If you’ve just for a credit card bonus, you probably have a hefty minimum spend you need to meet within the first several months of account opening. How do meet that minimum spending requirement for your credit card bonus?

If you’ve just for a credit card bonus, you probably have a hefty minimum spend you need to meet within the first several months of account opening. How do meet that minimum spending requirement for your credit card bonus?

Well, here’s a list of some great ways to meet the minimum spend requirements for those who are stuck. Use this information to strategize before taking advantage those excellent credit card promotions.

Best Ways To Meet Minimum Spending For Card Bonuses

For those who are only applying to one credit card with a bonus offer, everyday spending will probably be enough. However, if you have multiple card applications or if you’re applying for a card with a very high minimum spending requirement, we’ve complied some of the best options for meeting the spending criteria.

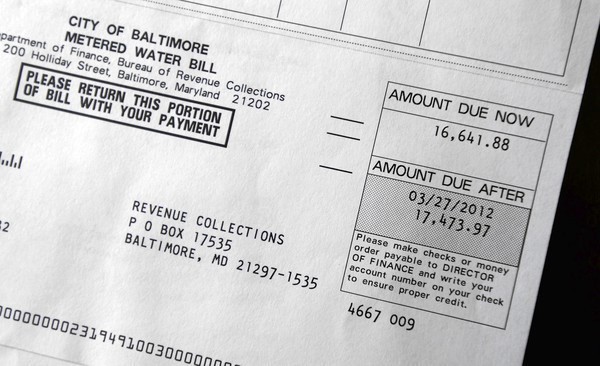

Fund Checking Accounts With A Credit Card

Opening a new bank account soon? Consider this. Fund towards the opening deposit when signing up for a new bank Checking account. Many people are using this option when taking advantage of the bank promotions available with new Checking and Savings accounts. You’re basically working towards bonus cash for a new credit card and new Checking/Savings account.

Many popular banks allow $500 to $1,000 of credit card funding towards the opening deposit. For example, both Chase Bank and TD Bank have great sign-up bonuses and allow credit card funding.

Gift Cards

Gift cards are excellent ways of meeting credit card minimum spending requirements outside of regular everyday spending. It’s like buying money that you can spend later at your leisure. Gift cards don’t expire and there are no fees after purchase. However, you may have to consider a purchasing fee for Visa and American Express gift cards.

Get gift cards to merchants that you regularly spend money at like grocery store, gas, restaurant or supermarket gift cards. With merchant-specific gift cards, there aren’t any purchase fees. You can even find discounted gift cards at these sites:

- Raise

- Gift Cards on eBay

- CardPool

If you want a versatile way to use your gift cards at any merchants that accepts credit cards, we recommend purchasing American Express and Visa gift cards. They will both have Purchase Fees ranging from $3-$7 when purchased online or in a physical store and Shipping Fees if purchased online. The best thing about these gift cards is that they can be spent virtually anywhere.

For those who frequent Amazon.com, definitely consider purchasing Amazon gift cards. There are no fees and they’ll never expire.

Pay Bills & Mortgage Through A 3rd Party

There are some 3rd party services that will help you pay for various bills using a credit card. Essentially, you’ll be paying the 3rd party service with your credit card and they will send off a check on your behalf to pay for those various bills that typically don’t accept credit card payments directly. The 3rd party service will generally charge a convenience fee of 2.5% – 3.0%, so take that into consideration when using this option to meet your minimum spend for credit cards.

The most well-known service is Plastiq.com. They charge a 2.5% fee for credit cards when you use them to pay for rent, college tuition, private schools, and business expenses. They’ll send a check or make a bank transfer for payment on your behalf for that fee. Plastiq also has a referral program where you can earn value towards waiving their processing fees. Check out our Plastiq review to learn more.

Pay Bills That Accept Credit Cards

Depending on your service provider, most utility bills can be paid with a credit card. Most service providers don’t charge extra fees for payment via credit cards. However, if you’re serviced by a smaller provider you should double check. Examples include electric, cell phone, and internet bills.

You can also opt to pay for multiple months in advance to help towards the minimum spending requirement if your provider allows that. You’ll be left with a credit balance on your account, which will have charges deducted with each monthly cycle.

In addition, you can pay insurance bills — auto, home and renter’s insurance — with a credit card depending on your insurance provider. You can usually pay for an entire year of renter’s insurance. Auto insurance is often charged every 6 months, so you can choose to pay for the entire year up front to help towards the minimum spend.

If you’re currently financing your home, many times the home insurance is charged towards your mortgage, so see about paying that up front separately if possible.

