A money order is another way to make cash deposits, instead of with a check, and can be bought with cash or a debit card. They can be used to pay bills, send money far distances, or to keep your banking information safe.

A money order is another way to make cash deposits, instead of with a check, and can be bought with cash or a debit card. They can be used to pay bills, send money far distances, or to keep your banking information safe.

If you are unsure on how to fill out a money order, be sure to keep reading to see a step-by-step guide.

|

|

|

How to Fill Out a Money Order

Filling out a money order is similar to filling out a check. Depending on where you get it, they can look different. For instance, one from a bank might be different than one from the post office.

1. Gather the information and funds that are needed

Getting all your information prior to filling out the money order will help minimize any errors. You will need the following:

- The funds for the amount and the fee

- Your name and address

- The recipient’s name and address

- Your account number (if you’re paying a bill)

2. Purchase the money order

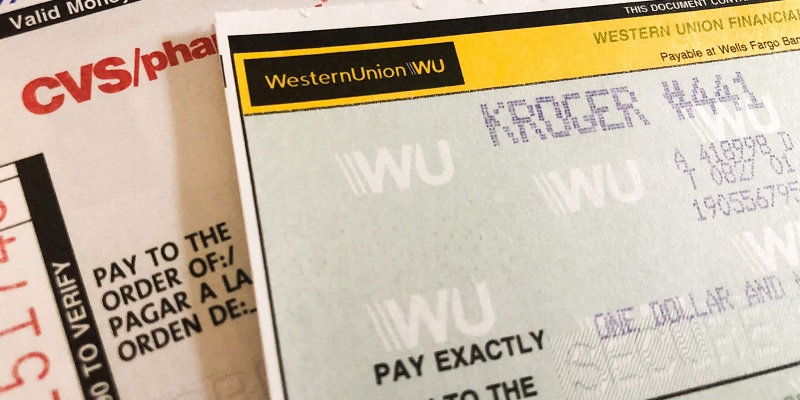

Money orders can be bought at many places such as:

- Your bank or credit union

- The post office

- Western Union and MoneyGram locations

- Convenience stores, grocery stores and pharmacies offering Western Union or MoneyGram services

3. Fill in the recipient’s information

Make sure you fill in the recipient’s name and address. If it gets lost and there is no information on it, someone else could steal it and cash it in.

4. Fill in your information

Next, you should fill in your name and address in case any information is needed regarding the money order. If you are worried about privacy, ask the vendor what information is required because some only need your name.

5. Make sure you include any additional information

Be sure that you include the account number for the service when you are paying for a bill. If you need to include any other information, there should be a memo section to do so.

6. Sign the money order

Some require a signature from the purchaser, which is located on the front. The back of the money order is where the recipient signs.

7. Keep the receipt for your records

There is a detachable section on the money order which is your receipt. Be sure to take this off before you send it so you can keep track of payment.

Advantages of Using a Money Order

Some transactions require you to use a money order or cashier’s check. Here are some advantages of using a money order:

- Safe: They can only be cashed out by the intended person, as long as you fill out the recipient information correctly and quickly.

- Prepaid: There is no lag time from when you write it and when the funds are taken from your account because it is prepaid.

- Replaceable: Make sure you keep the receipt because issuers might be able to replace it if it’s stolen or lost.

- Proof of payment: Since there is a receipt attached, you will be able to prove your payment.

Disadvantages of Using a Money Order

Overall, the advantages outweigh the disadvantages, however there are still some drawbacks.

- Completed improperly: Make sure it is filled out as soon as possible because if it gets lost or stolen, anyone can use it.

- Fees: The fees are relatively little, however they can add up if you use a lot of money orders. If that is the case, a better option would be to use a bank account to write checks or send payments electronically.

- Limited amounts: The usual limit is only $1,000. If you need to make larger payments, you can buy multiple money orders, however you would have to pay a fee for each purchase.

Author’s Verdict

Overall, a money order is a safe and easy way to make payments. The most important thing to note is that you should fill out the recipient information as soon as possible to prevent misuse.

In addition, we have a list of bank promotions to get some extra cash in your pockets today. You may also want to check out savings accounts if you want to get started on saving up money.