What may very well “revolutionize” the credit card industry in a given year is the introduction of the new ZeroCard Credit card which is confirmed to offer a much improved mobile banking experience powered through their signature “Zero app and ZeroCard,” which is a VISA card that acts as a debit card and has the ability to earn credit card rewards. Basically, you’ll be able to add funds into your account and spend those funds utilizing your designated ZeroCard.

What may very well “revolutionize” the credit card industry in a given year is the introduction of the new ZeroCard Credit card which is confirmed to offer a much improved mobile banking experience powered through their signature “Zero app and ZeroCard,” which is a VISA card that acts as a debit card and has the ability to earn credit card rewards. Basically, you’ll be able to add funds into your account and spend those funds utilizing your designated ZeroCard.

Now trusting an entirely new concept like this is categorized in my books as a risky endeavor considering if the reward will actually be paid out for those that decide to take advantage of the cash back, but it has been confirmed that the product is FDIC insured and seems rather promising for individuals that aren’t looking to be bind by debt, monthly statements, balances, and due dates imposed on a typical credit card.

Alternative Credit Card Bonuses:

Credit Card or Debit Card?

This card has a huge notion of being “revolutionary” based on the sole premise that you can load a balance on your card and accomplish the spend correlating to the balance that you funded; which is the debit aspect of this card. On the other hand, in order to earn a reward based 3% cash-back, it’s necessary that this card is induced with the credit card components. That means, the card will be processed as a credit card so you won’t be getting that bottom low rates from merchants that offer discounts for debit card usage. Also, you will be imposed to higher merchant fees much like a typical credit card.

In actuality, I don’t quite grasp the “revolutionary” aspect of this card yet; It basically seems like a secured card or a prepaid credit card with unrealistic spend:rewards bearing for the average consumer. The 3.0% cash back could be what’s so revolutionary about this card considering there’s only a few number of cards that offer 3% and that’s the JCB’s Mitsuwa and Marukai Premium (with the obvious limitations as to wherever this card is accepted).

In no way, shape or form am I discouraging any of you readers from attaining this card and pursuing in the $100,000 spend to a victorious 3% because compared to a secured or prepaid credit card, this card does offer significantly better rewards for those with the willingness to accomplish that spend. the bigger question would be, how do they make money off us consumers? What sets them apart from the typical banking establishment with a generic rewards structure is that Zero generates their revenue solely from merchant processing costs rather than charging their customers that typical banking fee and with their integrated mobile app and referral based program appealing to their customers, they will then be able to provide better rewards with higher interest on deposits than leading savings accounts.

How Will The ZeroCard VISA Infinite Rewards Be Composed?

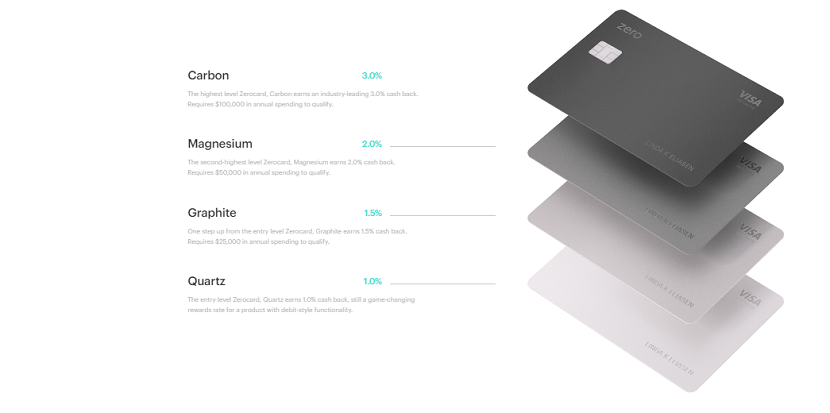

ZeroCard’s most attractive feature is that it offers up to 3% cash back in an apparent tiered rewards style; in which, the rewards you earn is a direct determinant on how much you spend with your ZeroCard annually. this rewards to spend platform is similar to achieving elite status on a premium airlines or hotel card. The following threshold is as followed:

- Quartz: 1% cash back with no minimum spend requirement

- Graphite: 1.5% cash back with $25,000 in annual spend

- Magnesium: 2% cash back with $50,000 in annual spend

- Carbon: 3% cash back with $100,000 in annual spend

ZeroCard VISA Infinite Referral Program:

‘Level up’ faster with their referral program. Simply registering for early access and referring your family, friends, colleagues, etc., you will be able to essentially earn higher tier for the remaining calendar year in addition to the following calendar year. Of course, if you already have the highest tier achievable; Carbon, you will be able to receive $100 in Bonus Incentive for each individual you refer to Zero Financial. Your referred friends must be able to make two qualifying purchases as well as direct deposit (2). Their referral program seems very interesting, but unfortunately, will only be a component to the game for a “limited time only” kind of ordeal.

This will constitute as requirements to ‘level up’:

- Use a friends link to receive Graphite level

- Share on facebook to receive Magnesium

- Share with three friends to receive Carbon status

ZeroCard VISA Infinite Credit Card Features:

- Carbon: 3% cash back with $100,000 in annual spend

- Magnesium: 2% cash back with $50,000 in annual spend

- Graphite: 1.5% cash back with $25,000 in annual spend

- Quartz: 1% cash back with no minimum spend requirement

- Make deposits and your balance in the Zero app goes up. Spend on your Zerocard and your balance goes down.

- Highest interest on deposits with none of the typical fees of traditional banks

- Zerocard is usable anywhere Visa is accepted, with free ATM access in over 50,000 locations.

- Deposits are FDIC-insured via their partner institution. And Visa’s Zero Liability Policy protects you if your card is ever lost, stolen or fraudulently used.

ZeroCard VISA Infinite Pros:

- Solid Metal (like Ritz Carlton, not like Chase Sapphire Reserve)

- Up To 3% Cash-Back

- Cash rewards are unlimited and automatically deposited into customer accounts on a monthly basis

- “VISA Infinite”

ZeroCard VISA Infinite Cons:

- Rewards will only be applicable to higher spenders

- Could impose you to typical credit card merchant fees of up to 2.0%

Conclusion:

All-in-all, I don’t necessarily find any risky endeavors possible with the ZeroCard VISA Infinite, although seemingly enough, $100,000 spend seems quite unrealistic for the average consumer to attain. Satisfying enough, I recommend that you take advantage of their referral program as soon as possible and level up first before anything if you’re interested in this card. You can earn Magnesium Status just from sharing your designated link on Facebook! Again, I don’t necessarily find this card all that appealing and I would recommend any ready with further knowledge to comment what they think about this “revolutionary” card. I mean, JCB’s Mitsuwa and Marukai Premium offers a 3% and Citi’s Double Cash earns 2%. Find our complete list of Credit Card Promotions today!