Recently, there has been a shift in the look of our debit and credit cards. Keep reading to find out more about What is a Chase EMV Chip.

Recently, there has been a shift in the look of our debit and credit cards. Keep reading to find out more about What is a Chase EMV Chip.

Europay, MasterCard and Visa collaborated to develop the EMV Chip to secure their users. Your Chase Bank account is safer than ever thanks to this new development.

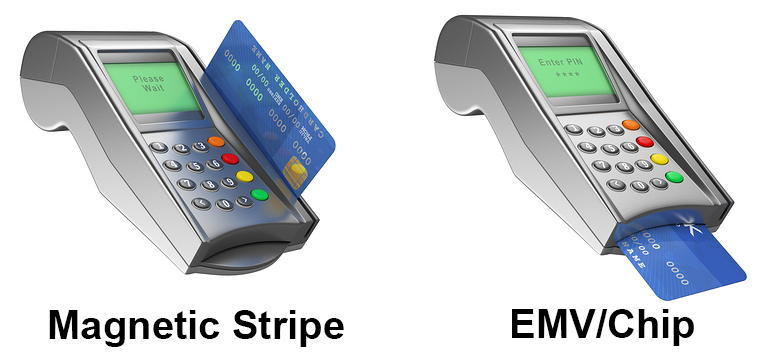

What it Looks Like

The new forms of the cards come in Chip-and-Signature and Chip-and-PIN. The former is generally a credit card and requires a signature, while the latter is usually a debit card and requires a four-digit PIN.

To the left, you can see the way we have used cards to make purchases. We just swiped the magnetic strip to make the purchase and input any information that was needed. The new way is to insert the card at the bottom of the card reader. By doing so, the card reader will read the chip and will provide you with a more secure purchase.

Chase offers a debit card with the EMV chip equipped with their Total Checking, Premier Checking, Sapphire Checking and Private Client accounts.

Likewise, you will also receive a debit card with Chase College Checking. If you qualify for the offer, using your debit card can earn you a $100 checking bonus.

Chase Credit Cards

This means that from now on when you receive a new Chase Credit Card, it will be equipped with the EMV Chip. Check out any of the reviews below for more information on these offers.

The Chase Freedom Card is offering a $150 bonus when you spend $500 in purchases within the first three months. Similarly, the Chase Freedom Unlimited card offers the same bonus and 1.5% cash back that you can redeem on rewards.

The Chase Ink Business Preferred Card is a small business credit card that will give you 80,000 bonus points after you spend $5,000 in the first three months. Or you may want to consider the Chase Ink Business Cash Card which will give you $500 cash back when you spend $3,000 on purchases in the first three months.

But if you don’t own a small business but want to earn one of the best credit card bonuses on the market apply for the Chase Sapphire Preferred Card. You will earn 60,000 bonus points after you spend $4,000 on purchases in the first three months. Additionally this card earns 2x points on travel and dining at restaurants worldwide and 1 point per dollar spent on all other purchases.

Compare this offer with the Chase Sapphire Reserve which earns you 50,000 bonus points after you spend $4,000 on purchases in the first three months. However, you earn 3x points on travel and dining as well as $300 annually in travel reimbursements.

Conclusion

With this new change, there will be less accounts of fraud because of the added security that the chip provides. Thankfully, Chase is on board for more protection for customer accounts.

If you liked this article, go ahead and check out our Chase Coupon Promotions to begin your banking journey with Chase.

The Best Bank Offers are updated here. See the below pages to get started with some of the best offers: • Chase Bank Offers. Chase offers a range of attractive Checking, Savings and Business Accounts. Chase has a great selection of sign-up bonuses in comparison to other big banks. • HSBC Bank Offers. HSBC Bank routinely has offers for several of their Personal Checking and Business Checking accounts. They also have a good referral program. • Huntington Bank Offers. Huntington Bank has high bonus amounts available through their Checking and Business Checking. Huntington also offers a Business Premier Money Market Account. • Discover Bank Offers. Discover Bank offers top cashback, savings, money market accounts and CD rates for you to take advantage of. Discover has industry leading selections to cater to your banking needs. • TD Bank Offers. TD Bank consistently offers a fantastic selection of checking accounts to cater to your banking needs. However, savings account offers are less frequently available. |