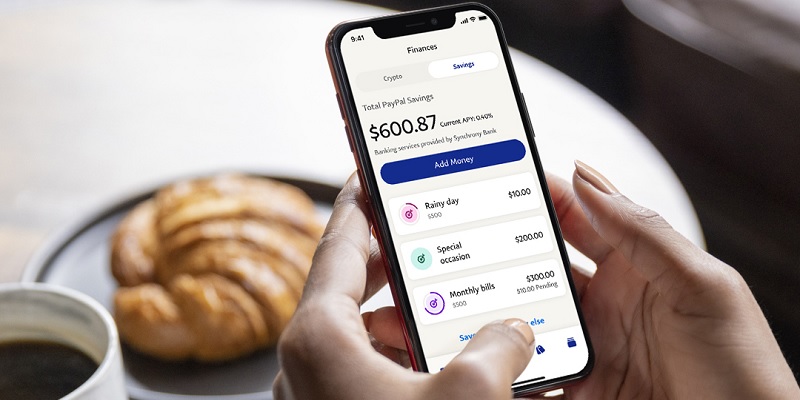

PayPal Savings Review: Earn 3.80% APY (Nationwide)

Earn interest with PayPal Savings. You work hard. Make your money work harder. Set your money aside and watch it grow – to the tune of 3.80% APY. Update 6/30/25: The rate has decreased to 3.80% APY from 4.00%. About PayPal Savings Review Thei mission is to democratize financial services to ensure that everyone, regardless… [Continue Reading]

Barclays Online Savings Review: 3.70% APY (Nationwide)

Available nationwide, Barclays is offering a generous 3.70% APY Rate with their Online Savings account. Definitely continue reading below for everything you would need to know about the attractive account and rate! Update 6/30/25: The rate has decreased to 3.70% APY (from 3.80%). Barclays Online Savings Review From their small London beginnings more than 300 years… [Continue Reading]

Ally Bank Money Market Review: 3.50% APY Rate (Nationwide)

Available nationwide, Ally Bank is offering a 3.50% APY Rate for their Money Market Account. Update 6/30/25: The rate has decreased to 3.50% APY from 3.60%. Ally Bank Money Market Account Review Ally Bank relentlessly focuses on “Doing it Right” and being a trusted financial services provider to their consumer, commercial, and corporate customers. Additionally, they… [Continue Reading]

Affinity Plus Federal Credit Union Money Market Review: 3.40% APY (Nationwide)

Affinity Plus Federal Credit Union has an offer of up to 3.40% APY nationwide for a new Money Market account. The Superior Market Account will be able to hold no more than $25,000 and there is no minimum balance fee included. Update 6/30/25: The rate has decreased to 3.40% APY from 3.50%. Affinity Plus Federal… [Continue Reading]

Heritage Bank Business Jumbo Deposit Review: Up to 3.51% APY (Nationwide)

Available nationwide, Heritage Bank is offering up to 3.51% APY on their Business Jumbo Deposit account. Update 6/24/25: The upper tier rate has decreased to 3.51% APY from 4.25%. Heritage Bank Business Jumbo Deposit Review Heritage Bank’s vision for the future is based on their mission of helping people succeed financially. Their goal is to continue… [Continue Reading]

Newtek Bank High Yield Savings Review: 4.35% APY (Nationwide)

With the Newtek Bank High Yield Savings account, earn a competitive 4.35% APY on your money! Update 6/2/25: The rate has decreased to 4.35% APY from 4.45%. Newtek Bank HighYield Savings Review Why Newtek Bank? They’re not reimagining banking. They’re redefining it. Same offerings, different wording. Turns out reimagining banking doesn’t actually help businesses succeed…. [Continue Reading]

First Foundation Bank Online Money Market Review: 4.25% APY (Nationwide)

Available for residents nationwide, First Foundation Bank is offering an Online Money Market 4.25% APY account. Update 6/2/25: The rate has decreased to 4.25% APY from 4.50% APY. You can only see the new rate after clicking on “Open Account”. First Foundation Bank Online Money Market Review First Foundation Bank is headquartered in Irvine, California and was… [Continue Reading]

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 56

- Next Page »