Pay Income & Property Taxes

Many tax payment service providers on the IRS website will accept credit cards as payments for your income tax. You just have to consider the 2 – 3% processing fee involved.

Depending on which state you live in, property taxes can be a huge chunk towards your minimum spending requirement. Unfortunately, processing fees also usually apply with this.

Pay Student Loans

Common lenders will generally have the option to pay with a credit card. However, processing fees apply here as well.

Pay Rent

Depending on the property you’re staying at, some allow credit card payments. Processing fees also apply here. Though, as mentioned above, you’ll likely be able to use Plastiq to pay your rent using a credit card.

Charity

You can get a tax deduction, earn points and meet spending requirements on your cards. Plus, feel good about helping a cause. Cards like the US Bank FlexPerks Travel Rewards card also offer extra points on charitable contributions.

Business Travel

It’s generally recommended that you place your business travel expenses on a separate business credit card. However, you can also decide to use your personal card as well during the minimum spend period. Just remember to track those expenses for tax season.

Dining, Gas & Groceries

These are pretty much the necessities when you’re going out.

Hopefully you’re using a rewards credit card to pay when you’re eating out regardless, but this is important if your card earns extra rewards on the Dining category like for the Chase Sapphire Preferred® Card. In addition, if you’re dining out with friends and everybody’s chipping in, see who would like to pay you back. Then, you can charge that total on your card.

Many credit cards offer extra rewards on these categories anyway. There’s no reason not to pay for these everyday expenses with your credit cards.

The Chase Sapphire Preferred® Card offers 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. You'll earn: • 5x on travel purchased through Chase TravelSM • 3x on dining, select streaming services and online groceries • 2x on all other travel purchases • 1x on all other purchases • $50 Annual Chase Travel Hotel Credit • Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027. Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase TravelSM This card carries a $95 annual fee. |

Gym, Daycare & Subscription Fees

If you’ve got a gym membership, Spotify or Apple Music subscription, websites to host, or anything else of the like that incurs monthly fees, use your credit card to pay for those. Other subscription ideas include Netflix, Hulu, Sling TV, HBO Now, Amazon Prime Video, and YouTube TV.

Daycare centers also usually allow for credit card payments. This can be $1,000 or more each month towards your minimum spending.

PayPal, Venmo & Cash App

Send money to a family member or friend via PayPal, Venmo, or Square Cash using your credit card on file. There will be a 2.5% – 3% fee accessed. Have your family/friend write you a check minus that fee.

Note: With these methods, terms and fees are continually updated, so be sure to check the current fees when going for them. These services are becoming more strict with their terms of use.

Money Orders

Some smaller local grocery stores will let you buy money orders using a credit card. Many times, you can get away without an extra charge. Then, just go deposit that money order back into your bank account.

Toll Tags

If you’re in a big city, there’s probably a few highways that charge tolls using a regional toll tag. Aside from reloads, see if you can add prepaying additional dollars to your account.

Prepaid Cards

Purchasing Vanilla Reloads used to be a great way to meet minimum spending requirements for credit card bonuses. Unfortunately, this isn’t really a good option anymore.

You used to be able to buy Vanilla Reload packs with credit cards in order to reload your Prepaid Cards. Retailers have become quite strict on this now, allowing only cash or debit cards to be used for purchasing reload packs.

Other Expenses To Pay For

- Adding authorized users to your card

- Babysitter, dog walker, maid, handyman

- Car repairs, Car registration

- Flexibile Spending Account (FSA)

- Gifts (holidays, birthdays, graduation)

- Home remodeling

- Religious contributions

- Wedding expenses

Author’s Verdict

This list gives you all the details on how to meet minimum spending requirements for those credit card promotions you always see here. Hopefully, you have a much better idea on how to meet the requirements effectively without unnecessarily spending extra money. If you have any other great ideas on how to meet minimum spending requirements, feel free to leave a comment below!

The Best Bank Offers are updated here. See the below pages to get started with some of the best offers: • Chase Bank Offers. Chase offers a range of attractive Checking, Savings and Business Accounts. Chase has a great selection of sign-up bonuses in comparison to other big banks. • HSBC Bank Offers. HSBC Bank routinely has offers for several of their Personal Checking and Business Checking accounts. They also have a good referral program. • Huntington Bank Offers. Huntington Bank has high bonus amounts available through their Checking and Business Checking. Huntington also offers a Business Premier Money Market Account. • Discover Bank Offers. Discover Bank offers top cashback, savings, money market accounts and CD rates for you to take advantage of. Discover has industry leading selections to cater to your banking needs. • TD Bank Offers. TD Bank consistently offers a fantastic selection of checking accounts to cater to your banking needs. However, savings account offers are less frequently available. |