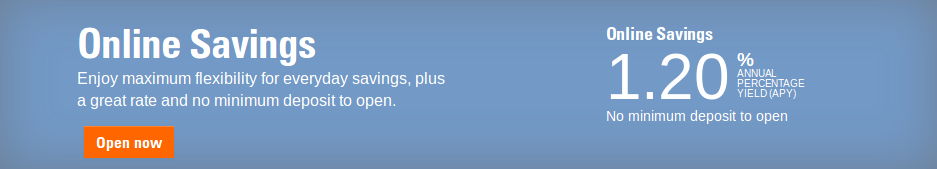

GS or Goldman Sachs Bank is currently offering 1.20% APY attached to their Online Savings account. This is top-notch interest APY with no minimum to open, no monthly fees, and just $1 or more to earn such APY. Goldman Sachs helps build and protect your money with beyond competitive rates, no transaction fees, and FDIC insurance up to the maximum allowed by law. Interest will be compounded daily, paid out monthly. If you are interested, be sure to scroll through the table below and when you see GS Bank Savings, just click the green button that says “Next” to proceed.

GS or Goldman Sachs Bank is currently offering 1.20% APY attached to their Online Savings account. This is top-notch interest APY with no minimum to open, no monthly fees, and just $1 or more to earn such APY. Goldman Sachs helps build and protect your money with beyond competitive rates, no transaction fees, and FDIC insurance up to the maximum allowed by law. Interest will be compounded daily, paid out monthly. If you are interested, be sure to scroll through the table below and when you see GS Bank Savings, just click the green button that says “Next” to proceed.

|

|

|

GS Bank Savings Information:

- Learn More (See table above)

- Account Type: Online Savings Account

- Rate: 1.20% APY

- Availability: Nationwide

- Expiration Date: None

- Soft/Hard Pull: Soft Pull

- Direct Deposit Requirement: DD is not required

- Monthly Fee: $0.00

- Additional Requirements: None

GS Bank Benefits/Services:

Setting aside the exceptionally attractive 1.20% APY, Goldman Sachs also offers features and perks that make the account so much more rounded. With no fees attached, no minimum deposit to open, and interest compounded daily. Surely, this savings account is hard to beat, especially from your traditional savings account with a .1% APY Rate. Note that you will be limited to 6 withdrawal limits per statement cycle, which by all means, is more than enough if you plan on saving.

Your money can be funded and withdrawn through external, wire or mail check transfer which is all free. Also, I emphasize that your returns will be paid out monthly and you will be allowed the maximum customer deposit limit up to $250,000, $500,000 for joint accounts. You will protected with FDIC insurance up to the maximum allowed by law ($250,000).

GS Bank Savings Rate:

It’s my intentions to make some distinctions to GS Bank’s 1.20% APY vs. CIT Bank’s 1.15% APY. From the get-go, you can see the apparent .05% difference in APY. Both accounts are online savings accounts and they do have a withdrawal limit attached; 6 withdrawals per statement cycle. Even the way you transfer to your account is the same, either ACH, wire, or by mail.

This aspect can be quite the hindrance considering it could take 2-3 business days for your transfer to come through, however, being a quirk of a 1.20% APY, it may very well be necessary. I mean, GS Bank does focus on their investment products without the availability of checking accounts anywhere in sight, so it’s quite understandable. Note that with CIT Bank’s online savings, you’re required to make the minimum opening of $100 comparative to Goldman Sach’s no minimum opening requirement, and APY earned after just $1.

Conclusion:

1.20% APY is as good as it really gets for a savings account and you can get such a product at Goldman Sachs Bank. All you have to do is scroll through our Best Bank Rates table above and when you find GS Bank’s Savings, be sure to click “next”. What makes this account so competitive is not only the rate, but just how there’s very little requirements attached and no hidden fees. Essentially, you’ll be earning 1.20% APY after just $1 in deposit value. Note that there’s no sign-up bonus and transferring your deposits to this bank could take 2-3 business days, however, I still think that shouldn’t stop you from reaping the highest APY Rate to date! Find all the best bank rates from our exclusive list nationwide!