Whether you are just establishing your financial history or already have a few accounts, understanding your Bank Statement is imperative to your personal finances. Think of your bank statement as a medical record. Wouldn’t you want to know everything involved with your health? This concept also applies to banking as it provides a detailed look into your financial activities. Using the promotion on a bank statement provides you with a closer look at your financial habits, highlight potential problems, and prove your worthiness as a borrower.

Whether you are just establishing your financial history or already have a few accounts, understanding your Bank Statement is imperative to your personal finances. Think of your bank statement as a medical record. Wouldn’t you want to know everything involved with your health? This concept also applies to banking as it provides a detailed look into your financial activities. Using the promotion on a bank statement provides you with a closer look at your financial habits, highlight potential problems, and prove your worthiness as a borrower.

However, if you have both a checking and savings accounts, you will likely receive both on the same statement. Typical of a statement, a statement period is usually one month long and will not necessarily match up with the calendar month. If you wish to learn more in regards to understanding a bank statement and how to utilize it, be sure to keep on reading!

What Is a Bank Statement?

A bank statement is a monthly or quarterly record of your transactions that summarizes your activities. This involves all your deposits and withdrawals that occur over a certain statement period. Examples such as this would include checks you wrote, credits you received and much more. Your statement also helps you track your finances, catch account mistakes and understand your spending habits on a regular basis. Have you been spending too much this month? What could you save more on? Are all questions that could be answered through your statement.

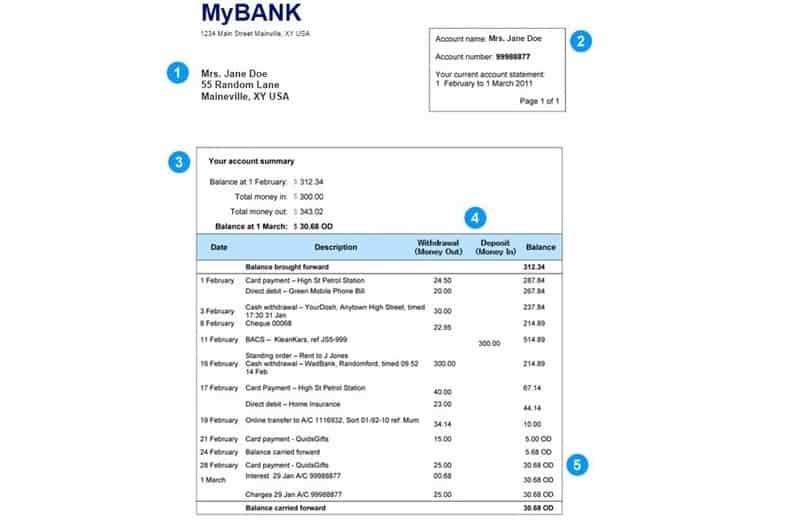

Additionally, a statement usually includes your name, address, account number as well as the bank name. The bank statement report itself usually lists the following:

- The depositor’s beginning balance

- Checks, withdrawals, and debits decreasing the balance during the month

- Deposits and credits increases the account balance during the month

- Photocopies of cancelled checks cleared during the month

- The ending balance of the bank account

How to Read a Bank Statement

For those who has never seen a bank statement, reading it can be quite a daunting task. With words and numbers everywhere, where do you even start? Thankfully, once you have understand the set up of one bank statement, you are able to do so regardless of what banks or credit unions you choose to join later down the road.

Depending on the bank, the layout of your bank statement would vary. However, they will not stray too far away from the example given above.

Every statement summary would always provide you information in regards to:

- Your current balance: Which takes into account all the pending transactions you currently have, this balance is all your funds that are immediately available for cash withdrawal.

- Pending transactions: Pretty straightforward as this section lists out any transactions you have that are still pending.

- Transaction Date: This section allows you to check the date when the transaction was processed.

- Transaction History: All of your activities for that statement period would be listed here. This section would include all of your withdrawals and deposits in regards to your account. Additionally, it would list whether it is a credit or debit.

- Account Number: This set of digit identifies your account, which is typically located on the top right-hand corner. Additionally, you can find your account number at the bottom left-hand corner of your check or online. Your account number is not to be confused with your routing number, which is a nine-digit number that identifies your bank.

- Account: This section lets you know whether this statement is for your checking account or savings account.

Terms Relating to a Bank Balance

Starting Balance: This is the amount you had in your account during the beginning of the statement period prior to any deposits of withdrawals.

Ending balance: This amount translates to the amount in your account when the statement period ends. The reality of it is quite simple. If you save more than you spend, your ending balance will be higher than the starting balance. However, if you spend more or transfer more to a different account, you’ll have a lower ending balance than you started with.

Daily balance detail: Some bank statements would provide you with your balance for each day during that stated period. With this features, you are able to see your spending habits and how your balance fluctuated.

Terms Relating to a Bank Statement

Deposits: Deposits can include direct deposit from your employer, cashed checks, wire transfers, money you transferred from PayPal or Venmo, and other credits. These are known as individual installments of funds into your account.

Interest: Depending on the financial institution you are currently with, you will earn interest on your checking account. If you do earn interest, your bank statement will show how much you have earned. However, if you have multiple savings accounts under the same umbrella account, the statement may show the total interest paid as well as the total interest for each account. Some banks will also list the amount of interest you’ve earned over the life of the account.

Fees: This section reveals the exact fees you paid during the statement period. Fees you can usually expect to find in this section would include overdrafts, returned checks, ATM withdrawals, and a monthly maintenance fee. However, if you were to use a debit card outside the U.S., expect to pay an ATM fee or even an international fee.

Overdraft Protection: Depending on your financial institution, you may have overdraft coverage on your account. Your statement may reflect it if you have this coverage. You can check whether it had to kick in at any point during the statement period.

Statement period: These are the dates during which the transactions occur, usually a month-long period. However, if the statement says, “January 2019,” that doesn’t necessarily mean the statement period was actually for the month of January. It may begin at the end of December and end a few days before the end of January.

How to Use Your Bank Statement

Reconcile Your Account

Remember in the beginning when I mentioned you should think of your statement as a medical record? Keeping check of every little detail on it and making sure everything is accurate is imperative to your personal health and growth. You wouldn’t want to catch any mistakes or errors on your medical record would you?

“Reconciling your account” means you are matching your own record of deposits, withdrawals, interests and fees with the information on your bank statement. Doing so assures you that the bank calculated the figures correctly. Additionally, it can also help you avoid overdraft fees if the bank statement shows that you have less money than you think.

Track Your Spending

Not only does your statement show all your activities, it also keeps track of your spending. When it comes to following a budget, this step is absolutely essential. How else would you know how much you spent during a specific statement period?

If you don’t currently have a budget and would like to start one, you can get in contact with financial advisers through your current financial institution. In fact, banks such as Citibank and SunTrust Bank provides you with advisers would will walk you through your expenses and withdrawals to see where and how you can save more money.

Correct Any Errors

When you reconcile your bank statement, you might come across charges that you don’t remember making. A perfect example of this would be remembering your dinner bill was $36 but it shows up on your statement as $51. Where’d those extra charges come from? Mistakes such as this can easily occur on statements so always be watchful. Because banks are handling thousands of accounts at the same time, they are unlikely to be as vigilant as you are. It is your own responsibility to notice any mistakes.

If you catch a mistake, report it to your bank or credit union. You’ll usually have 60 days from your statement date to dispute any errors.

Keep a Record

Although legally, banks have to keep your statement for five years, it is still a good idea to keep track of your statements elsewhere. Consider downloading them onto a separate drive in case of any discrepancies you may have down the road. There are countless methods to do so such as cloud-based systems like Dropbox or Google Drive or even savings them as PDFs.

You’ll probably need to refer to a bank statement when you pay taxes on your account earnings. And if you plan to refinance or buy a home in the near future, potential lenders might want to see several statements.

Conclusion

All in all, bank statements are a great tool to utilize when it comes down to your personal finances. You are able to track your expenses and spending per statement period. Additionally, you will be able to track your withdrawals and deposits while providing you with the exact date when these transactions happened.

However, if you don’t have a bank account yet, definitely take a look at our list of Bank Bonuses, Referral Bonuses, Bank Rates as well as our CD Rates for all your banking needs.

The Chase Sapphire Reserve offers 125,000 bonus points after you spend $6,000 in purchases in the first 3 months from account opening. You'll earn • 8x points on all purchases through Chase Travel, including The Edit • 4x points on flights booked direct • 4x points on hotels booked direct • 3x points on dining worldwide • 1x points on all other purchases This card does carry a $795 annual fee and there are no foreign transaction fees. However, you're able to earn a $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year & up to $120 application fee credit for Global Entry or TSA Pre✓®, and more annual value from perks and benefits. Member FDIC |